The U.S. economy grew by 2.6% in the third quarter of 2022, according to the U.S. Bureau of Economic Analysis report released Thursday.

Compared with the gross domestic product figure from the second quarter, which showed the economy shrunk 0.6%, that appears to be solid economic growth.

Not quite—according to EJ Antoni, a research fellow in regional economics in the Center for Data Analysis at The Heritage Foundation. (The Daily Signal is the news outlet of The Heritage Foundation.)

“Usually, when we talk about these numbers, we always think a growing GDP means a growing economy, and that’s good for people, but this is one of those instances where that’s not really the case,” Antoni says.

Antoni offered his predictions for future GDP reports.

“As a former bartender, I’ll use a bit of an alcohol analogy here. This last report—the third-quarter report, that is—I think was last call. So, if you want to judge the party based on alcohol consumption, things are looking great. That’s a high number, ” he says.

“But viewed in context, the party’s over. And I think from here on out, we go back to negative numbers,” he added.

Antoni joins “The Daily Signal Podcast” to discuss the GDP further, as well as President Joe Biden’s false claim that he won congressional passage of his student loan forgiveness plan, and how the economy is affecting Americans.

Read a lightly edited transcript below or listen to the interview.

Samantha Aschieris: Joining the podcast today is EJ Antoni. He is a research fellow in regional economics in the Center for Data Analysis here at The Heritage Foundation. EJ, thanks so much for joining us.

EJ Antoni: Sam, thanks for having me.

Aschieris: Of course. It’s great to have you back on. I want to talk about the gross domestic product, or GDP, that was released on Thursday morning. It increased by 2.6% in the third quarter of 2022, according to a U.S. Bureau of Economic Analysis report. EJ, you told me on Thursday morning that this report isn’t all good news. Why’s that?

Antoni: It’s a great question. Usually when we talk about these numbers, we always think a growing GDP means growing economy, and that’s good for people, but this is one of those instances where that’s not really the case.

So, GDP is composed of four different things. We have consumer spending, we have business investment, then we have government, and then we have something called net exports.

So when you look at the first three, that’s consumer spending—what you and I go out and buy—business investment, and then government, you combine those three and you actually get a negative number. And so, where did all the growth come from? It came from that last category, net exports. And the mathematics behind that is, essentially, we take all of our exports and then we subtract out our imports, and that value is a contribution to GDP.

Well, because Americans were literally poorer in the third quarter, we could afford fewer imports, and that combined with the increase in exports is where we got, literally, all the growth from in the third quarter.

Aschieris: Now, I want to ask you a little bit more about what we saw in the second quarter, the GDP decreased by 0.6%. And since that report and over the last few months, generally we’ve heard about a recession. Based on the GDP report that we saw on Thursday and this increase that we saw of 2.6%, are you still concerned about a recession? Why or why not?

Antoni: No, certainly. And I mean, we’ve, at this point, already had the recession because we had two consecutive quarters of negative growth. And then if you want to look at the entire year, so all three quarters, the first nine months of 2022, the economy has grown 0.08%. So not even a hundredth of 1%. I mean, if that’s not a recession, I don’t know what it is.

And when I talk to people, it feels like a recession to all of them. They’re not able to afford what they used to buy. They’re not able to save as much as they used to save. And what they are able to save, their investments aren’t doing as well. So once again, if this is not a recession, I’m not quite sure what is.

Aschieris: I’ve certainly seen prices at my local supermarket going up over the last few months noticeably for different items. So I personally am feeling it as well.

We still have some time before the next report is released, but based on what we’ve been seeing, and of course by then we’ll have more complete data, do you think we’ll continue in this pattern of seeing an increase or do you think we could go back to seeing potential decreases?

Antoni: That’s a great question. As a former bartender, I’ll use a bit of an alcohol analogy here. This last report, the third quarter report that is, I think, was last call.

So if you want to judge the party based on alcohol consumption, things are looking great. That’s a high number. But viewed in context, the party’s over. And I think from here on out, we go back to negative numbers. And the key reason for that is because the dollar is getting so strong relative to other currencies.

