A clear majority of Americans believes that imposing a firm limit on borrowing with spending cuts is the only chance for Congress to kick its gluttonous spending habit.

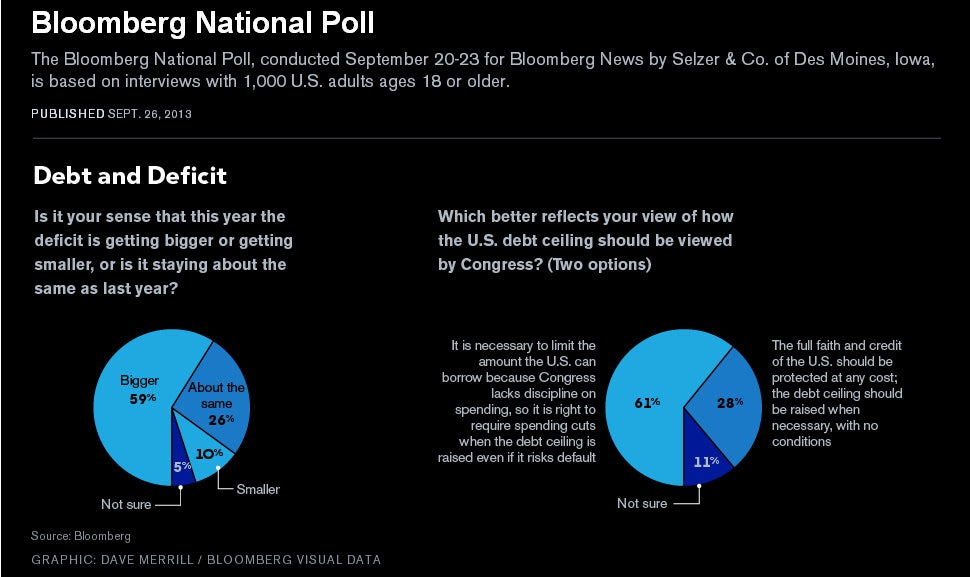

A recent poll released by Bloomberg shows that the majority of Americans oppose President Obama’s demand that Congress raise the debt ceiling without any spending cuts—by a margin of nearly two to one: 61 percent of Americans surveyed said that it is “right to require spending cuts when the debt ceiling is raised, even if it risks default,” because “Congress lacks discipline on spending.”

This call for spending cuts in any debt limit deal is a strong public rebuke of President Obama and Secretary Jack Lew’s plea to expand the government’s borrowing authority with no strings attached. Indeed, Americans are rightfully concerned with Washington’s inability to limit borrowing. The current debt accrued in credit markets is at a 50-year high and is projected to reach a dangerous 83 percent of gross domestic product in less than one decade.

Washington has raised the debt limit seven times during Obama’s presidency, adding $43,000 of debt for every American household in just the past four years. And the last time Congress and the President raised the debt ceiling, not only did they fail to accomplish any spending cuts; they also racked up an additional $300 billion in national debt.

The Republicans’ proposed measure to suspend the debt cap until December 31, 2014, would push the debt ceiling up by $1.1 trillion—another $8,800 per household—while saving only $256 billion from budget revisions and entitlement reforms. This is unacceptable. As Heritage budget expert Romina Boccia points out:

[T]he proposal is woefully inadequate. Republicans have all but given up on the Boehner rule, requiring a dollar in cuts or reforms for a dollar increase in the debt limit. They are already $300 billion behind, and this latest proposal would put them $1.1 trillion deeper in the hole.

What’s the solution? Boccia outlines a financially responsible way to handle the debt ceiling: “To avoid a debt crisis now and in the future, Congress should cut spending and enact policy reforms that put the budget on a path to balance.”

Congress still has some time and options. Even if the debt limit is not raised by mid-October, Boccia writes, “the Treasury would not necessarily default on debt obligations,” as it can “reasonably be expected to prioritize principal and interest payments on the national debt, protecting the full faith and credit of the United States above all other spending.”

In other words, risk of a default is practically nil—unless the President and Treasury choose to default, an unprecedented and almost inconceivable course of action.

Americans know what it takes to get Washington’s budget problems under control. Will President Obama listen?