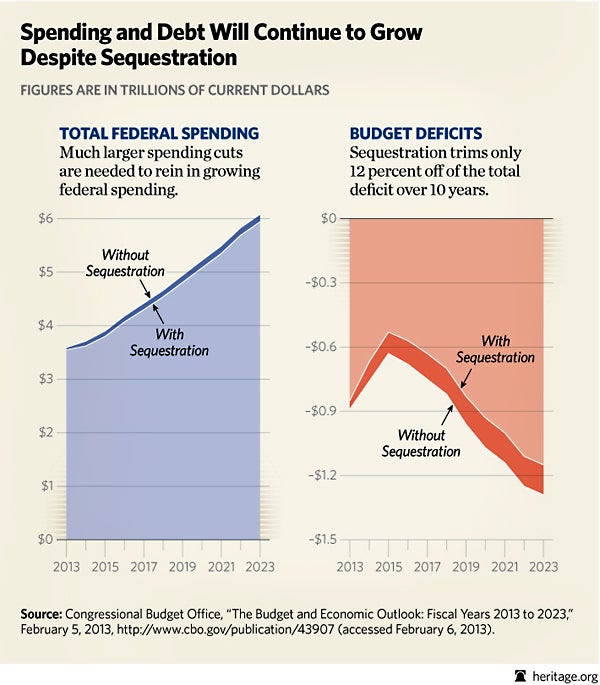

Sequestration, the set of automatic spending reductions set to hit on March 1, barely makes a dent in federal spending over the next decade. Much larger spending cuts are needed to rein in growing spending and debt and avoid a debt crisis.

Although sequestration this year will cut $85 billion out of agency budgets, the actual spending reduction in fiscal year (FY) 2013 will be only about $42 billion, as spending budgeted in one year often does not go out the door until future years. In the world of Washington budget-speak, this spending is referred to as “outlays.”

Spending continues growing at this massive pace because sequestration leaves the real drivers of spending and debt—the entitlement programs—nearly untouched. In 2013, spending is projected to grow by $57 billon without sequestration and by $15 billion with sequestration. The sequestration reduction to discretionary spending, including to defense, of $39 billion in 2013 is more than offset by the $85 billion increase in mandatory or entitlement spending this year.

Total spending in 2023 will be only 2.4 percent less than what it would have been without sequestration. Neither does sequestration rein in chronic deficits. Sequestration trims only 12 percent off cumulative deficits over the decade, while U.S. debt held by the public continues growing to economically damaging levels. Deficits return to trillion-dollar levels before the end of the decade. Tax increases would not solve Washington’s budget crisis but would only weaken the economy.

The President and Congress should put the budget on a path to balance by reforming the entitlements and cutting inappropriate and wasteful federal spending deliberately.

The stakes are high. Excessive government spending and debt hurt Americans in real ways by reducing their economic opportunities, which means less business and job creation, lower wages, and a much less prosperous future—especially for low- and middle-income earners.