Who in America will earn the most money this year? You might as well ask who will win the Major League Baseball batting title. Each year, someone will have the top batting average, but the competition is fierce and the best performers are hard to predict.

As in baseball, so in life: Data from 1991 through 2010 shows that only a third of the top 1 percent of taxpayers cracked that level for five years in a row. And from 1999 to 2009, 50 percent of people who earned over $1 million a year did so just one year. Another 15 percent managed just two years.

Millionaires are often business owners experiencing a temporary boom in their business—who have busts in other years—or who sell a business one year reaping a gain that is not repeated. Other millionaires are rewarded for years of risky investment in a single year.

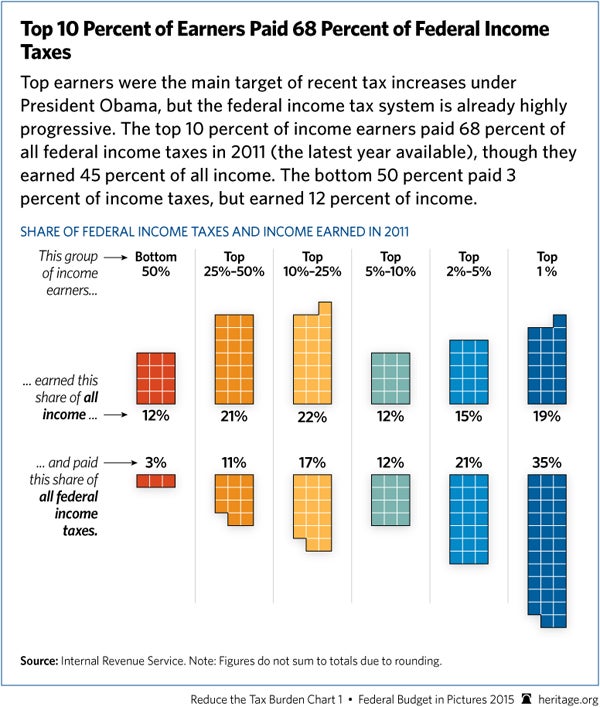

The top 1 percent of earners paid 35 percent of all federal income taxes in 2011 (the latest year available), though they earned only 19 percent of all income. The bottom 50 percent paid 3 percent of income taxes, but earned 12 percent of income. Those lucky enough to be at the top—including most of baseball’s best hitters—do pay a big share of taxes.

Internal Revenue Service data shows that from 1992 to 2010 the top 400 taxpayers in the country—some of whom are billionaires—changed significantly from year to year. From 1992 to 2010, 4,024 different taxpayers appeared on the top 400 list. That’s more than ten taxpayers for every spot in the top 400. Over 70 percent—2,909—made the list only one year.

The churning at the top means many Americans will have a day in the sun. Twelve percent of the population will reach the top 1 percent of income earners at least once. And 39 percent of Americans will spend time in the top 5 percent of earners, 56 percent will be in the top 10 percent and a whopping 73 percent will spend at least a year in the top 20 percent of earners.

Will your income make you a top-tier taxpayer when you file taxes next year? Will Houston’s Jose Altuve repeat as the MLB batting champ? We’ll have to wait and see.