During debate over the BUILD Act (Better Utilization of Investments Leading to Development Act)—a bill that would rename and double the size of the Overseas Private Investment Corp.—proponents asserted that it was needed to counter China’s aggressive “One Belt, One Road” debt-trap diplomacy initiative that finances infrastructure projects in developing countries.

The question is, will BUILD, passed by Congress last year, counter China?

Judging by the Overseas Private Investment Corp.’s recent lending decisions, so far, the answer to that question appears to be “no.”

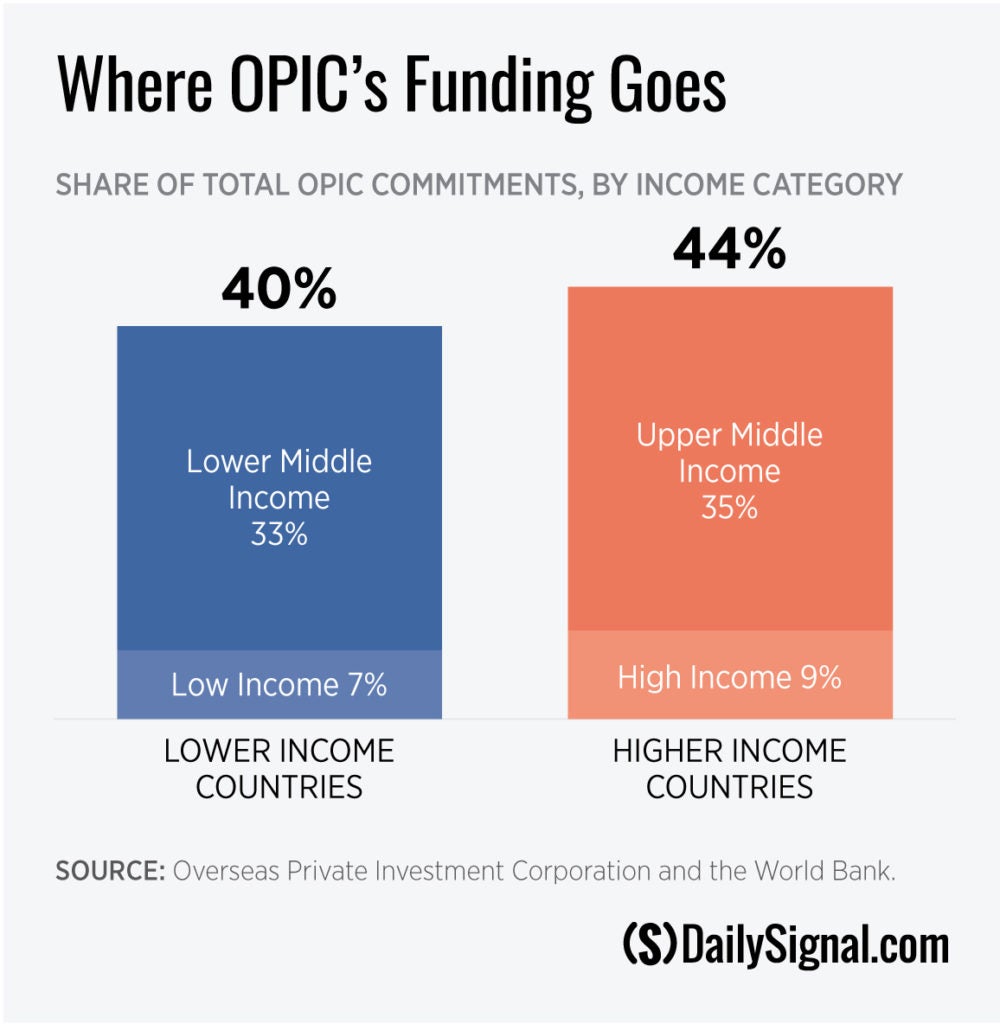

Why? First, because the majority of the Overseas Private Investment Corp.’s loan portfolio, as of the end of 2018, is still in upper-middle and high-income countries (excluding regional loans).

Meanwhile, almost all of the countries that are identified in a March 2018 study by the Center for Global Development as most heavily indebted to China’s One Belt, One Road program are low- and lower-middle-income countries (according to the World Bank’s 2019 rankings).

