A large tax increase is scheduled to hit almost all taxpayers at the end of next year—that is, unless Congress comes up with, and agrees to, another plan before then.

Expect a lot of talk about taxes from politicians over the next year-and-a-half as Washington grapples with the looming tax cliff.

Unfortunately, few lawmakers will speak the blunt truth that onerous taxes punish wealth creation and innovation, and therefore lead to less prosperity for everyone.

Even fewer will address the shadow that unsustainable deficits cast on future prosperity, as our kids and grandkids face the prospect of far more onerous taxes and inflation.

Instead of talking about the harm that taxes cause to America’s economic vitality, most lawmakers will talk about taxes from one of three perspectives: the Tax Demagogues, the Tax Benefactors, and the Economic Stimulators.

The language each of them uses undermines, in its own way, the reality that overtaxation and overspending drag down the economy.

In their desire to raise taxes and spending, the Tax Demagogues appeal to people’s envy. The problem with our society, they say, is that the rich don’t pay their “fair share.” Never mind that the top 1% of Americans pay more than 45% of federal income taxes.

Or they might say the problem is that we don’t tax “greedy” businesses enough—as if raising business taxes will cause them to make better products at lower prices while paying higher wages. As if higher taxes will encourage the entry of innovative startups that drive competition.

By trying to persuade voters that taxes are someone else’s problem, the Tax Demagogues hope to continue spending with impunity.

The next category, the Tax Benefactors, could be mistaken for philanthropists based on their rhetoric. The problem is they want to be philanthropic with someone else’s money.

Their “tax plans” focus on expanding tax credits and benefits to Americans who pay no taxes. They tout credits for health care, child care, low-income housing, and everything else under the sun. They claim that cutting a check “lifts people out of poverty,” apparently ignorant of how much harm has been caused by the welfare state since the 1960s.

To listen to them talk about the government raining down “tax benefits” upon people, you might forget that the government can’t pay for such benefits unless it taxes that money away from someone else or simply prints the money, inflating away the value of people’s hard-earned incomes and savings.

The last category, the Economic Stimulators, are more eclectic. Sometimes, their tax proposals are sound, but even then the Economic Stimulators shroud their policies in language that makes it seem like the government must come in to boost the economy like a car with a dead battery.

But if the economic engine isn’t humming, it’s because taxes and the government leviathan are gumming things up. Good pro-growth tax policy isn’t about the government “stimulating investment; it’s about removing government-imposed constraints to allow Americans to invest and innovate more freely.

Excessive and poorly designed taxes kill jobs, reduce wages, and drive investments overseas.

Improved tax policies help mitigate that damage, but government policy doesn’t create jobs; entrepreneurs and businesses do. They do this when they’re free to keep most of what they build so they can continue to build, invest, and expand their endeavors, while creating job opportunities and innovative new products in the process.

Policymakers must not lose sight of who the actual job creators are.

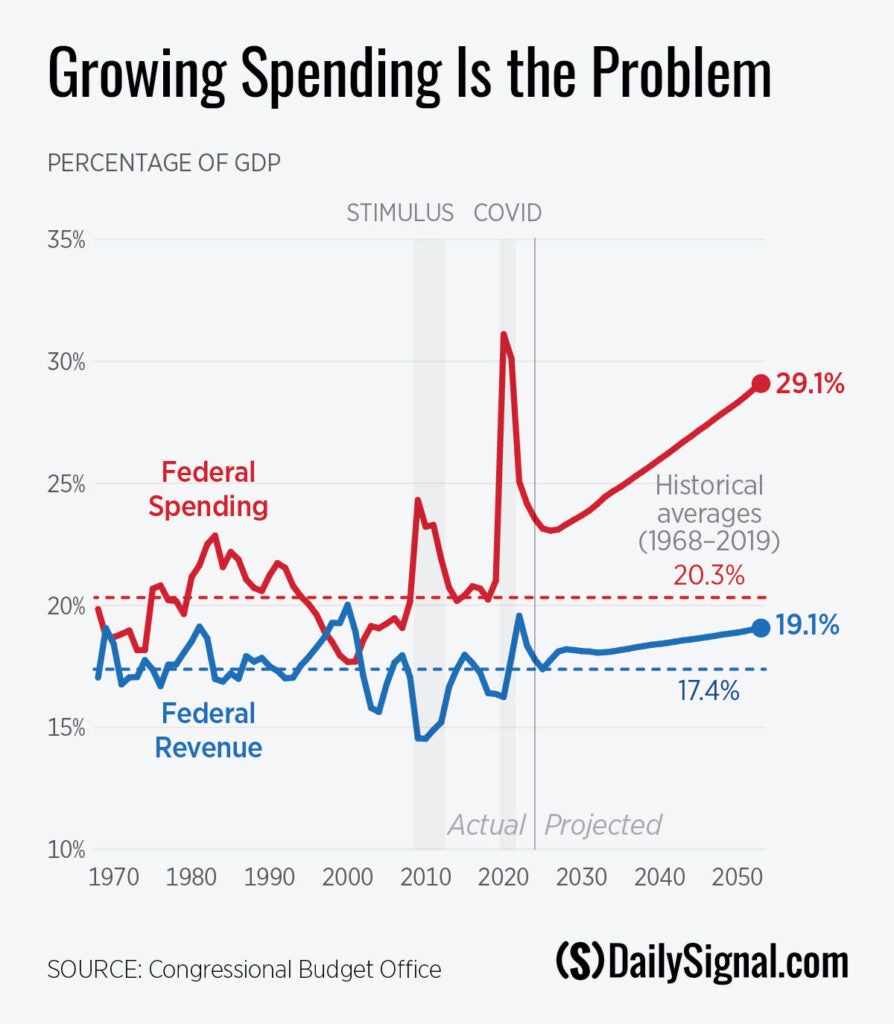

Taxes aren’t the only problem America faces as the 2025 tax cliff approaches. There’s also the matter of the $34.6 trillion national debt that’s driving inflation and interest rates higher.

