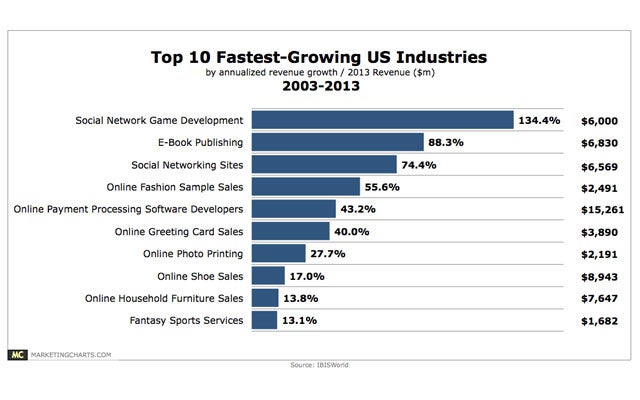

The Marketplace Fairness Act, also known as the Internet sales tax, would burden the fastest-growing industries in the United States with a tidal wave of new regulations, which is bad news for American consumers and entrepreneurs.

The Marketplace Fairness Act, also known as the Internet sales tax, would burden the fastest-growing industries in the United States with a tidal wave of new regulations, which is bad news for American consumers and entrepreneurs.

It would slam these businesses with regulations because it would allow states to require online businesses with annual online sales of more than $1 million — that have no dealings in those states outside of individual customers — to collect their sales taxes.

As a result, many businesses in the industries that have seen the most growth in the past decade would be forced to collect sales taxes for as many as 9,600 sales tax jurisdictions.

The Daily Signal depends on the support of readers like you. Donate now

Popular and growing online businesses providing goods consumers purchase on the Internet, from fashion samples to shoes to household furniture, would have to comply with the laws in each of these locations. There is nothing fair about this, because brick-and-mortar stores would still have to collect sales taxes only where they are physically present. Plus, online businesses could face up to 46 different tax audits (from the 45 state governments that collect sales taxes and the District of Columbia).

Washington should be looking for ways to reduce the government’s burden on growing businesses and budding industries. The Marketplace Fairness Act does the exact opposite.