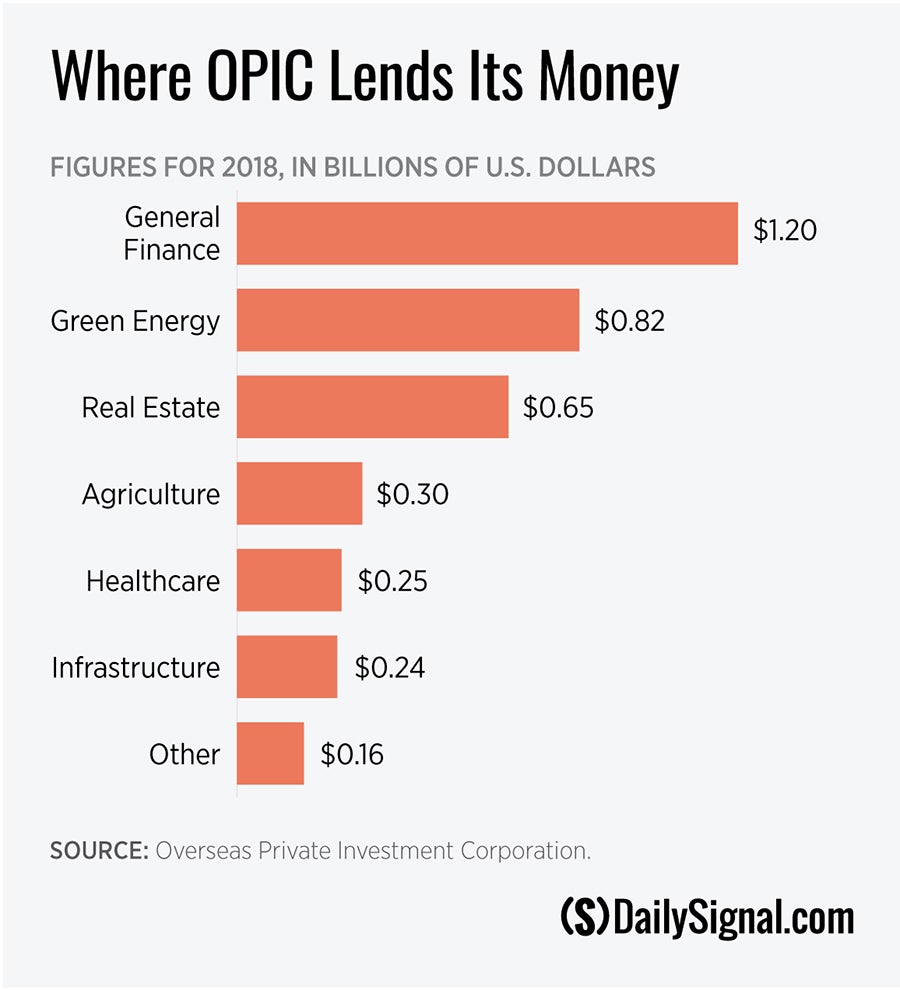

Second, although the Overseas Private Investment Corp. did reduce its lending to high-income countries in calendar year 2018, it continued lending to its traditionally favored sectors (especially financial services and renewable energy)—sectors that are not targeted by Chinese lending.

In fact, the infrastructure-sector loans favored by China were clearly a lower priority in 2018 for the Overseas Private Investment Corp.

During the debate about the BUILD Act in 2018, a Heritage Foundation analysis reported that, while it would rebrand and double the size of the Overseas Private Investment Corp. through the creation of the new U.S. International Development Finance Corp., the BUILD Act would not make sufficiently substantive changes in the Overseas Private Investment Corp.’s focus or operations. Nor would it specifically require that the new Development Finance Corp. counter influence from China’s One Belt, One Road initiative.

Likewise, the BUILD Act failed to address concerns about misguided Overseas Private Investment Corp. activities in preceding decades; namely, that it focused insufficiently on low-income and lower-middle-income countries that truly lacked access to private capital and that the Overseas Private Investment Corp. did not encourage policy reforms that would reduce the demand for its development financing and insurance subsidized by U.S. taxpayers.

The final version of the BUILD Act as passed by Congress did, however, include a ban on lending to high-income countries and also contained a provision requiring the new Development Finance Corp. to obtain a presidential waiver certifying to the appropriate congressional committees that any proposed loans to upper-middle-income countries further “the national economic or foreign-policy interests of the United States” (Section 1412c, Paragraph 2A).

More troubling, though, is the provision (Section 1421c, Paragraph 4) that empowers the Development Finance Corp. to make equity investments up to “35% of the corporation’s aggregate exposure.”

In other words, a U.S. government corporation could in the near future hold ownership stakes in foreign companies totaling more than $20 billion. And the BUILD Act would not prohibit the Development Finance Corp. from making these equity deals with nontransparent state-owned enterprises owned by foreign governments.

The new Development Finance Corp., which is replacing the Overseas Private Investment Corp., could play a useful—albeit small—role in supporting specific U.S. foreign policy and national security goals if it:

- Fulfills the BUILD Act mandate to focus lending on low-income and lower-middle-income developing countries that face genuine obstacles to accessing private capital markets.

- The Development Finance Corp. prioritizes U.S. support for policy reform in those countries.

- The new Development Finance Corp. refocuses its loan portfolio going forward to compete more effectively with China’s One Belt, One Road initiative in sectors such as infrastructure.

If the Overseas Private Investment Corp.’s lending decisions in 2018 are any indication, however, the new Development Finance Corp. will face major hurdles to achieving this reorientation.