Given America’s fiscal position, it isn’t good enough to say that taxes should be cut indiscriminately. Lawmakers should avoid adding to the mounting federal debt and deficits.

First and foremost, Congress must cut spending to get deficits under control. The deficit doesn’t stem from too little taxation, it stems from too much spending.

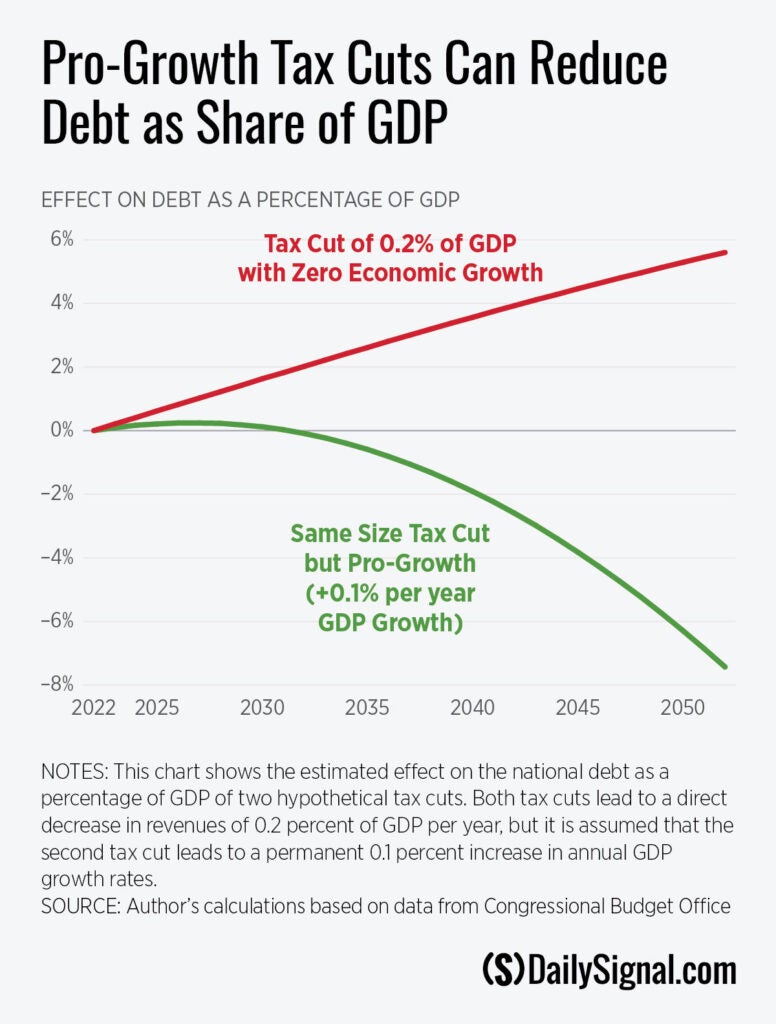

But to avoid exacerbating the deficits and debt, lawmakers must also focus on tax reforms that allow the economy to grow in a fiscally responsible way.

How do they do that? Here are five keys (elaborated upon in greater detail in this report):

- Improve incentives by reducing harmful taxes on productive activities such as investing, saving, and working. The more the government taxes what leads to prosperity, the less prosperous society will be.

- Eliminate unnecessary carveouts to allow for lower tax rates. Special-interest tax credits and industry-specific breaks for things like electric vehicles and solar and wind power unnecessarily distort prices and hurt the economy. Fewer carveouts enable lower tax rates.

- Make tax policy permanent, not temporary. Permanent tax reforms allow businesses to operate under a stable set of rules that is both simpler and less likely to encourage federal lobbying.

- Reduce high tax rates and double taxation. Part of the danger of uneven, poorly designed taxes is that they distort price signals, which are critical to a well-functioning economy. High tax rates and multiple layers of taxation wreak far more economic havoc than modest rates.

- Simplify taxes. The billions of hours that individuals and businesses dedicate to their taxes and to tax planning because of the complexity of the tax code saps economic resources and reduces Americans’ living standards.

Excessive debt threatens American prosperity, but higher taxes on wealth creators and innovators is no solution.

Just as someone earning $1 million per year can afford higher monthly mortgage payments than someone making much less, a strong economy is essential if America’s economic engine is to be powerful enough to get out of our gaping fiscal hole.

To allow Americans to prosper, Congress must mitigate the damage of its own taxes, spending, and debt, so that entrepreneurs and innovators can lead us out of the mess that Washington created.