Now, for you and I, when we go out shopping, it doesn’t feel like the dollar’s very strong. Everything’s getting more expensive. Our dollar doesn’t go as far. But when you look at the dollar compared to other currencies, it’s strong because those other currencies are getting weaker faster than our dollar is. And as a result of that, our exports, which are other countries’ imports, are going to be more expensive, which means we will export less. And so the only thing that is really a large positive contributor to GDP at this point is going to go away.

Aschieris: Yeah, I mean, I just wanted to ask, I’m not sure if you can see into the future at all, but if you could predict when Americans might be able to see some relief from this economic stress that many of us have been feeling over the last couple of weeks, over the last year or so, can you provide any insight, any glimpse of hope?

Antoni: I’m not sure I can provide a glimpse of hope. I can provide some insight, though. Unfortunately, what got us here are bad public policies. And until those bad public policies change, the outlook is not going to change.

But I suppose the glimmer of hope then is that these are self-inflicted wounds. And so as soon as you take away, again, those negative inputs, the negative outputs will go away as well. So it’s not as if we’ve somehow hit a point of no return. I don’t think we have at least.

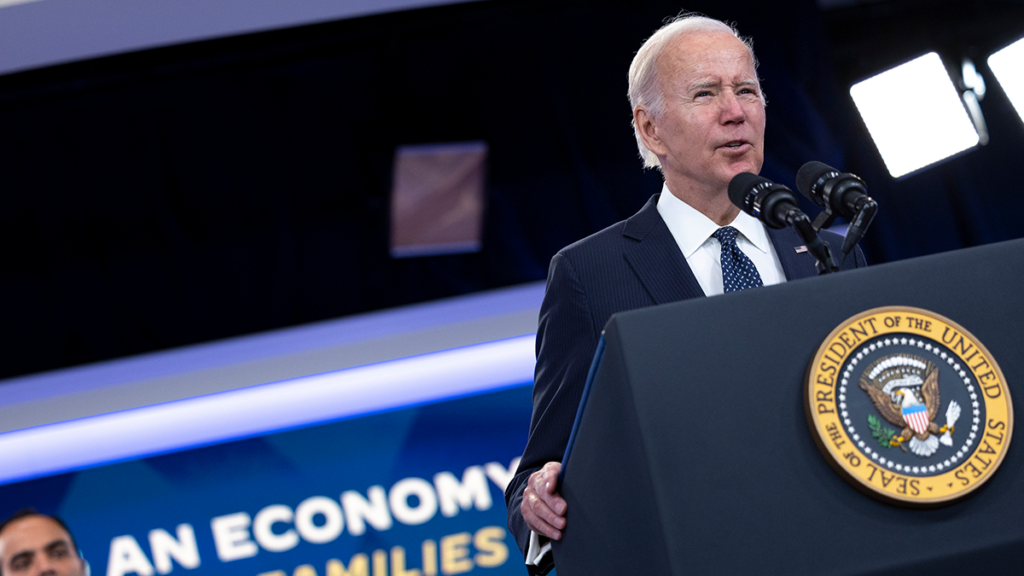

Aschieris: I want to ask about President [Joe] Biden’s comments on Thursday about the GDP report. He said, “For months doomsayers have been arguing that the U.S. economy is in a recession and congressional Republicans have been rooting for a downturn.” But today, on Thursday, when he was saying this, we got further evidence that our economic recovery is continuing to power forward. Today’s, Thursday’s, data shows that in the third quarter, Americans’ incomes were up and price increases in the economy came down. What’s your reaction to President Biden’s comments?

Antoni: Well, let’s take that last piece first. Price increases came down. He didn’t say prices stopped increasing, the increases just aren’t quite as horrible as they were in previous months. But we’re looking at prices that are still more than 8% up compared to where they were a year ago, and that’s just overall. You want to talk about specific items, then it gets even worse, especially when we start getting into basic staples like gasoline, eggs, milk, bread, that kind of thing.

But again, let’s go back to this whole idea that the economy is somehow powering forward. Growth of less than 100th of 1% is not powering forward. That is anemic at best, and it’s on the verge of going downhill.

