With Wisconsin leading the way, 14 states enacted “significant, broad-based tax cuts” in 2014, according to a report released this week.

Surprisingly, several states controlled by Democrats made the American Legislative Exchange Council list. Then again, 2014 was an election year.

The blue states that made the cut were:

Minnesota: The Democratic stronghold “bowed to economic reality,” said Jonathan Williams, director of ALEC’s Center for State Fiscal Reform. The cuts in corporate taxes, however, will be largely offset by $2.1 billion in tax increases enacted in 2013.

New York: The Empire State increased its death-tax exemption and lowered its corporate tax rate.

Maryland: After raising taxes and fees 100 times under Democratic Gov. Martin O’Malley, the state increased the exemption on its death tax, nearing the federal rate.

Rhode Island: The state cut corporate taxes, while broadening them. It also raised the death-tax exemption, but hiked other fees. ALEC called Rhode Island’s actions a “close call.”

By comparison, Wisconsin, under Republican Gov. Scott Walker, slashed some $800 million in taxes, making the Badger State No. 1 on ALEC’s scorecard.

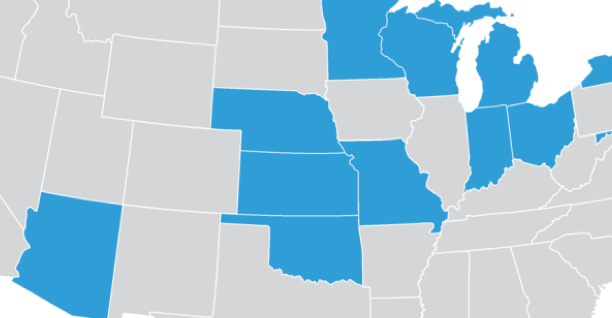

Other tax-cutting states were Arizona, Florida, Indiana, Kansas, Michigan, Missouri, Nebraska, Ohio and Oklahoma.

Looking ahead, Williams and research analyst Ben Wilterdink predicted 2015 will be a “record-breaking year” for state tax reductions.

“Lots of pro-growth candidates were elected,” said Williams, citing new governors in Nebraska and Arizona.

ALEC did not list states that raised taxes.