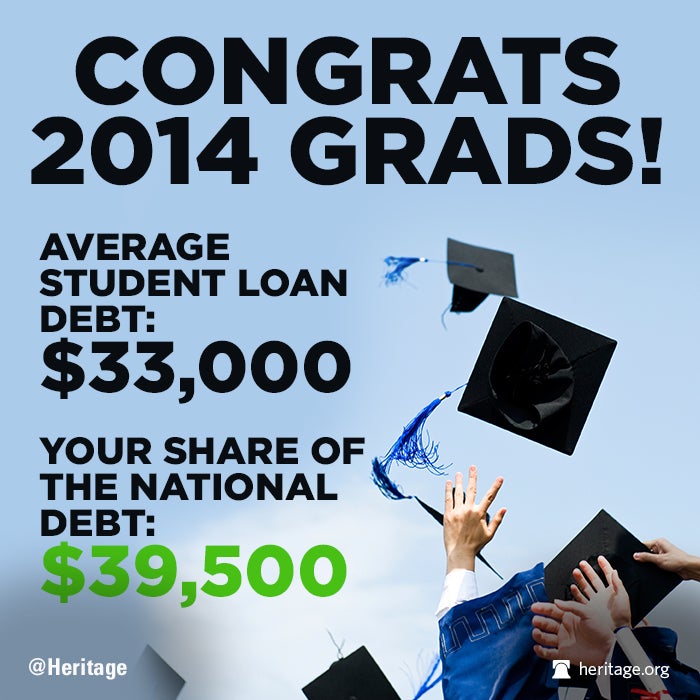

Congratulations to the Class of 2014—after all of your hard work in college, you will leave your campuses the most indebted class of graduates ever. The average grad will carry $33,000 worth of student loans off the stage with her diploma, nearly double the amount students took on 20 years ago (even when factoring inflation).

But what’s even worse: your share of the national debt. That comes to $39,500.

Each American will see his share of the national debt increase from $39,500 today to $142,000 in 2038, or more than triple the average starting salary for 2013 graduates.

As The Wall Street Journal notes, the class of 2013 graduated with the then-record amount of debt last year, and as the student loan burden continues to rise faster than inflation, the class of 2015will likely claim the title next year. In addition, a greater share of college students took loans out in 2014, leaving 70 percent of all graduates in debt. Compare that to the Class of 1994, when only half of graduates left school with loan payments to make.

The explosion of debt that graduates face today mirrors that of the nation. Despite the temporary dip in budget deficits, each year’s cash shortfall adds to the mountainous national debt, which now stands at a record high of $17.5 trillion.

And the debt will only continue to grow more quickly. Similar to how a greater proportion of college students is taking out loans, a greater share of the U.S. population will begin to consume more government services as the baby boomer generation retires and becomes eligible for Social Security and Medicare. This will cause the government to take on more and more debt to pay for these services as the growth of retirees outpaces the growth of the workforce.

Indeed, the Social Security Trust Fund ran a $74.6 billion deficit in 2013, a number that will jump to $322 billion in less than 20 years. Furthermore, a report from the Institute of Economic affairs indicates that the national debt held by the public is really $95 trillion—more than seven times the published figure—once government pension and health care commitments missing from official budget calculations are accounted for.

The burden of student and national debt should be a major concern for recent graduates. In addition to having to pay off more student loan debt than ever, graduates face a weak job market still struggling in the Obama recovery. And as the national debt increases more quickly, younger generations could face a larger future tax burden and lower investment in the private economy, possibly hampering economic growth.

So what can recent grads do? Take steps to start saving today, as young Americans should not count on Social Security to provide them with the same benefits today’s retirees receive. Also, grads should make their voices heard and urge Washington to make necessary budget and entitlement reforms that would reduce the debt and ensure economic prosperity for all. Young Americans have faced challenges before and have overcome them—there is no reason that this generation should be different.