A recent Rasmussen poll revealed that a strong majority (71 percent) of Americans believe that middle-class Americans pay a larger share of their income in taxes than the wealthy pay. Just 20 percent think the opposite.

The poll’s results are not surprising given the popular notion that millionaires use loopholes and other gimmicks to escape paying taxes. (For example, see the myth about Warren Buffett paying less in taxes than his secretary.) Moreover, since the tax code is so convoluted, it is easy to believe that the wealthy are getting away with not paying what they actually owe.

The Wealthy Pay Much Higher Taxes

In reality, high earners pay much higher taxes than the middle class.

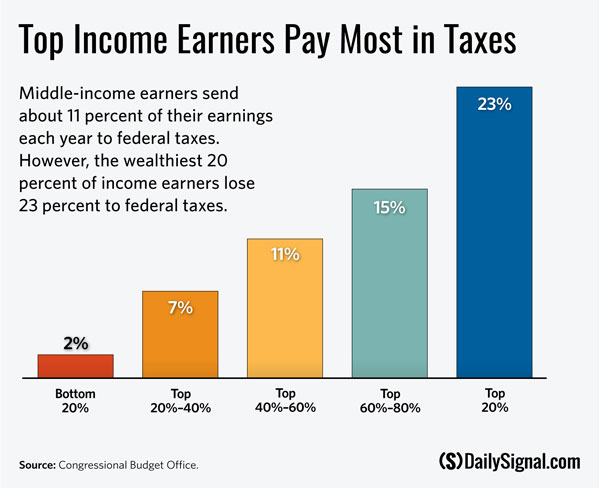

Chart 1, generated using 2011 Congressional Budget Office data, compares average federal tax rates across different income groups. Average federal tax rates are calculated by dividing total federal taxes by total before-tax income.

As the chart demonstrates, the wealthy hand over more of their income to Uncle Sam than other groups do. While the bottom two quintiles pay only 1.9 percent and 7 percent of their earnings in federal taxes, the top two quintiles pay an average of 15.2 percent and 23.4 percent, respectively. Taxpayers in the middle bracket part with 11.2 percent of their incomes.

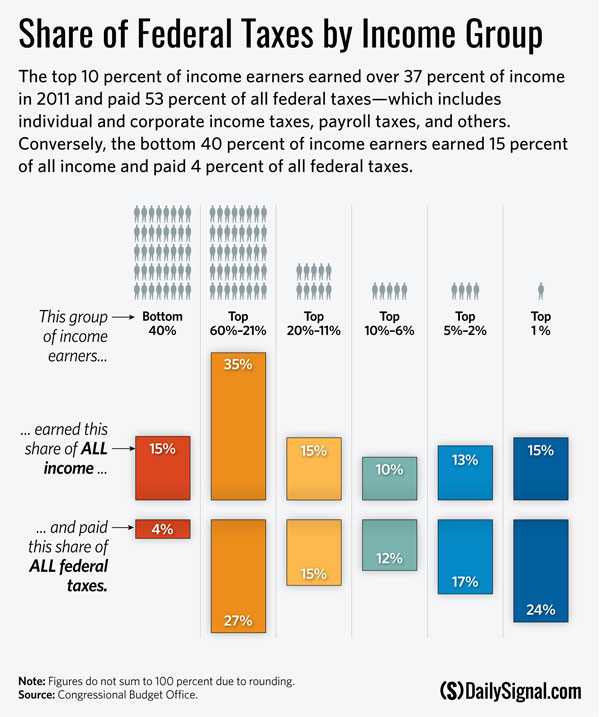

When looking at the shares of taxes that the various income groups pay as shown in Chart 2, it becomes even clearer how much more the wealthy pay. For instance, the top 10 percent of income earners pay 53 percent of all federal taxes while earning 38 percent of all income. The middle 40 percent, a group four times larger, paid 27 percent of all federal taxes while earning 35 percent of the income.

The Progressive Tax Code

Tax equity is a highly controversial topic in politics, and assessing the fairness of the current system is beyond the scope of this article. However, it would be factually inaccurate to argue that low-income and middle-income workers are paying more than the wealthy.

Higher-income earners pay higher taxes because the tax code is progressive. It levies higher rates on taxpayers as they earn more income. It also reduces and phases out tax breaks, such as certain deductions and credits, as income rises. As such, progressivity is both a function of marginal tax rates and the average effective rate.

Reform Key to Restoring Trust

One of the many benefits of tax reform is that a simplified and transparent system would be less likely to create misconceptions about who pays how much tax. This would restore the American people’s trust that their fellow citizens are paying what they are supposed to pay.