Two Members of Congress are reportedly trying again to impose an excise tax on certain financial transactions—i.e., the “Robin Hood tax.”

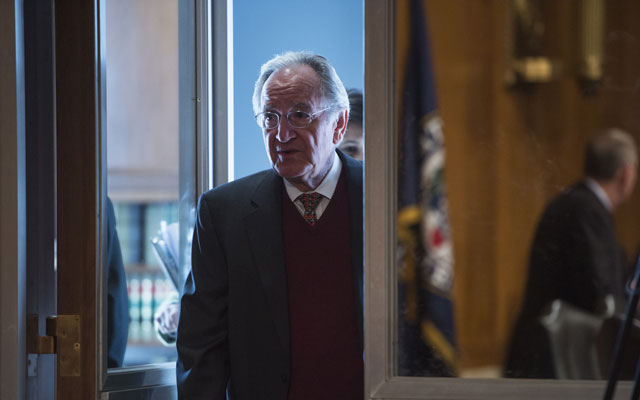

A financial transactions tax can take several forms, but the version proposed by Senator Tom Harkin (D–IA) and Representative Peter DeFazio (D–OR) in the last Congress would have charged 0.03 percent of the value of a stock or bond trade or 0.03 percent of the actual payment made for a derivatives contract, depending on the type of transaction.

While such a small tax might not seem troublesome, many experts believe that the Harkin–DeFazio financial transactions tax would wreak havoc on the economy.

The Congressional Budget Office (CBO) warns that a tax on financial transactions could “diminish the importance of the United States as a major financial market” and that, in the short run, “imposing the transaction tax would probably reduce output and employment.”

These are not minor considerations in an economy that is still recovering. The U.S. financial industry dominates those of most other nations, but it has been feeling competitive pressure from other areas. As the CBO says, a financial transactions tax would drive major portions of the industry overseas, including the part that conducts high-volume trading.

This would diminish the importance of the U.S. as a financial center and greatly reduce the economic benefits that come with it. Among other things, thousands of high-paying jobs would leave the U.S., sharply reducing employment at hundreds of non-financial companies that depend on these customers.

Although the tax seems like a tiny amount, it often amounts to much more than the profit that financial firms would earn from the affected trades. In addition, a financial transactions tax would harm middle-class investors who are saving for retirement as much as or more than it would harm high-frequency traders.

The tax would apply to trades made by fund managers handling investments in funds such as 401(k) and similar retirement savings plans, IRAs, 529 college savings plans, annuities, and a host of others who mainly serve moderate-income families.

The reduced investment growth of these plans could cause smaller retirement incomes and make it harder to pay tuition bills, save for a down payment on a home, and meet a number of other savings goals.

Harkin and DeFazio will no doubt argue that their financial transactions tax, in addition to punishing Wall Street, could raise revenue to close the deficit. This claim is questionable, as the volume of financial transactions would fall as companies move overseas and restructure products and transactions.

Further, this country has a deficit and debt crisis because Washington spends too much, not because it taxes too little. Congress needs to focus on cutting spending, not unnecessary and economically damaging tax hikes.

A financial transactions tax has never received much support in Congress for very good reasons. That should remain the case with the latest Harkin–DeFazio effort.