Liberal economists like Paul Krugman might be calling for more government spending to help our ailing economy, but federal spending cuts are the better bet for long-term economic growth according to a new study released today by The Heritage Foundation’s Romina Boccia.

Liberal economists like Paul Krugman might be calling for more government spending to help our ailing economy, but federal spending cuts are the better bet for long-term economic growth according to a new study released today by The Heritage Foundation’s Romina Boccia.

Krugman stubbornly argues that government should spend more for the economy to thrive. Last spring as the 2013 sequester took place, he offered “a refresher on the nature of our economic woes and why this remains a very bad time for spending cuts.”

Just a few months after that, Moody’s asserted that the U.S. economy “has demonstrated a degree of resilience to major reductions in the growth of government spending.” It appears Krugman and his big-spending allies are the ones in need of a “refresher”: Spending cuts help, rather than hinder, long-term economic growth.

Heritage’s Grover M. Hermann Fellow Romina Boccia provides this much-needed refresher by showing how spending cuts foster economic growth by encouraging private-sector investment and limiting the negative effects of deficit spending on the economy. Boccia argues that reducing government spending today spurs economic growth in the future and puts America on the path to fiscal well-being.

Here are several key takeaways for lawmakers:

- Spending and debt must be addressed to avoid slow economic growth and European-style austerity. Boccia cites Lorenzo Bini Smaghi of the European Central Bank: “Austerity is the result of countries’ democratic decisions to wait until the last minute before acting, under pressure of the markets, mainly by raising taxes rather than implementing long-waited reform.” For the U.S., this advice is timelier than ever. Congress has continuously avoided proactive solutions to the nation’s spending problem, perpetuating an endless cycle of the country careening from crisis to crisis. “If lawmakers neglect entitlement reform and further spending reductions,” Boccia warns, “growing spending and high debt will significantly depress U.S. economic growth.”

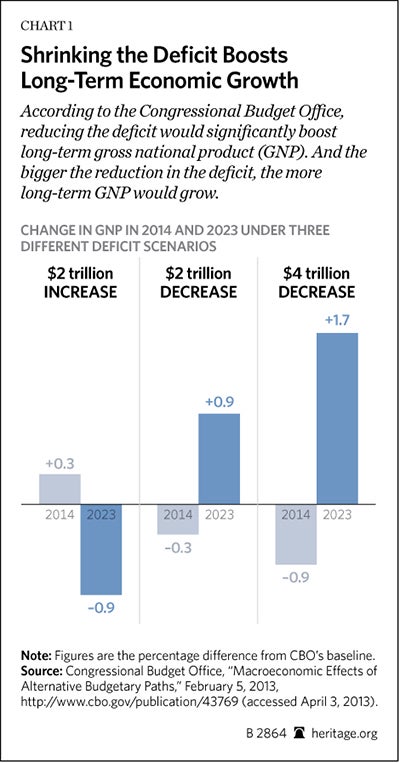

- Government spending and debt continue to grow, even with sequestration in place. Even with sequestration in place, federal spending is still projected to grow by 69 percent over 10 years. “Lawmakers should deliberately budget within sequestration,” Boccia argues, “and do much more to slow the explosion in spending and debt.” Reducing the debt is a priority, as the Congressional Budget Office projects publicly held debt will reach 87 percent of gross domestic product (GDP) by 2023, a level that, according to the CBO “will reduce the nation’s output…and it raises the risk of a fiscal crisis.” This is reinforced by studies that show countries with high debt levels experience low economic growth.

- Budget cuts today mean economic growth tomorrow. The biggest takeaway is that any short-term dip in output from cutting spending would be “followed by stronger economic growth in the long term.” Lawmakers should not be afraid to make difficult cuts today to accelerate growth in the future. As Boccia concludes, “[P]utting the budget on a path to balance with spending cuts would spur economic growth by reducing uncertainty and by freeing up resources for investment and job creation.” If Capitol Hill continues to drag its feet on reforms, “the U.S. economy will suffer a self-inflicted wound from unavoidable austerity measures” and continue trudging slowly down the path to recovery.

Legislators in the budget conference have a new opportunity to protect the nation’s fiscal future and encourage economic growth. Following basic principles—addressing future debt and enforcing lower levels of spending—will help secure a more prosperous economic future for working Americans.

Michael Sargent is currently a member of the Young Leaders Program at The Heritage Foundation. For more information on interning at Heritage, please click here.