On Thursday, President Obama formally notified Congress that the total federal debt (debt subject to statutory limit) is within $100 billion of the debt limit and requested an increase of $1.2 trillion.

The announcement comes as no surprise, because such an increase is the anticipated third and final installment of $2.1 trillion in debt limit increases provided under the Budget Control Act of 2011 (BCA), passed at the conclusion of last summer’s debt ceiling debate.

The BCA states that Congress has 15 calendar days from the President’s notification in which to pass a resolution disapproving the debt limit increase; a House vote is expected on January 18. If the House rejects the President’s request, it is doubtful that the Senate will concur. Even if Congress does pass a joint resolution of disapproval, it is not likely to muster enough votes to override a presidential veto. Put simply, the debt limit increase is practically guaranteed.

The Daily Signal depends on the support of readers like you. Donate now

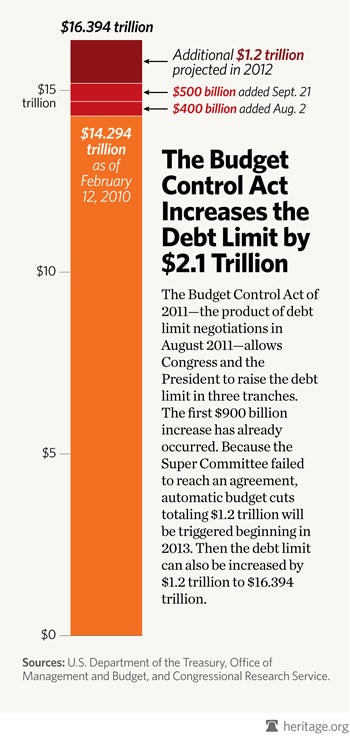

Upon passage of the BCA last August, the debt limit automatically increased by $400 billion, from $14.294 trillion to $14.694 trillion. In late September it was raised again, this time by $500 billion, to the current limit of $15.194 trillion. The President’s request of a $1.2 trillion increase will bring the debt limit to an astounding $16.394 trillion, which is over 100 percent of U.S. GDP.

The Heritage Foundation chart below illustrates these debt limit increases and shows the proportion of new increases compared to the debt limit prior to the BCA. (Article continued below.)

While “the level of publicly held debt [debt sold in credit markets] at any one time reflects the extent to which the federal government has engaged in deficit finance,” The Heritage Foundation’s J. D. Foster wrote ahead of last year’s debt limit debate, “the need to raise the debt limit reflects an intention to continue deficit financing.”

Raising the limit gives Treasury the legal authority to issue more debt; it does not solve our debt problem. This is like time and again receiving a hypothetical parole card in the game of Monopoly rather than a get-out-of-jail-free card. Passing a debt limit increase should not give the federal government cause to sigh in relief and carry on as usual. Indeed, business as usual for Washington amounts to irresponsible spending, larger annual deficits, and mounting debt. The same fiscal problems that the BCA was intended to address persist, and they’re only growing worse.

It is high time that Washington’s leaders—from Congress to the President—start acting to address our spending and debt problems. When the President releases his budget proposal for fiscal year 2013 in a few weeks, he has yet another opportunity to propose real spending cuts and entitlement program reforms. Whether he will seize it and begin restoring fiscal discipline in Washington or waste it on populist, campaign rhetoric remains to be seen.

Many distractions will plague Washington during this election year, but it must resist the urge to put off addressing these problems. History shows that its promises to fix things later fail to materialize. America is on a dangerous fiscal path, and we must change course.