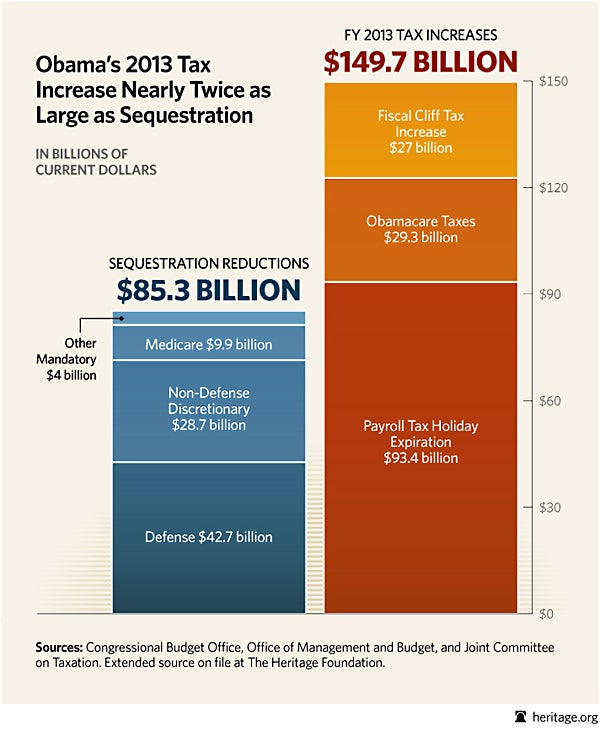

While President Obama is traveling across the nation campaigning against sequestration at the very last minute, the economy is working through a tax increase nearly twice the size of the sequestration cuts for fiscal year (FY) 2013.

The President knew for more than a year that sequestration was looming and yet showed no leadership on finding more deliberate spending cuts that set priorities and put the nation’s fiscal house on a solid foundation.

President Obama said in a recent press release on the looming sequester:

And here’s the thing: They don’t have to happen. There is a smarter way to do this—to reduce our deficits without harming our economy.

Indeed there is. But it’s not the way the President would have you believe. The President argues that sequestration would hurt the economy and calls for more tax increases instead. But failure to rein in spending and raising taxes is a recipe for economic stagnation.

Excessive government spending and a skyrocketing national debt are slowing growth and job creation over the long term. Federal spending is crowding out private investment and job creation, and the U.S. debt is quickly growing to economically damaging levels.

Tax increases, especially on investors and small businesses, also hurt economic growth in more than one way.

1) By taking more money out of the economy that could otherwise have been spent on growing a business and hiring workers; and

2) By changing the incentives against productive work and investment, which slows growth over the long term.

Sequestration-level spending cuts and much more are needed to put the U.S. budget on a path to balance. Sequestration, a blunt instrument that’s indicative of Washington dysfunction, reduces projected spending by only 2.4 percent. Even with sequestration, federal spending is on course to reach nearly $6 trillion by FY 2023, growing by 67 percent from today’s $3.6 trillion. Washington policies like deficit spending and rapidly rising debt are keeping the economy from recovering. As Heritage economist J. D. Foster explains:

Just as deficit spending failed to spur the economy, cutting spending and reducing the budget deficit would generally not slow the economy in the near term. It may even provide a modest short-term lift while improving the economy’s performance in future years. As many now acknowledge, a main cause of the slow recovery in recent years is an oppressive uncertainty surrounding the effects of Washington policies. Smaller deficits mean less uncertainty, which means a somewhat stronger economy in the near term. In the longer run, less deficit spending means more capital available for private investment to increase future productivity and future wages.

Americans face real economic hardship—but it’s not as a result of sequestration. If the President and Congress kick the can down the road on meaningful spending cuts and necessary entitlement reforms much longer, Americans will experience lower earnings, fewer available jobs, and fewer opportunities to better themselves and their families. The President and Congress should put the budget on a path to balance in 10 years, without raising taxes any further.