With its November 23 deadline fast approaching, the “super committee” created by the Budget Control Act is back in the news, and it is still grappling with its mandate to find $1.5 trillion in deficit reduction savings.

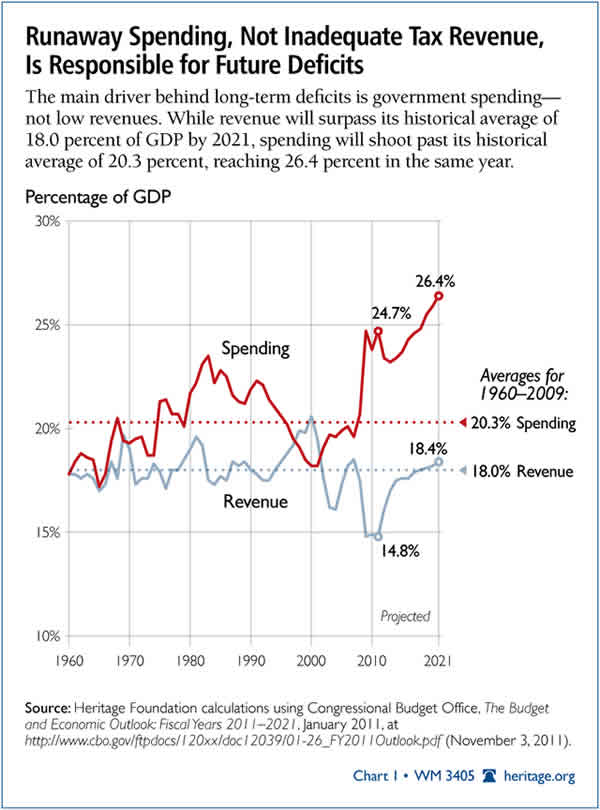

One of the ideas being bandied about is a continued call to raise taxes in order to reduce the deficit. But as the chart below shows, inadequate tax revenue is NOT the problem, too much spending is. (Article continued below infographic)

The Daily Signal depends on the support of readers like you. Donate now

In their new paper “Three Pillars of Reform for the Super Committee,” Heritage’s Alison Fraser , Patrick Knudsen and Mackenzie Eaglen lay out ways that the super committee can get control of America’s deficit problem without raising taxes, while fully funding national defense. And they explain why raising taxes would only make matters worse and would entirely ignore the root of the problem:

There are many calls for tax hikes (though they are often couched as “additional revenues”) as a part of a so-called balanced deficit reduction package. Do not be fooled. The very notion that deficit reduction must be a mix of spending cuts and tax increases is a kind of fiscal moral equivalency that fundamentally misstates the problem.

Taxes are low today at around 15 percent of GDP (versus the 18.4 percent historical average), but this is the continued fallout from the global recession and the myriad of bad policies that have occurred since, plus some temporary tax cuts. The government’s deficits and debt are a problem of excess spending. Consider these facts:

- By 2021, tax revenues will exceed their historical average of 18.4 percent of GDP—even if the Bush-era tax policies are made permanent;

- Spending in 2021 will reach 26.4 percent of GDP—higher than the historical average of 20 percent; and

- After 2021, spending will explode, reaching nearly 35 percent of GDP by 2035, fueled largely by entitlement spending.

Read more of their paper at Heritage.org.