The last major update to the U.S. tax system was in 1986—over 29 years ago.

Think about how much has changed since then. In 1985, Microsoft Windows was released. Since then, Microsoft has released more than 20 updates to the operating system.

Updating the tax system is one of the perennial policy issues politicians enjoy talking about, and has the potential to be a key policy debate in 2015 and 2016.

But whether all the talk, hand-wringing and head-nodding will actually result in change is yet to be seen.

While Washington has consensus that tax reform needs to happen, there’s significant disagreement on how to reform it.

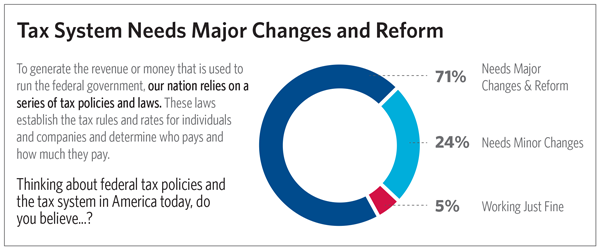

A recent study on American attitudes and support for tax reform conducted by the American Perceptions Initiative, a project of The Heritage Foundation, found that only a slight majority of Americans support tax reform (52 percent), in part, due to limited familiarity with what “tax reform” actually means.

However, once respondents gained more familiarity with the current tax system and the possibility of alternate approaches, the level of support for tax reform among Americans jumped significantly to 71 percent. Only 5 percent believe the system is working just fine.

Americans are uncertain about what reform could mean, how it would impact them and whether they trust Washington to tackle the problem.

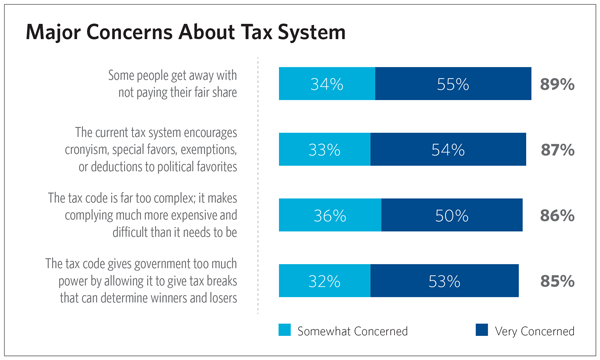

A majority of Americans (75 percent) want to “keep taxes as low as possible to stimulate investment and growth.” And their desire to fix the current tax system is built on the concerns that it’s “unfair, corrupt, and too complex.”

Everyone agrees the tax system should be fair. Americans currently feel “some people are getting away with not paying their fair share.” Similarly, a majority of Americans agree the current system encourages cronyism, gives government too much power to pick winners and losers and is too complex.

But it’s not clear that they trust Washington to be able to fix it: Seventy-nine percent say Washington is incompetent and corrupt and cannot be trusted.

When asked about what “fairness” means, 56 percent of Americans believe fairness means everyone pays an equal share or percentage. Those that make more will ultimately pay more—25 percent of a million-dollar salary is obviously more than 25 percent of a $50K salary. Forty-four percent believe fairness means those with more should pay more (that is, a higher percentage).

With this as a backdrop, any attempt at tax reform should focus on the concerns of fairness, corruption and complexity. An updated tax system that would garner the most support would:

- Ensure the entire tax burden is transparent

- Close loopholes for corporations and individuals

- Eliminate special tax breaks for highly profitable businesses

- Institute changes that increase the amount of money individuals take home

While voters are not very familiar with alternative systems, there are clearly appealing aspects to them. In fact, after learning just a little bit about three alternatives—National Sales Tax, Business Transfer Tax, Flat Tax—only one in five (20 percent) would want to continue with our current federal income tax system. Eighty percent would prefer one of the other alternatives.

Americans are ready to support changes to the tax system. In order to build that support, the language of reform is important. Highlighting the top concerns and problems with the current system heightens the demand for change.

Conservatives would be wise to put forward a plan to update the tax system that treats everyone fairly, is simple and straightforward, rewards hard work and savings, and eliminates special privileges.