Millions of Americans are expected to pay a fine rather than buy health insurance.

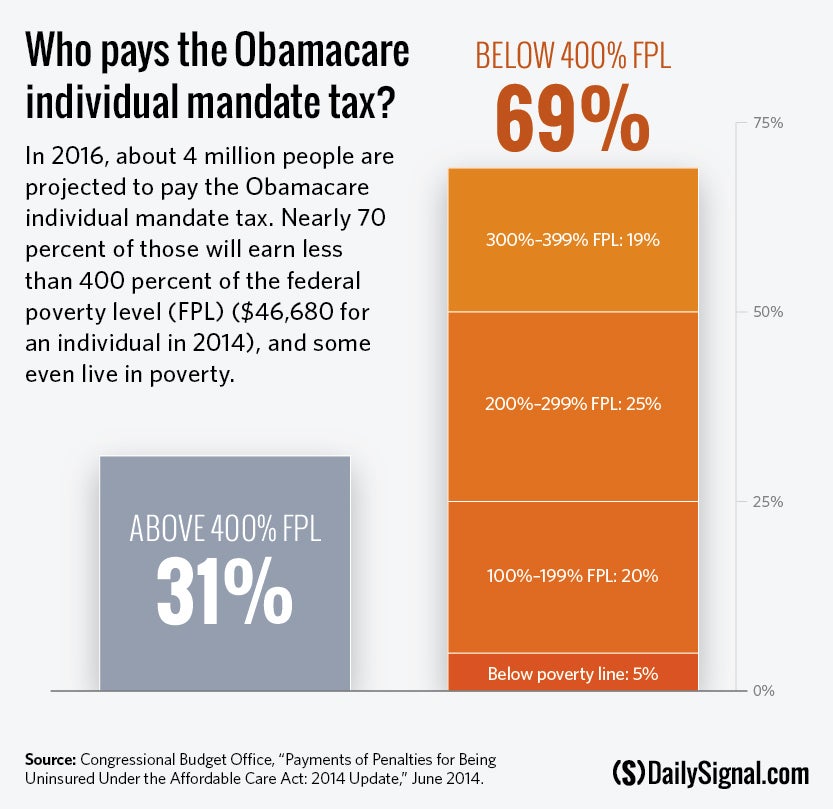

Obamacare’s individual mandate forces people to either purchase a government-approved level of insurance coverage or pay a fine. The Congressional Budget Office (CBO) recently updated its projections on how many will pay the mandate penalty to about 4 million payers in 2016.

Nearly 70 percent of those that are expected to pay the penalty have incomes that qualify for premium tax credits in Obamacare’s exchanges, meaning they could receive some government subsidy to offset the costs of insurance, although other factors might deem them ineligible.

From 2015-2024, the mandate will generate $46 billion in revenue from the uninsured. The penalty is the greater of $95 or 1 percent of income this year. In 2015, it will increase to $325 or 2 percent of income in 2015, and in 2016, it will reach $695 or 2.5 percent of income.

Although only 4 million will pay the penalty for not obtaining coverage, the CBO projects 30 million people will be uninsured in 2016. This is because the 26 million people that are uninsured but do not have to pay a penalty are assumed to qualify for one of the law’s many exemptions.

Examples of exemptions include unauthorized immigrants, people with incomes low enough that they are not required to file an income tax return, people with incomes below 138 percent of the federal poverty line that live in states that do not expand their Medicaid programs, and those filing for bankruptcy in the last 6 months.

Another way to qualify for a hardship exemption that is a bit peculiar is to have had your plan canceled due to Obamacare’s new requirements on insurance plans and then subjectively deem other coverage options unaffordable—without needing to submit proof.

Without a doubt, the individual mandate tax is one of the law’s most contentious provisions but taxpayers must remember that it is just one of the law’s 18 new tax increases—which are estimated to bring in an estimated $771 billion in revenue over a decade.