A new report published in the Federal Reserve Bank of St. Louis Review provides strong evidence that the Administration’s obsessive focus on boosting exports as a way to help U.S. manufacturers is just plain wrong.

The study debunks the idea that changes in either imports or exports affect growth in manufacturing. Instead, both exports and imports are lagging indicators that respond to changes in manufacturing output rather than cause them.

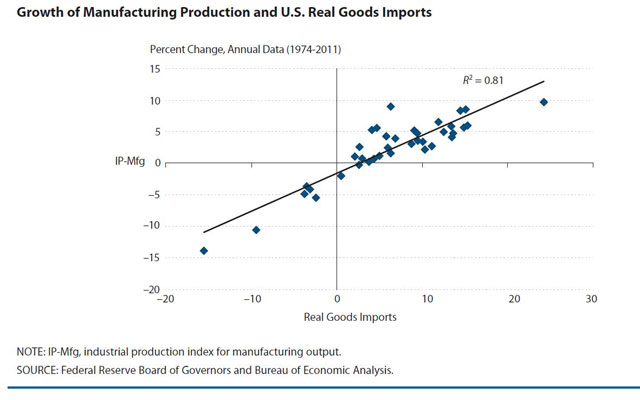

According to the authors, the “importance of imports to domestic manufacturing performance cannot be overstated.” Intermediate goods imports and capital goods imports are the lifeblood of U.S. manufacturing. Without them, manufacturing output is impossible. In fact, goods imports account for a far greater share of U.S. manufacturing value added than do exports.

Export promotion is misguided at best and seriously harmful if policies include restrictions on imports or manipulation of currency to cheapen the value of the dollar.

The Administration needs to rethink its approach to economic growth. Exports are not the path to manufacturing success. Foreign trade helps build the U.S. economy more when we find new markets in which to buy raw materials and capital goods than when we push for new markets in which to sell the things we make.

The new study doesn’t deal much with the employment effects of trade, but its conclusions affirm and complement a recent study by The Heritage Foundation that found imports of goods from China in just two sectors (toys and clothing) responsible for more than half a million U.S. jobs.