Aschieris: Now, just speaking of the president, Biden claimed earlier this week during an interview with NotThis News that his student loan forgiveness plan was backed by congressional support. My colleague Virginia Allen reported on this earlier in the week. Let’s take a listen to his comments per Townhall.

President Joe Biden: You’re probably aware, I’ve just signed a law that’s being challenged by my Republican colleagues, the same people who got PPP loans during the, for up to close—in some cases, up to $500,000, $600,000. They have no problem with that. The individuals in Congress got those.

But what we’ve provided for is, if you went to school, if you qualified for a Pell Grant, you’re qualified for 2,000, I mean, excuse me, you qualify for $20,000 in debt forgiveness. Secondly, if you don’t have one of those loans, you just get $10,000 written off. It’s passed. I got it passed by a vote or two, and it’s in effect.

Aschieris: So Biden actually used executive action for this plan. It wasn’t signed into law and Congress did not vote on it. Also, the 8th U.S. Circuit Court of Appeals temporarily halted the plan about a week ago. If this plan does move forward, what impact would it have on the economy?

Antoni: Well, I suppose the President was, in a way, correct when he said he got it passed by a vote or two. It was his own. He did this by executive fiat. There was no action in Congress. I mean, I suppose the president suffers from short-term memory loss, perhaps. I don’t know.

But in terms of the impact on the economy, I mean, this is just more spending, more money that the government doesn’t have that will have to be covered by the Federal Reserve, which means more printed cash out there in the economy, which means more inflation. And I fail to see why we’re going to give another handout to literally the only demographic whose wages have kept up with inflation.

When you start going through the census data, you find, for example, black men have probably been hit the hardest by Biden’s inflation and their wages not keeping up. But literally the only group is college grads whose wages have risen faster than inflation, and yet they’re the ones we’re going to give all this money to.

Aschieris: Well, you speak about college grads, and I’ll be honest, on my Instagram feed for the stories, I’ve seen a ton of posts and sharing about the student loan plan and people expressing their support of it, saying how it’s a great idea and it’s going to help so many people. What is your message specifically to that demographic who might believe that this is a great idea?

Antoni: Well, No. 1, it’s a classic case of robbing Peter to pay Paul, and the left hand not knowing what the right hand is doing. Even if you’re one of the people who get relief from this, you’re still going to pay for it in your taxes.

And you might make the argument, “Well, I’ll pay less in taxes than I’ll actually get from this.” OK, that’s great. Until the next generation comes around and they demand the exact same handout that you got and now what? And now you’re paying money for a benefit you’re not receiving.

Aschieris: So EJ, just broadly speaking about the economy right now, how are Americans doing?

Antoni: Americans are hurting. I mean, really, truly, genuinely hurting. For the elite, for people whose income would typically adjust well with inflation and who have a lot of assets that appreciate as inflation goes up, they’re doing just fine. But the middle and working classes are just getting absolutely crushed.

The average earner has lost $3,000 in annual income since Biden took office. For the typical family with two parents working, if they’re both earning that average income, that’s a $6,000 loss. Throw on another $1,200 in increased borrowing costs on average, because interest rates have gone up. And then that’s just the average.

If you want to talk about someone, let’s say, who was trying to buy a home right now compared to someone who bought a home when Biden first took office, take the median-priced home, the typical 30-year mortgage on that, given the interest rate changes and the price changes, the mortgage, those monthly payments on the mortgage, it’s going to cost you an additional 10 grand a year over a 30-year loan. That’s $300,000 more for the same house.

Aschieris: That’s absolutely insane. I hope that Americans can receive some economic relief soon. EJ, thank you so much for joining the podcast today. It’s always great to have you on and to get your insight. EJ Antoni with The Heritage Foundation. Thanks so much.

Antoni: Samantha, thanks for having me.

Have an opinion about this article? To sound off, please email letters@DailySignal.com and we’ll consider publishing your edited remarks in our regular “We Hear You” feature. Remember to include the URL or headline of the article plus your name and town and/or state.