It’s difficult to believe that less than a year ago, proponents of expanding the natural gas industry insisted that it needed federal subsidies. But at least one prominent advocate is now singing a different tune.

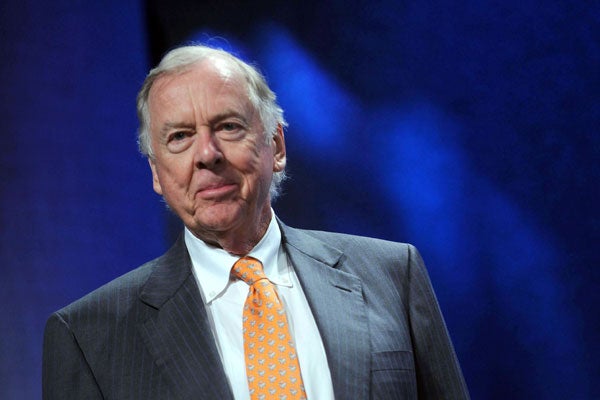

Back in December, billionaire T. Boone Pickens wrote in Politico:

The problem is that there is limited NGV [natural gas vehicle] manufacturing capability in the U.S. But there will be—because the per-gallon and life cycle savings of NGVs are too big to ignore. Congress is considering the Nat Gas Act in both the House and Senate. The Nat Gas Act provides for a modest, paid-for tax exemption for five years, to offset the marginal difference in purchase price between an NGV and a standard diesel-powered vehicle.

Now, however, in the face of congressional opposition to the Nat Gas Act, Pickens seems to have changed his mind.

“You don’t have to have a tax credit; it’s going to happen,” he told reporters about the switch from diesel-powered trucks to natural-gas-powered ones. After all, natural gas is “$2 a gallon cheaper.”

That’s the power of a market making a decision without federal intervention.

Like most federal subsidy programs, the Nat Gas Act would have been good for big investors (including Pickens) but bad for taxpayers and energy consumers, because it would have distorted the market for natural gas vehicles.

“Special tax credits create the perception that NGVs are more competitive than they actually are by artificially reducing their price for consumers,” Heritage’s Nick Loris wrote in 2011. “Rather than increase competition, this artificial market distortion gives NGVs an unfair price advantage over other technologies. But if natural gas vehicles are economically competitive, vehicle manufacturers will make them and consumers will switch over without market manipulation from Washington.”

And that’s exactly what’s happening, as Pickens now admits.