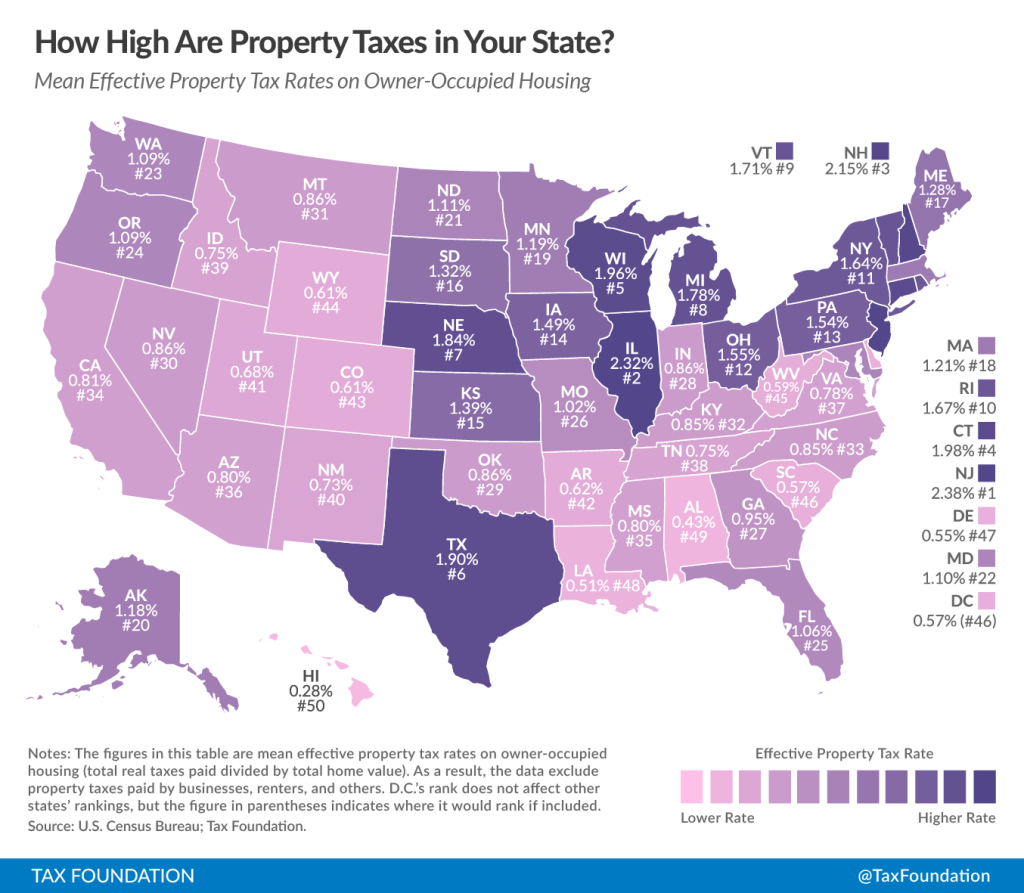

What is the property tax rate in your state? A new map from the Tax Foundation has the answer.

The Tax Foundation, a non-partisan research think-tank based in Washington, D.C., notes that states tax property in a variety of ways and that the rates listed are the “effective rate” paid by the taxpayer.

Jared Walczak, a policy analyst with the Center for State Tax Policy at the Tax Foundation, writes that the map “cuts through this clutter, presenting effective tax rates on owner-occupied housing.”

“This is the average amount of residential property tax actually paid, expressed as a percentage of home value,” Walczak wrote.

New Jersey has the highest rate at 2.38 percent.

Illinois has the second highest rate at 2.32 percent, followed by New Hampshire at 2.15 percent and Connecticut at 1.98 percent.

Hawaii has the lowest rate at 0.28 percent. Alabama has the second lowest rate at 0.43 percent, then Louisiana at 0.51 percent and Delaware at 0.55 percent.

Curtis Dubay, a research fellow in taxes and economic policy at The Heritage Foundation, said that “people generally hate property taxes because they have to pay them directly, unlike income taxes that are withheld from their paychecks.”

“Property taxes are directly correlated to how much a town or county spends. If someone doesn’t think they’re getting good value for what they pay in property taxes, they need to convince their local government to spend less.”

Where does your state rank?