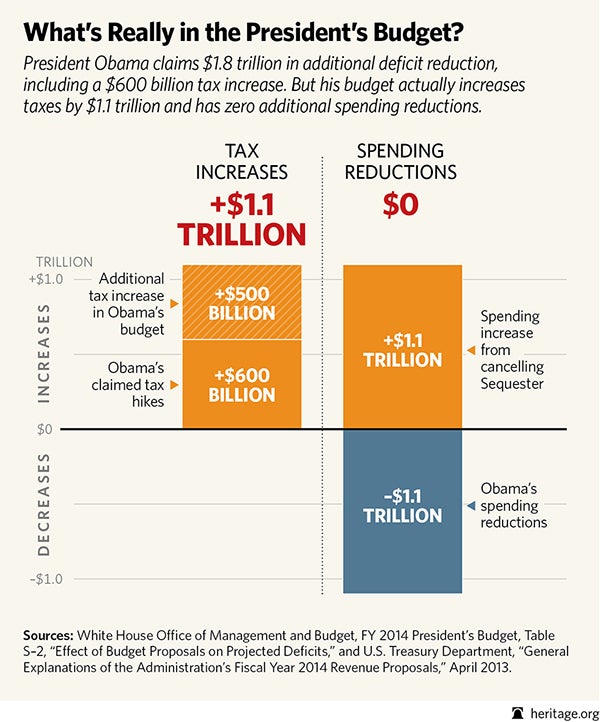

The Congressional Budget Office’s (CBO) official score of President Obama’s budget shows in numbers a vision for economic decline in America. The President imposes a tax increase totaling $1.1 trillion (and a net increase of about $1 trillion), some components of which would directly hit middle-class and lower-income Americans.

On the spending side, the President would cancel sequestration and claims to offset the $1.1 trillion spending increase with equal spending reductions for a zero-spending effect. What this means in reality is that Americans would be left with a $1.1 trillion tax hike and $0 in additional spending reductions. This defines the President’s “balanced approach.”

But it gets even worse. The President’s largest budget savings are fake!

- $601 billion in fake war savings. The President employs an old budget gimmick, claiming savings from a troop drawdown in Afghanistan and related spending on overseas contingency operations. These are only phantom war savings, as it would save money Congress did not intend to spend in the first place.

- $290 billion in fake emergency savings. Unless the President has the ultimate crystal ball predicting that there will be no hurricanes, floods, or other emergencies for which Congress will appropriate funding over the next 10 years, these savings are completely unrealistic. In 2013 alone, the President and Congress allocated over $40 billion in funding for Hurricane Sandy, even though much of the funding had nothing to do with the damage done by the storm. And of course this spending allowed lawmakers to bypass the Budget Control Act caps.

In the big picture, the CBO shows the President’s budget would do the following:

- Increase spending immediately by $26 billion in 2013 and by a whopping $142 billion in 2014, for a total spending increase of nearly $170 billion by next year alone.

- Increase the deficit by more than $200 billion in less than 3 years (2013 through 2015).

- If one buys the President’s fake savings, he would still rack up a total deficit of $5.2 trillion in just 10 years, $1.1 trillion less than the CBO’s most recent baseline projects. That’s the same amount as the President’s tax increase. Very clearly, the President would impose real tax hikes, but mostly fake spending cuts. His actual deficit at the end of the period would most likely be higher—but what does he care? His term will be long over.

America’s budget is on a fiscal collision course that requires courageous leadership to pursue reforms to those programs causing the greatest fiscal strain: entitlements. Instead, the President has decided to kick off his second-term with a budget that’s deeply partisan, and proposes a vision for economic decline.

More details on what’s in the President’s Budget:

- What policies are in the budget? Read: President Obama’s 2014 Budget: A Second-Term Vision for Economic Decline.

- What taxes would the President raise and which would affect me? Read: Net Tax Increase in Obama’s Budget Over $1 Trillion.

- How would Obama’s IRA Cap affect retirement savings? Obama’s IRA Cap: A Cap on Defined-Contribution Retirement Savings Plans.

- Obama’s Fake Budget Marketing Exposed: Morning Bell: Obama’s Fake Budget Marketing Exposed.