Following the news that the U.S. national debt has increased by $1 trillion for the fifth year in a row and that Greece’s debt crisis may force it from the eurozone, The Heritage Foundation has published a primer on national debt and sovereign default.

National debt in a healthy economy should grow more slowly than gross domestic product (GDP). Thus, the key statistic is debt as a percentage of GDP. A useful benchmark is 60 percent of GDP, an upper boundary that eurozone countries vainly pledged not to cross.

U.S. national debt is currently about 71 percent of GDP—plus an additional 31 percent of GDP of “in-house” debt that the U.S. Treasury owes to the Social Security trust fund and similar funds.

A toy economic model, like a back-of-the-envelope calculation, can illustrate the potential effects of large and fast-growing debt. Although the numbers and events used in this model were made up, it can be illustrative for America’s future. The model shows a country that starts out with a national debt of 70 percent of GDP in 2013. Let’s assume that the country’s GDP normally grows 2 percent per year.

- Let’s model the economy under two spending regimes: In the first regime, the government runs a deficit of 1 percent of GDP each year. In the second regime, the government runs a deficit of 4 percent of GDP each year.

- In both regimes, a mild but extended recession hits the economy in 2019 and 2020. Under both regimes, the government responds with a spending increase of an identical dollar amount.

- In the second regime, high debt (97 percent of GDP) leads to a partial default on government debt at the end of 2020. Although the level of debt at which default occurs differs across countries, no country can accumulate debt infinitely. Let’s assume that default extends the recession and prevents the government from borrowing in the future.

The first regime, in blue (see Fig. 1), shows that in normal times, debt as a share of GDP can decline even when the government runs small deficits. However, a boost in spending during a recession permanently increases debt. Unless debt is declining substantially as a share of GDP during normal times, a series of occasional recessions will result in dangerously high debt.

The second regime, in red, shows how rapidly debt can grow under large deficits. Extra government spending in a recession takes the debt situation from bad to worse. In the U.S., deficits have been between 8 percent and 9 percent of GDP during the recovery from the Great Recession. American policymakers should know that cutting the deficit in half will delay, not prevent, a future American debt crisis.

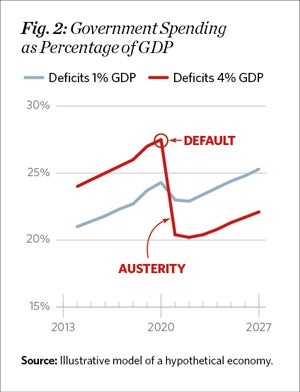

Figure 2 shows the model’s predictions for government spending. Under both regimes, spending grows at the same rate as GDP, with a temporary jump during recessions. In the second regime, however, default leads to a sudden stop in the government’s ability to finance deficit spending. The drastic drop in spending, a form of “austerity,” occurs in 2021 as the government defaults and can no longer borrow to pay its workers. Public-sector workers and those who depend on government services would find such cuts devastating.

The lesson from Figure 2 is that if spending outpaces economic growth, it results in painful austerity. If the U.S. government will not accept gradual, planned reductions in spending in the present, it should expect sudden, unplanned reductions in the future. After losing money to default once, lenders will no longer finance U.S. deficit spending.