The controversy over the Obama Administration’s gutting of welfare reform continues to grow. Two new government reports show the move’s illegality and effects on taxpayers. And the House of Representatives is set to vote today to approve or disapprove Health and Human Services’ (HHS) rewriting of the 1996 law.

Yesterday, the Government Accountability Office (GAO) issued a new report saying that in the years since the Clinton-era reform added work requirements to the Temporary Assistance for Needy Families (TANF) program, five states inquired about waivers of TANF requirements. The report confirms that since welfare reform was enacted, HHS has never before suggested that it had any authority to waive the work requirements. Waiver requests were turned down, in fact.

In specific instances in 2005 and 2007, the response from HHS was clear: “HHS stated that all applicable programmatic requirements apply to a family that is provided TANF-funded cash assistance, and the Department does not have authority to waive any of the provisions.”

In the debate thus far, one question has largely gone unanswered: Just how strict are these now-controversial work requirements?

In a new report, Heritage expert Robert Rector explains that “the work requirements were quite lenient, requiring only 30 percent to 40 percent of a state’s caseload to participate in work or a work-related activity and requiring individuals to work as few as 20 hours per week to fulfill the requirement….Yet half of TANF recipients receive a welfare check without performing any activity at all.”

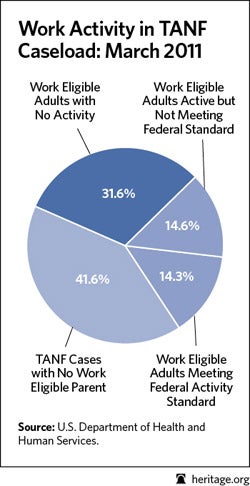

In a snapshot of the TANF recipients in March 2011, only about 14 percent of the recipients were actually meeting the work requirements. The other 86 percent were receiving their welfare benefits just the same.

As Rector says, “It is difficult to understand why anyone would want to weaken these already overly lenient work standards.” Yet he details the left’s vigorous opposition to work requirements in welfare dating back to the Nixon Administration.

The Obama Administration’s rewriting of the law will cost taxpayers, too. A new estimate by the Congressional Budget Office (CBO) says that the Obama Administration’s move will actually increase the deficit by $60 million over the next 10 years. Why? Because states have been paying penalties if they aren’t meeting the work requirements—and under the Administration’s rewriting of the law, those penalties are gone. So is the revenue to the federal government.

But the Administration’s gutting of welfare reform not only costs taxpayers; it also harms those welfare reform was designed to help. By jettisoning the law’s goal of reducing dependency, the new policy will increase welfare caseloads and leave more people stuck in poverty.

Workfare separates those who truly need help from those who do not. Faced with a simple requirement to prepare or search for work, many people simply choose not to enter the welfare rolls in the first place. This is generally good for the prospective recipient and the taxpayer. As Rector explains:

Time spent on welfare never looks good on a job resume. Welfare dependence erodes work habits and job skills and reduces contacts with other employed persons that can lead to future job opportunities. Unnecessary enrollment in welfare therefore undermines an individual’s long-term earnings potential and increases the prospects for future poverty.

Those already on welfare, faced with a requirement to search or prepare for work, leave welfare much more quickly. Having a work requirement tied to welfare benefits is good for recipients and good for taxpayers. As Rector’s new report shows, stronger, not weaker, work requirements are needed.

But the Obama Administration is moving in the opposite direction. Under the new welfare performance measures devised by the Administration, the old pre-reform welfare program with rapidly rising caseloads would be judged a rousing success, while welfare reform itself—with rapid declines in the caseload—would be judged a failure. As Rector states, “The Obama Administration is not just gutting welfare reform; it is turning it on its head.”

Falsehoods continue to circulate on this topic, but the facts are starting to break through. After speaking with Heritage’s Rector, The Washington Post’s “fact check” columnist took a second look at former President Bill Clinton’s recent speech and gave him two “Pinocchios” for misleading people about the TANF work requirements.

Heritage just held a fact check panel of its own this week, featuring Rector, Senator Orrin Hatch (R-UT), The Daily Caller’s Mickey Kaus, and Kay Hymowitz of the Manhattan Institute. Watch the video here.

Quick Hits:

- The Justice Department’s inspector general has issued a report about the Fast and Furious gunwalking scandal, but critical information about the White House’s involvement is still missing, reports Human Events.

- The White House is close to completing its next executive order that will legislate by administrative fiat. This one will enact cybersecurity rules that couldn’t pass Congress.

- A senior Pentagon official argued yesterday that the Obama Administration’s “reset” policy with Russia is working.

- A Christian schoolteacher in Egypt has been sentenced to six years in prison for posting cartoons on Facebook deemed defamatory to Islam and for insulting President Mohamed Morsi and his family.

- The Chicago Teachers Union strike is over—and the union’s strong-arming strategy prevailed. Heritage’s Lindsey Burke wraps up what the union won.