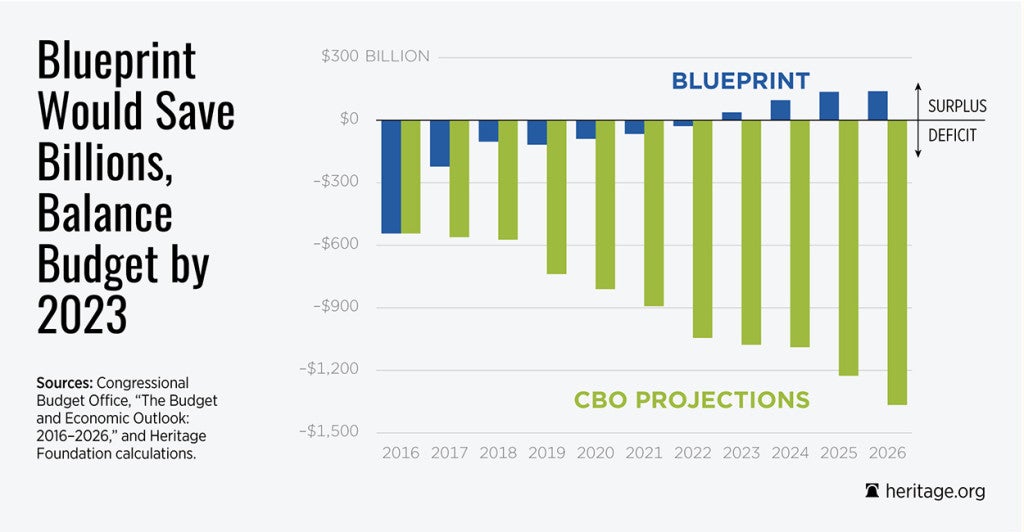

The Congressional Budget Office (CBO) projects that the annual federal deficit will rise to $1.4 trillion by the 2026 fiscal year.

The U.S. is on an unsustainable course that threatens to reduce economic prosperity for current and future generations. The Heritage Foundation’s Blueprint for Balance: A Federal Budget for 2017 quickly reverses this course, turning trillion-dollar deficits into multi-billion-dollar surpluses. In total, the blueprint reduces deficits by over $9 trillion through 2026, compared to current CBO projections.

>>> To Read The Heritage Foundation’s A Blueprint for Balance: A Federal Budget for 2017

The budget proposal achieves primary balance (spending minus interest costs) in the first year and eliminates the deficit within seven years. It does all this without counting any benefits from growing the economy and at the same time repealing all of the tax revenues associated with Obamacare. The blueprint achieves this by:

Responsibly Bringing Spending Under Control

Over the next decade, the Heritage budget would reduce the growth in spending to an average rate of 1.7 percent annually, well below the nearly 5-percent annual growth rate under CBO’s baseline projection. Total outlays under the plan are almost $10.5 trillion lower than CBO estimates over the next 10 years.

Reforms Entitlement Programs

Entitlement spending is growing on autopilot, consuming more and more of the federal budget each year. Tens of trillions in unfunded obligations are threatening younger generations with massive tax increases and undue burdens of debt.

This blueprint would repeal Obamacare; modernize Medicare by transitioning to a premium-support system and making key reforms to meet demographic, fiscal, and structural challenges; cap the federal allotment for Medicaid and give states greater flexibility in designing benefits and administering the program; and make commonsense reforms to Social Security to ensure that seniors and individuals with disabilities are protected from poverty, while accounting for increased life expectancy, reducing the growth in benefits, and modernizing disability benefits.

Prioritizes Essential Discretionary Spending and Cuts Wasteful Programs

The Heritage Blueprint for Balance would reduce non-defense discretionary spending by almost $100 billion in the 2017 fiscal year alone. This is accomplished by eliminating programs that benefit special interest groups at the expense of taxpayers, that would be more efficiently administered by the private sector or state and local governments, and that are wasteful or duplicative.

By moving resources from less critical domestic programs, the blueprint is able to reprioritize defense spending to equip the military at a more adequate level and meet ever increasing challenges across the globe

Repeals Obamacare and Provides a Tax Cut to Americans

The Heritage Blueprint for Balance would save taxpayers over $1.3 trillion in taxes by repealing President Obama’s disastrous health care law. Unlike every congressional budget proposal, the Heritage plan repeals all of Obamacare, including its tax revenues. This will benefit job creators as well as individuals and help get the nation’s economy back on track.

It is time Congress pass a conservative budget. Heritage’s Blueprint for Balance shows the way.