In the throes of a debate about how much taxpayer money would go to Illinois public schools, state lawmakers have agreed to provide students more educational options.

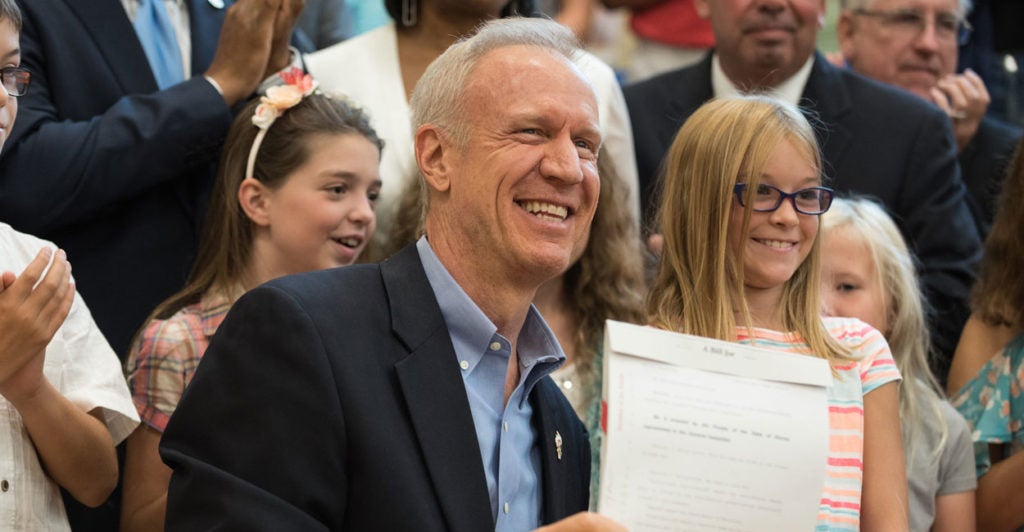

On Thursday, Illinois Gov. Bruce Rauner’s signature created a program that allows for up to $75 million in tax credit-eligible contributions to K-12 private school scholarship organizations. Under the law, individuals and businesses can make charitable contributions to nonprofit organizations that award scholarships to eligible students.

Donors will receive a credit on their state taxes worth 75 percent of their contributions. To be eligible for a scholarship, students must be from families with household incomes not greater than approximately $74,000.

Commonly known as “tax credit scholarships,” this school choice opportunity helps thousands of students in 17 states access a quality education when their assigned district school is not a good fit for them.

In Florida, more than 100,000 children use a scholarship, while Arizona scholarship organizations awarded some 70,000 private school scholarships in fiscal year 2016.

The scholarships have helped students like Gabe Alva-Rivera. As a child, he attended a school in Mexico that didn’t even have running water, but his family moved to Arizona where he thrived in a private Catholic school.

In a 2013 interview, he explained that he founded and coached a middle school robotics team. He went on to study mechanical engineering at MIT.

This year, Illinois joins Arizona, Florida, and North Carolina as states that created or expanded ways for students to find a great learning experience when they struggle in a district school.

Arizona and Florida lawmakers made more students eligible for education savings accounts, scholarships that allow parents to customize a child’s education through personal tutors, private schools, and online classes, to name a few possible uses. North Carolina policymakers enacted a similar law in June.

Illinois’ new scholarships are a bright spot in a bill marked by burdens on taxpayers and even requirements for private schools that want to enroll scholarship students. The Illinois Policy Institute explains that taxpayers will fork over another $150 million to Chicago Public Schools, and city residents should expect a property tax increase.

Additionally, scholarship students under the bill will be required to take the state assessment. This rule undermines a private school’s ability to decide what and how to teach, and gives schools an incentive to provide the same instruction as district schools since students will take the same tests.

Surveys indicate that similar rules in Louisiana’s K-12 private school voucher system have prevented some private schools from enrolling scholarship students, and, as a result, families have fewer educational options.

President Donald Trump’s administration has indicated that a federal tax credit scholarship proposal could be in the offing later this year.

But Heritage Foundation experts and researchers from states like Texas, South Carolina, Tennessee, Georgia, Alabama, New Mexico, Idaho, Iowa, Utah, and Oklahoma have urged Education Secretary Betsy DeVos to keep federal activity within the bounds of Washington’s areas of responsibility.

The Trump administration would do well to provide more private educational opportunities to children in Washington, D.C., students in active-duty military families, and children living on Native American reservations.

Meanwhile, proposals to give students more learning opportunities in the 50 states should be left to state lawmakers. Well-intentioned proposals to help students can be mired in complex federal funding formulas and extend the federal government’s reach into our everyday lives.

Trump administration officials that favor more learning options should use their high profile to explain that every child should have the chance at a great education and the American dream. For students succeeding in their local district school, policymakers should encourage these achievements.

But when a district school isn’t a good fit for a child—students with special needs or those looking for more challenging material—state lawmakers should create opportunities like the new Illinois scholarships (absent the aggressive regulations) for families living within their borders. Washington should practice restraint.