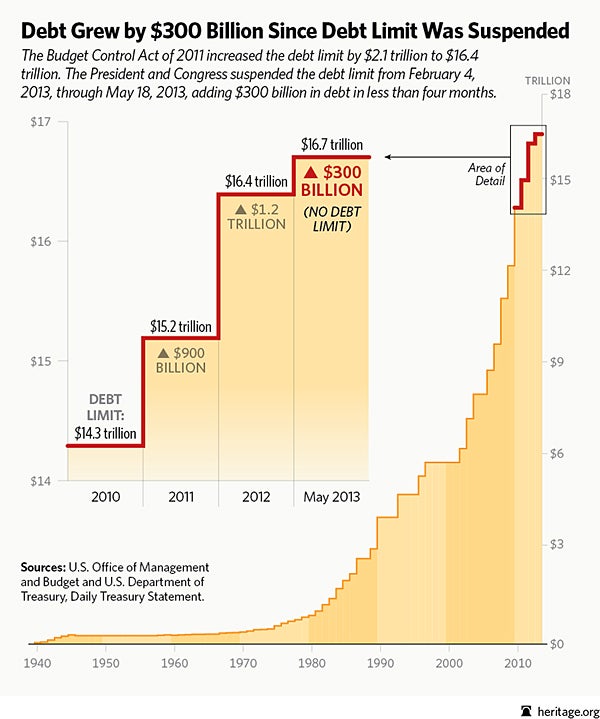

On May 19, the United States hit its debt ceiling after adding $300 billion in more debt since lawmakers suspended the ceiling in February.

But the cash won’t run dry until at least Labor Day, according to Treasury Secretary Jack Lew, whose department can employ a variety of cash management tools to continue spending beyond the official debt deadline.

Congress last hit the debt ceiling in January. The President and Congress then decided to “suspend” the debt limit through May 18. This is the first time that lawmakers adopted a debt ceiling date instead of a dollar amount. The Congressional Budget Office explains:

On May 19, the debt limit will be raised to its previous value—$16.394 trillion—plus the amount of borrowing that occurred while the limit was suspended (that is, from early February to May 18).

In other words, the President and Congress decided in February that they would continue borrowing through May 18, with the new debt limit becoming the then-current limit of $16.394 trillion plus whatever was added on since then. Washington racked up $300 billion in more debt in less than four months, making the current limit $16.7 trillion.

This is the pattern of recurrent budget negotiation crises:

- Spend;

- Spend some more;

- Run up against the debt ceiling;

- Resort to “extraordinary measures” to ward off a possible default for a while; and finally,

- Settle for inadequate measures that fail to curb soaring debt in the future.

We’ve entered stage 4, and hitting the debt ceiling should prod lawmakers to accelerate discussions over substantial spending reductions to improve the U.S. fiscal outlook. Despite lower deficits in the short term, the U.S. budget trajectory continues on a fiscal collision course as spending on Social Security, Medicare, Medicaid, and Obamacare is a ticking debt bomb. Stage 5 needs to become: Adopt substantial bipartisan policy reforms that significantly slow spending and put the budget on a path to balance in 10 years or less.

As the failed super committee negotiations (which resulted in the all-around-hated sequestration) demonstrated, lawmakers need to put in law real policy changes to the entitlement programs, and not push off tough decisions to a new committee that’s doomed to fail from the get-go. The threat of sequestration was not enough to gather lawmakers around bipartisan reforms. The savings and much more are necessary, though.

It’s overdue that lawmakers do their jobs and agree on a budget that focuses spending on federal priorities. The budget should fully fund national defense. It should reduce waste and duplication and eliminate inappropriate spending by privatizing functions better left to the private sector, leaving areas best managed on a more local level to states and localities. And it should make important changes to the entitlement programs so that they become more affordable and benefits are helping those with the greatest needs.

Our nation is on a dangerous fiscal course, and the debt ceiling is lawmakers’ opportunity to grab the oars and steer us out of the coming debt storm.