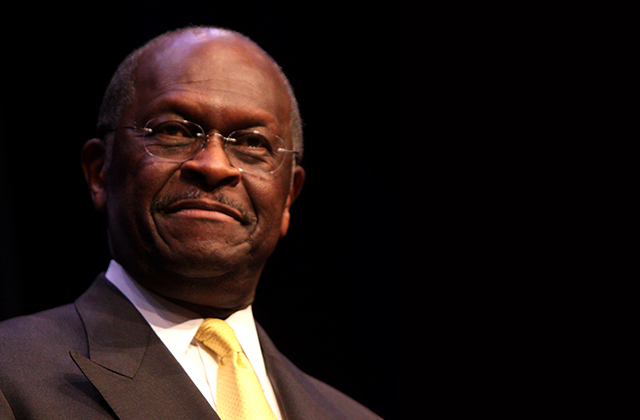

Herman Cain, who ran for president on the 9-9-9 tax plan, challenged Republican leaders in the House of Representatives to pass a tax reform bill this year—and thereby force a debate on the issue.

Cain spoke to The Foundry after hosting his radio show from The Heritage Foundation today. A longtime champion of the FAIR Tax, Cain said he would prefer replacing the tax code entirely, although anything that simplifies it for the American people would be a welcome change.

When asked about the House GOP reform plan, introduced last month by Ways and Means Chairman Dave Camp (R–Mich.), Cain said he was encouraged to see some movement. He warned, however, that Republican leaders wouldn’t follow through on the issue.

“I wish they would put it on the floor, the Republicans would get behind it and pass it,” Cain said. “Put it on Harry Reid’s desk, then talk about the fact that he’s sitting on it when it could be helping to boost this economy.”

He added: “If you’re not going to replace the tax code, at least do some serious simplification. Right now, we don’t have the leadership in the House to even get it on the floor and get it passed.”

Cain encouraged conservatives to rally behind the idea of tax reform now in hopes of a long-term plan that would radically alter the tax code.

“I ran for president on 9-9-9, but that was a transition plan to the FAIR Tax,” he said. “The bill that Representative Camp and his committee have come up with is a good start. It has a lot of good features in it. But, ultimately, I’m in favor of replacing the entire tax code.”

Heritage tax policy expert Curtis Dubay recently analyzed Camp’s proposal, concluding that despite some flaws, it could at least inspire a debate on the issue. Dubay notes that:

While the plan is unlikely to become law, it could spark a national debate, eventually leading to fundamental tax reform. Authors of future tax reform proposals should learn from Chairman Camp’s effort that maximizing the economic benefit of tax reform is extremely difficult when forced to balance pro-growth rate reductions and other positive reforms with adverse changes that hurt growth.

Cain said his frustration with Congress is an unwillingness to tackle big problems like tax reform.

“People in Congress think that if it’s too big to do, they don’t even try,” he said. “That is the complete opposite of the way the American people think. Somebody’s got to step up and do the tough jobs and heavy lifting.”