Congress is moving full steam ahead on ramming through a bloated, wasteful, and debt-exploding $1.9 trillion legislative package.

Although it’s supposedly justified by the COVID-19 pandemic, most of the spending is designed to appease progressive ideological causes and politically connected interest groups.

A prime example is the $57.5 billion currently earmarked for various parts of the transportation industry.

The Daily Signal depends on the support of readers like you. Donate now

While transportation is often thought of as a nonpartisan issue, most of these taxpayer funds are being used to provide preferential treatment for labor unions, and most of the rest is of questionable value.

More than half of the amount, $30 billion, goes to mass transit. That is, frankly, absurd.

To begin with, transit covered only a small fraction of the nation’s transportation system even before the pandemic, with all forms of public transportation accounting for just 5% of commuter trips in 2019.

In addition, this $30 billion would represent roughly 60% of total yearly transit operating costs nationwide, on top of the more than $10 billion that transit agencies annually receive from the Highway Trust Fund.

Thus, the federal government will single-handedly provide nearly all of the funds for transit operations, even though the vast majority of transit use occurs in a small handful of metro areas.

That means taking money from people in Manhattan, Kansas, to pay for transit services in Manhattan, New York.

The same thing already happened last year: Congress provided $39 billion in transit funding across multiple relief bills in 2020.

Since so few people are using transit during the pandemic, what are taxpayers buying for the $30 billion? The answer is: outrageous compensation packages for unionized government workers.

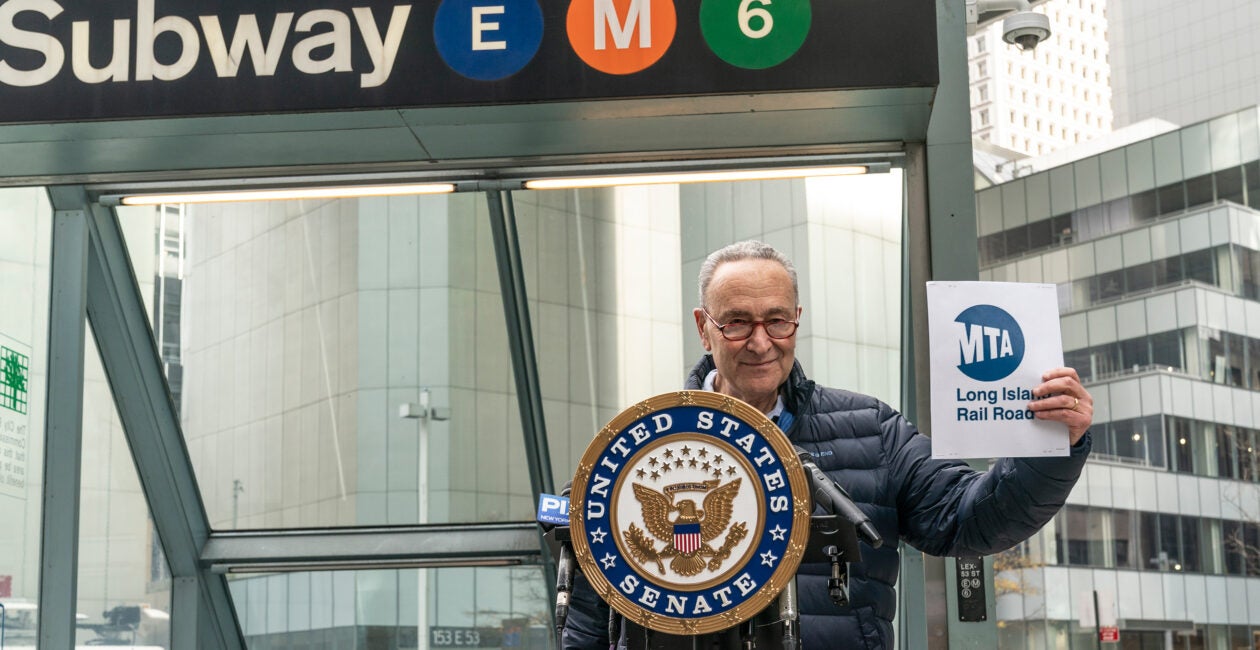

For example, the largest transit organization—New York’s Metropolitan Transportation Authority—has labor costs of $151,693 per employee.

Rather than pressuring local transit agencies to examine their bloated payrolls and insane costs, continued subsidies allow them to keep doling out goodies (and help the labor unions provide generous support to urban political machines).

An additional $14 billion would subsidize airlines to freeze their payrolls in place despite the sharp decline in air travel. This is now the third round of handouts for airlines, which have already received $50 billion over the past year.

It would be one thing if we could reasonably expect airline traffic to snap back to 2019 levels once COVID-19 is under control. However, experts predict that it will take several years for that to occur, partially as a result of the widespread use of teleconferencing.

As such, trying to prevent a single airline layoff is an exercise in futility.

It should not surprise you to learn that airline employees are also heavily unionized.

The next-largest share of transportation funds, $8 billion, would go to airports. As with the other bailouts, that is intended to allow airports to ignore the steep drop in consumer demand and avoid finding ways to cut costs.

Airports already received a $10 billion COVID-19 bailout last year. The first bailout was an epic disaster, with a botched formula giving unintended jackpots that covered up to four years of expenses.

While we should expect the second bailout to avoid that specific foul-up, it’s worth remembering that taxpayers already provide airports with a multitude of subsidies, many of which are aimed at low-use airports to maximize political (rather than public) benefits.

While Congress should clearly put these subsidy plans in reverse, it should also recognize that there are ways for the federal government to help the transportation industry, including:

- Getting rid of red tape and federal micromanagement that drive up the cost of construction projects and interfere with decision-making for state and local governments.

- Setting up pre-purchase accounts with airlines to cover future flights for government employees, which would provide cash without being a pure handout.

- Avoiding unnecessary travel restrictions.

- Eliminating federal rules that interfere with airport self-funding, which would allow airports to recover more effectively as passengers return.

It has become all too easy for legislators to “solve” problems by whipping out the national credit card.

However, with the national debt at a staggering $27.9 trillion, they should think twice when considering new taxpayer-funded handouts—especially when those handouts are aimed at already favored groups, such as labor unions.

Have an opinion about this article? To sound off, please email letters@DailySignal.com and we will consider publishing your remarks in our regular “We Hear You” feature.