An economist says “American families are having to eat the rotten fruit from the tree of government overspending” after the U.S. Bureau of Labor Statistics reported on Wednesday that the consumer price index, a key measure of inflation, rose 0.2% in June.

“It’s great news for the consumer that inflation has slowed dramatically from 40-year highs, but we’re still in terrible shape,” EJ Antoni, a research fellow for regional economics in the Center for Data Analysis at The Heritage Foundation, told The Daily Signal in a written statement. (The Daily Signal is The Heritage Foundation’s news outlet.)

“Real weekly earnings are down 4.6% since January 2021 and prices are up 16% over that same time. Annual inflation has outpaced earnings gains for 26 of the last 30 months,” Antoni added. “Even more worrisome is the fact that inflation has settled at 3%, which is about 50% higher than either the 2% target or the 1.8% average we saw from 2009 until the Biden administration.”

The Daily Signal depends on the support of readers like you. Donate now

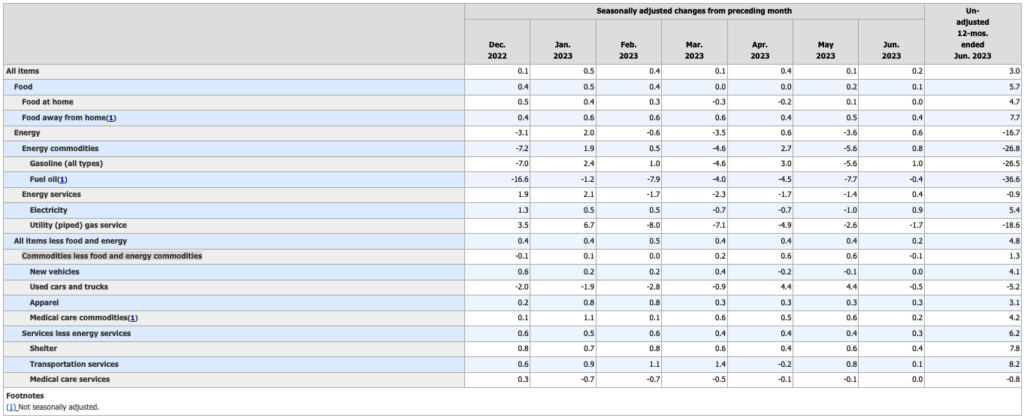

The food index increased 0.1%, the energy index increased 0.6%, the gasoline (all types) index increased 1%, and the shelter index increased 0.4%, while the fuel oil index decreased 0.4%, the utility (piped) gas service index decreased 1.7%, and the used cars and trucks index decreased 0.5%, according to the U.S. Bureau of Labor Statistics.

“Good jobs and lower costs: That’s Bidenomics in action,” President Joe Biden said in a statement on the report.

“Today’s report brings new and encouraging evidence that inflation is falling while our economy remains strong. Annual inflation has fallen each of the last twelve months and is now down to 3%.”

Alfredo Ortiz, chief executive officer and president of the Job Creators Network, also reacted to the inflation report.

“The price of goods and services has risen by more than 16% over the course of President [Joe] Biden’s term. This destruction in the dollar’s value has reduced Americans’ real wages and living standards,” Ortiz said in a written statement. “For some goods and services, such as food, prices are up more than 20%.”

“While inflation is finally coming back down, it remains far higher than the Federal Reserve’s target rate, and it’s important to remember today’s price increases are compounding off a much higher base,” Ortiz said. “Core inflation over the last year continues to outpace average wage growth, meaning Americans are still experiencing real wage destruction related to core goods and services.”

Inflation rose 0.1% in May and a year-over-year rate of 4%, CNBC reported.

The May report, released on June 13, showed that the food index increased 0.2%, the used cars and trucks index rose 4.4%, the apparel index rose 0.3%, and the transportation services index rose 0.8%, according to the U.S. Bureau of Labor Statistics.

Meanwhile, the energy index decreased 3.6%, the fuel oil index decreased 7.7%, the medical care services index decreased 0.1%, and the gasoline (all types) index decreased 5.6%, the U.S. Bureau of Labor Statistics reported last month.

The July consumer price index report will be released on Aug. 10 at 8:30 a.m.

This is a breaking story and may be updated.

Have an opinion about this article? To sound off, please email letters@DailySignal.com, and we’ll consider publishing your edited remarks in our regular “We Hear You” feature. Remember to include the URL or headline of the article plus your name and town and/or state.