At the close of business, the federal government’s debt limit will increase by another $1.2 trillion, the final installment in a series of hikes that started last summer.

This last increase, from $15.194 trillion to $16.394 trillion, was essentially granted in the Budget Control Act (BCA) of 2011, passed August 2 at the culmination of the debt limit debate. Last week, the House rejected the debt limit increase in a resolution of disapproval, but the Senate blocked that legislation. The BCA states that unless both legislative bodies agree to reject the scheduled increase and no Presidential veto follows, then the increase will go into effect.

So this was expected. Yet now more than ever, Congress has work to do. It must make tough decisions to steer the nation in a new, fiscally responsible direction.

Though some question the value of debt ceiling votes, they are a useful exercise, as they force Congress to confront the consequences of reckless spending, which would be lost if the limit increased automatically. This check on the nation’s level of borrowing therefore serves an important, albeit painful, function. As The Heritage Foundation’s J. D. Foster describes the situation:

A change of course in federal spending is inevitable. The question is whether it will be orderly, beneficial change brought by design or disorderly, harmful change brought by disaster. Reaching the debt limit provides the critical moment to force the necessary action to reduce spending and borrowing.

This most recent increase of $1.2 trillion is practically automatic, taking the pressure off of Congress at a time when it should be taking steps to swiftly rein in runaway federal spending.

There is a lot to do to get the nation’s fiscal house in order. Before the ink on the BCA was dry last August, Heritage President Edwin Feulner spelled out Congress’s charge: come up with solutions that “drive spending down toward a balanced budget, reduce the share of the economy devoted to public debt, preserve America’s ability to protect the nation, and shift to a job-creating tax system without raising taxes.” This is Congress’s crucial job this year.

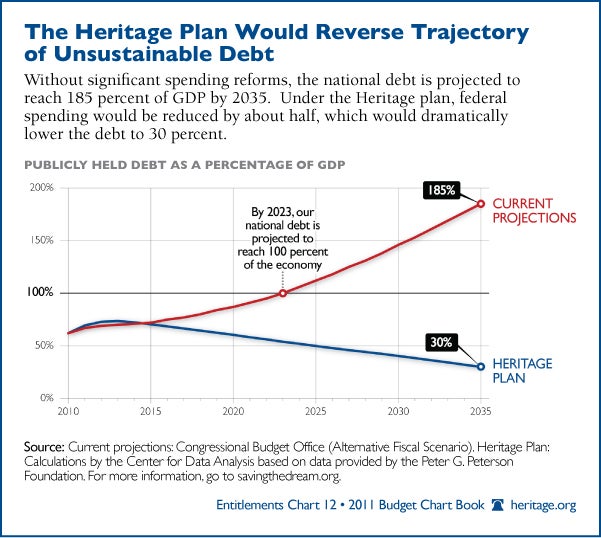

Other than insisting that the rich pay their “fair share,” which The Heritage Foundation has explained is “Fair to No One,” President Obama’s State of the Union address this week did not contain any ideas to get spending and deficits under control. Instead, he proposed even more spending, which of course has to be paid for through higher taxes or borrowing. Doing either will harm the economy further and do nothing to lower the level of debt. Publicly held debt represents about 70 percent of gross domestic product and, driven by expanding entitlement program spending, is on track to surpass 100 percent within a decade, as this chart illustrates.

The credit markets will not stand for this, because they know that a country cannot thrive economically with debt levels that high and rising.

Congress and the President should not let this happen. America needs bold solutions now that solve the spending and debt crisis. Now is the time to change course.