At a time when huge spending bills marked “coronavirus relief” are easily passing Congress with little scrutiny, poorly run states are asking unscrupulous members of Congress to slip in taxpayer bailouts to rescue them from years of their own fiscal mismanagement.

In response, the House of Representatives on Friday passed a coronavirus relief bill that includes a half trillion dollars (trillion with a “t”) in unrestricted funds to bail out state governments for years of reckless expenditures entirely unrelated to the pandemic.

I have the same reaction to these proposals that I had when I worked in government and people were proposing millions of dollars in monuments to little known people on what seemed like every street corner, while many Americans were out of work and struggling to make their next mortgage payment: “Have you lost your mind?”

People are suffering, and federal taxpayers have already sent states and localities hundreds of billions of dollars to help pay for expenses related to fighting the coronavirus. States have received more than $200 billion in grants and $500 billion in loans to municipal governments.

Add to that the fact that state and local governments are also benefiting from the more than $1 trillion in federal coronavirus relief that has flowed to their businesses and residents in the form of small business loans, relief checks, and increased unemployment benefits.

Some states haven’t even spent all of their coronavirus grant money because the pandemic didn’t hit them as hard as anticipated, yet many are asking for more. They just don’t want to have to spend the money on actual coronavirus relief this time.

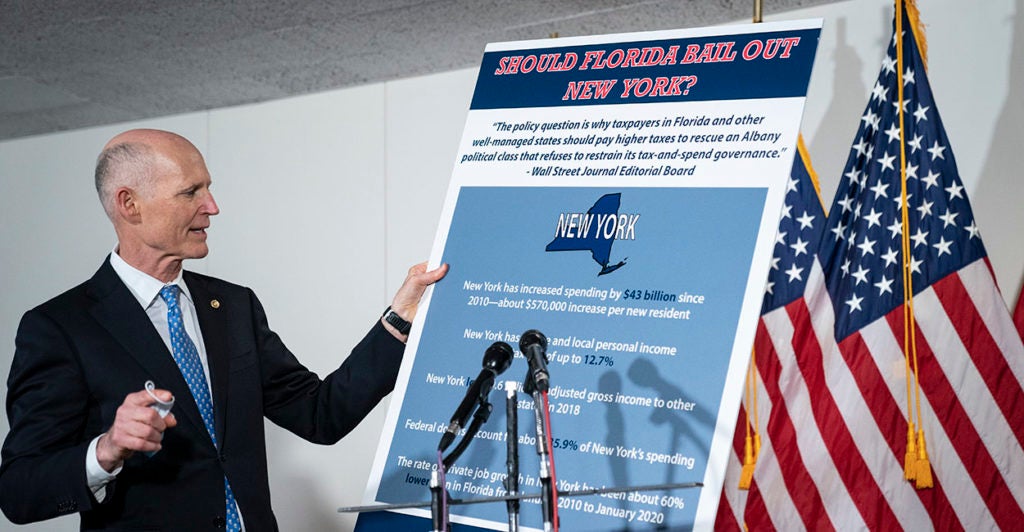

Sen. Rick Scott, a Florida Republican, is one of the voices in Congress speaking out against state bailouts, calling the funding “a piggy bank for unrelated expenses that have nothing to do with responding to the coronavirus.”

He rightly warns that the money will be used to bail out pension plans, reward decades of mismanagement, and encourage states to become even more dependent on the federal government.

Many states want to use the money to rescue their woefully underfunded pension plans. For years, rather than putting money into these pension plans to ensure they could fund the retirements they promised to their state employees, politicians diverted money into other spending projects.

Bailing out states is, simply put, a bad idea. It shields politicians from the consequences of their actions and encourages the same reckless spending habits that got them into a financial mess in the first place.

That wouldn’t just harm the rest of us federal taxpayers; it would also do long-lasting harm to their citizens: When federal taxpayer funding runs out, the reckless spending and bigger budgets remain, and states will just raise taxes on their own citizens to make up the difference.

Federal bailouts of the states in the early 2000s and in the Great Recession of 2007-09 show us that these fiscally irresponsible leopards seldom change their spots.

In 2003, states received $20 billion in federal aid, but instead of balancing their books, many states just increased their spending and debt.

Again in 2009, much of the $300 billion slated for state governments to help them recover from the recession was used instead to permanently expand government programs. For instance, states were given about $50 billion to stabilize their education systems, but instead, many used the funds to add brand new staff positions.

There is an old adage that the definition of insanity is doing the same thing over and over again and expecting a different result. The insanity of state bailouts must end. Sending mismanaged states hundreds of billions of dollars in bailouts is basically like giving a drug addict money and telling him not to buy drugs with it.

While many in Congress oppose these bailouts, some say they might be a necessary component to any relief package. That’s because pro-bailout members of Congress are willing to hold hostage the rest of the package in order to get them included.

For the good of taxpayers everywhere, lawmakers must resist bailouts. Instead, Congress should provide targeted and temporary relief for taxpayers, families, and businesses to fight the devastating health and economic effects of the coronavirus pandemic, not pay the past-due bills that fiscally irresponsible politicians have racked up over the years.

Originally published by The Washington Times