U.S. and European businesses continue to find China a harder place to do business with its increasing regulations.

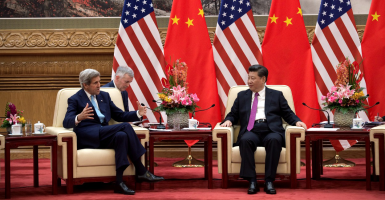

This struggle between the West and China was made clear at the 8th annual US-China Strategic and Economic Dialogue, which was held last week.

The U.S.-China Strategic and Economic Dialogue is a high-level dialogue between the U.S. and China to discuss a wide range of bilateral, regional, and global economic and strategic issues.

It was established in 2009 by President Barack Obama and former Chinese President Hu Jintao, as follow-on to the economic-focused Strategic Economic Dialogue established during the George W. Bush administration.

Some observers have hailed this latest round in Beijing as the most productive conference to date. The reality, however, is that on substantial issues, there was little or no progress (for good reason).

There are a multitude of big picture issues that block progress on bilateral economic issues between the world’s two largest economies.

Notably, China is currently suffering enormous excess industrial capacity in most of its critical manufacturing sectors. In May, the U.S. Commerce Department paved the way to levy a 522 percent anti-dumping import duty on Chinese cold-rolled flat steel.

While the Chinese made a commitment to reduce excess capacity, this may not materialize anytime soon.

The Chinese are likely to continue to price exports well below marginal cost as long as economic growth continues slumping. This also, unfortunately, kills near-term prospects for a bilateral investment treaty with the United States.

The yuan has depreciated somewhat sharply against the U.S. dollar in recent months. As part of the Strategic and Economic Dialogue agreement, Beijing has again promised to address this by pushing for market-based exchange rate reform and greater transparency about future policy, including avoiding competitive devaluations.

But while U.S. officials welcomed this, and although there is recent precedent for the Bank of China intervening to actually prop up the value of the yuan, there is simply a limit to how valuable—in dollar terms—the Chinese will allow its currency to be.

Another significant agreement from this week’s conference is Beijing’s promised efforts toward improving its quarterly gross domestic product accounting and to also report comprehensive international banking statistics to the Bank of International Settlements—making critical information available on the world’s largest banking system.

To attract more foreign capital, China has stated a commitment to strengthen its corporate governance (rated one of the worse in the world), including measures to protect the rights of minority shareholders and increasing disclosure requirements. If this came to fruition, it would dramatically increase the return on domestic capital, currently an Achilles’ heel in China’s economy.

Perhaps the most contentious economic issue is equitable treatment of foreign investors in China. The Chinese also agreed to remove discriminatory trade and investment barriers, particularly in the area of financial services.

When considering the Chinese promises on economic reforms made last week, one is reminded of Vladimir Lenin’s quip, “Promises are like piecrust, they are meant to be broken.” Whatever their officials may have had in mind in making these promises, circumstances are more likely than not going to mean they go largely unfulfilled.