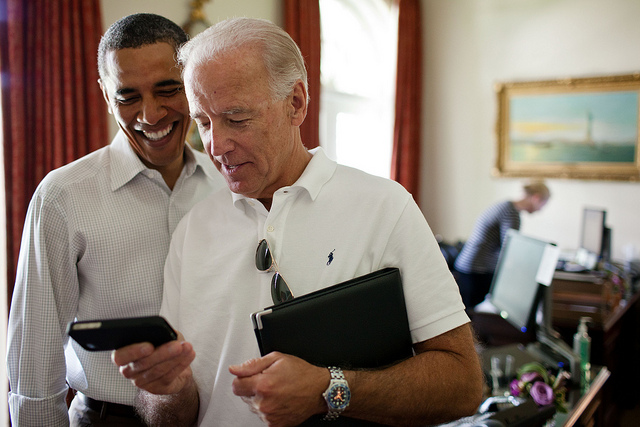

Four days before the April 15 filing deadline, the White House today released 2013 income tax returns for President Barack Obama and Vice President Joe Biden showing each man and his wife paid just under $100,000 in tax.

The White House blog noted that the president and first lady reported adjusted gross income of $481,098 and paid $98,169 in total tax.

The Obamas donated $59,251 to 32 charities, with the largest reported gift being $8,751 to the Fisher House Foundation. The Rockville, Md.-based nonprofit is best known for providing a homey place to stay for families of members of the armed forces receiving medical treatment in the Washington area.

Biden and his wife, Jill, together reported adjusted gross income of $407,009 and paid $96,378 in taxes. The Bidens gave substantially more in charity than in previous years, donating $20,523 in 2013.

With thousands of credits, deductions, and exemptions in the tax code, Heritage Foundation research fellow Curtis Dubay notes, it’s no surprise that more Americans — including the president and vice president — use pricey software or professional CPAs to prepare their returns. Tax reforms, Dubay wrote in a recent paper, could simplify the filing process:

“The best that can be said of Tax Day is that it provides a yearly reminder of just how convoluted the tax code is and how much damage it does to the economy. It should also serve as a periodic reminder that filing taxes does not have to be this way.”

The National Taxpayer Advocate Service, the arm of the Internal Revenue Service designed to help the average taxpayer, reports that U.S. tax filers spend an estimated 6.1 billion hours and $168 billion on preparing their returns.

This story was produced by The Foundry’s news team. Nothing here should be construed as necessarily reflecting the views of The Heritage Foundation.