AARP’s latest video opposing spending reductions in Social Security or Medicare once again pushes the flawed argument that cutting federal budget waste and loopholes would effectively address America’s unsustainable fiscal problems. A senior featured in the video asks, “With billions in waste and loopholes, how could they look at us?”

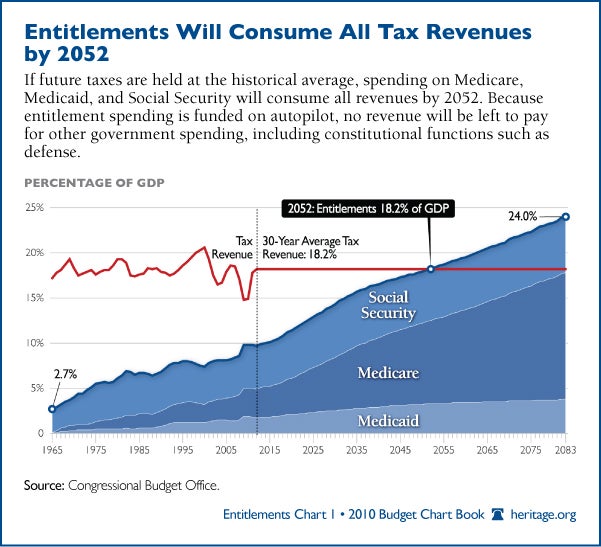

Yes, there is substantial government waste that Congress can eliminate, but that shouldn’t be a substitute for real entitlement reform. Spending on Medicare, Medicaid, and Social Security—the three main entitlement programs—represents more than half of the entire federal budget today and will consume all of tax revenues by 2049.

It is this spending that drives the debt and deficits, not government waste or tax loopholes.

With entitlement spending projected to more than double by mid-century, burdening future generations with unmanageable debt levels, Congress must tackle the difficult issue of entitlement reform now.

AARP argues that today’s seniors have paid into the system all of their lives and should get what they paid for. But both Social Security and Medicare are set up so that current workers pay for the benefits of current retirees rather than paying for their own future benefits. So seniors don’t actually receive what they paid into the system at all. In some cases, they receive more—the value of the benefits current seniors are receiving in Medicare is well in excess of what they paid in.

The benefits seniors receive today won’t be around later if Social Security and Medicare remain as-is. Unless Social Security is fixed, everyone who is receiving benefits will face an automatic 25 percent benefit reduction by about 2036. Even now, some seniors are forced into poverty due to an inadequate Social Security benefit.

For these reasons, groups like AARP should support improving—not just preserving—entitlement programs through structural reforms. Heritage’s Saving the American Dream plan, for instance, would improve benefits by guaranteeing that no senior under these programs would have to live in poverty or without access to health care. The Heritage plan accomplishes this for Social Security by increasing the retirement age to reflect changes in life expectancy that have already occurred; providing a predictable, new flat benefit; and ensuring that benefits go to Americans who actually need them. It reforms Medicare by transitioning to a system in which seniors receive a defined contribution, receive catastrophic care coverage, and can choose the health plan that most appeals to them.

Finally, the video spotlights the current 50 million seniors receiving benefits, which only stresses the severity of the problem: Taxpayers are stretched to their limits to fund inefficient and costly entitlement programs for a rapidly increasing number of beneficiaries. Compared to 50 years ago, when five workers paid the benefits for each retiree, today only three workers exist per retiree; in 20 years, it will amount to only two. In a word: unsustainable.

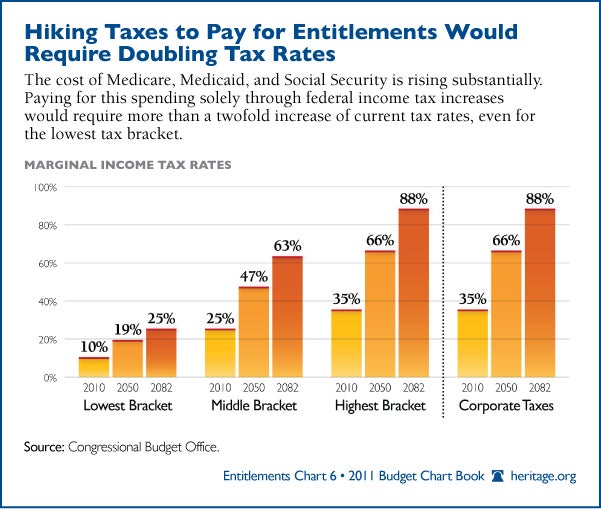

There are two ways to solve this problem. One way—the Obama way—is to lock in these unsustainable benefits and tax our way out. That would mean tax hikes on every American: from 10 to 25 percent for the lowest bracket, 25 to 63 percent for the middle, and 35 to 88 percent for the highest, by 2082.

Would AARP’s members really want to pass on such a legacy to their grandkids?

The better solution is to transform these programs in a way that could give AARP’s members confidence that they will have economic security in retirement, that Social Security and Medicare will be around for decades, and that their grandkids will have the same kind of promise and opportunity they had. Surely that is the kind of legacy AARP’s members want.

Saving the American Dream must be the job of this Congress and this President.

22 Replies to “AARP: How High Do You Want Your Grandkids’ Taxes to Go?”