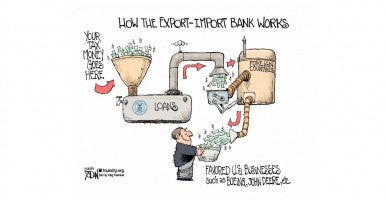

Supporters of one of Washington’s prime examples of cronyism, the Export-Import Bank, are rolling out the dollars and surveys to make the case that the bank is the “good kind” of corporate welfare (Is there such a thing?). But the sugar-coated rhetoric and selective numbers don’t make a convincing case.

In a release publicizing its study in support of Ex-Im, the American Action Forum says the reforms it calls for will “better protect taxpayers while minimizing market distortions.”

“Better protect taxpayers”? We should protect taxpayers, period, by getting them off the hook for subsidizing Ex-Im loans.

“Minimize market distortions”? We should get rid of government-induced distortions, period, by getting rid of a government program that picks winners and losers.

If taxpayers have to be protected and markets are being distorted, there is clearly a problem.

And here’s a gem of a survey: The Export-Import Bank released its own survey of small business owners who profit from foreign businesses using Ex-Im loans to purchase their products. Guess what they found? More than 80 percent said they were “satisfied or extremely satisfied with their overall Ex-Im Bank experience.” Well, of course they are! The U.S. government loans foreign companies the money to buy their products – and if the foreign companies ever default, they don’t have to worry because the loans are backed by U.S. taxpayers. That’s a good deal, all right, except for the taxpayers…but they weren’t asked any questions in the survey.

What “small business” really means to the Export-Import Bank >>>

Another major backer of Ex-Im, our friends at the Chamber of Commerce, must have noticed things aren’t “trending” their way on Twitter as they’ve begun running ads on the most popular hashtag for those following the issue: #EndExIm.

Indeed, momentum is building to do exactly that – end the Export-Import Bank. Earlier this month, a coalition of 30 conservative organizations and groups, from Americans for Prosperity and Club for Growth to Heritage Action and the National Taxpayers Union, sent a letter to Congress urging them to oppose the reauthorization of the Ex-Im Bank, whose charter expires in September.

Conservatives are opposed to the Ex-Im Bank scheme for good reason(s). It gives loans to foreign companies in nations hostile to the U.S., such as Russia and Venezuela. It creates an unfair playing field for American companies like Delta, who pays full price for planes it purchases from Boeing, yet has to compete with Air China, which is buying planes from Boeing with subsidized loans. Sure, Boeing likes it. But talk to the folks at Delta and companies in other industries, from the environment and energy to medical equipment manufacturing, where Ex-Im loans help foreign companies at the expense of American companies.

And considering 98 percent of the $2.2 trillion in annual U.S. exports are financed without help from Ex-Im, America and American companies would certainly get along just fine without it. And so would other countries. The American Action Forum report itself says nearly 41 percent of the taxpayer exposure through Ex-Im is concentrated in Asia – a region for which there is ample export financing. And even Boeing, one of the primary beneficiaries of Ex-Im, has publicly stated it could obtain private financing for its export sales if necessary.

Those are the facts on Ex-Im, and no amount of advertising or public relation stunts will change them.