For months now the so-called super committee has been meeting in secret, tasked with delivering a budget-cutting (er… make that deficit-cutting) plan. Many have doubted they could actually reach their minimum target of $1.2 trillion in cuts. Few, if any, details had leaked—until today, when we learned that the Democrats are trying to break the logjam and “go large” by offering up a deficit reduction package approaching $3 trillion.

So, score one for the Democrats for exceeding the minimum cuts? Not so fast. As the old saying goes, the devil is in the details. Nowhere could this be more true than in public policy. The size of any deficit-reduction package is just as important as the policies it contains. A larger deficit-reduction package, it seems, should be a good thing. But if it is filled with flawed and misguided policies that exacerbate the current flaws in government programs, it is worse than no proposal at all.

The Democrats’ offering is yet another 50/50 package—half cuts, half tax hikes. Tax hikes of $1.5 trillion on American taxpayers, already suffering from persistent 9 percent unemployment.

Next, we will read news outlets’ panicked cries: Why won’t Republicans sign on to such a scheme?

A few budget facts are in order here:

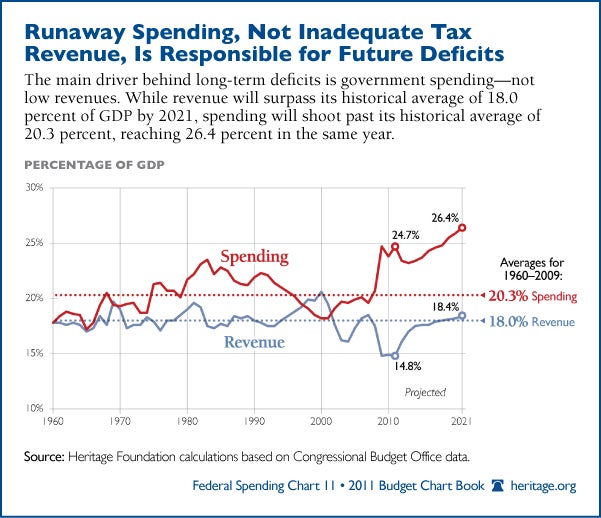

- By 2021, tax revenues will exceed their historical average of 18.4 percent of GDP—even if the Bush tax cuts were made permanent.

- Spending in 2021 will reach 26.4 percent of GDP—higher than the historical average of 20 percent.

- After 2021, spending will really take off, reaching nearly 35 percent of GDP by 2035 and fueled largely by entitlement spending. (Article continued below chart)

Houston, we have a spending problem, not a tax problem.

And, when taxes go up—or even when Washington lectures the nation about the “rich” and corporations paying their “fair share” or gratuitously promises to raise taxes to get more revenues—business, large and small, are just not that thrilled about it. That kind of talk makes them unwilling to take risks, buy new equipment, expand… and hire new employees. So any deficit-reduction plan that hikes taxes should be a nonstarter! Even talking about tax hikes chills economic activity and job creation.

Oh, and that deficit-driven stimulus plan to create jobs? Proven failure. Democrats ought to strike that element (reportedly between $200 billion and $300 billion) from their plan.

According to Politico, the Democrats are “including landmark changes impacting Medicare and Social Security,” yet the details that have been leaked reveal no such landmark changes. Instead, the usual suspects are being bandied about: increasing premiums for Medicare (a good idea) and more cuts to providers (hasn’t worked yet). As for Social Security, discussions are rumored to include changing the Consumer Price Index (a good idea as well, though it would result in tax hikes on that side of the budget ledger.) But these are hardly landmark changes.

Also rumored are $100 billion in savings to the Medicaid program, but here too, there are no details.

Truly landmark changes are required if Congress is to solve our spending and debt crisis. These must include bold, transformational changes to entitlement programs and a true growth agenda through revenue-neutral tax reform that underpins strong growth and job creation. And lastly, Congress must ensure that the federal government can deliver one of its few constitutional functions—defending the nation.

For the real, bold solutions necessary to fix our spending and debt crisis, the Super Committee should look to Saving the American Dream.

8 Replies to “Super Committee Proposal: Tax Hikes Should Be a Nonstarter”