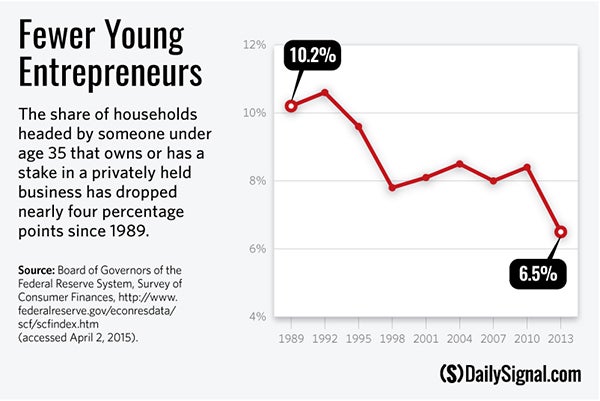

According to the Federal Reserve Survey of Consumer Finances, the share of people under 35 who own a stake in private businesses has fallen from 10.2 percent in 1989 to 6.5 percent in 2013, the latest year data is available.

This is part of a larger trend as private business ownership overall has fallen from 13.3 percent of all families in 1989 to 11.7 percent in 2013. But the drop for those under 35 has been particularly pronounced, and it is likely all the following reasons have played a part:

- It has become more difficult to run a small business with various government entities pushing new regulations at entrepreneurs. Government regulations ranked as one of the biggest challenges facing small businesses in a recent survey of 1,000 small business owners.

- Older people who have run businesses for years have learned to navigate the regulatory regime, but younger entrepreneurs struggle to jump through all the hoops required to start a business.

- Would-be entrepreneurs are emerging from college with more debt than in the past, making it hard to get additional loans to start businesses.

- Banks faced with higher costs and new regulations themselves are not willing to make as many small business loans as they did in the past.

Some say the younger generation has a lower tolerance for risk than their parents and seek the security of a paycheck over the uncertainty of business profits and losses. But today’s enterprising young people face a different business environment than their parents’ generation.

Would-be entrepreneurs today see business owners complaining of a highly uncertain regulatory environment that makes it hard to plan a business. Their reluctance to start a business may be less about risk aversion and more the result of a clearly thought-out decision-making process that weighs the positives and negatives of business creation.

The situation is unlikely to improve unless the regulatory climate is eased. If regulations are trimmed, look for more millennials to put shingles on doors and open for business.