Government-backed solar companies have taken a beating over the last few months, with Solyndra garnering most of the attention. But since the solar company’s bankruptcy in late August, another sector of the “green economy” has moved to the edge of a financial cliff: the renewable electricity grid.

Like Solyndra, a number of “smart grid” companies have received taxpayer backing. But federal financing was not enough to keep Beacon Power, a manufacture of flywheel energy storage technology, from going bankrupt. They may not be the last smart-grid company consigned to that fate.

Beacon received a $43 million loan guarantee from the same stimulus-funded Energy Department program that financed Solyndra. Late last month the company filed for chapter 11 bankruptcy protection.

But it gets worse: despite having used $3 million marked for loan repayment to fund operating expenses, Beacon announced Wednesday that it will likely have to liquidate its assets instead of restructuring. It is not clear whether the government will recoup the $43 million through bankruptcy proceedings.

Meanwhile, another smart-grid battery manufacturer has cleaned house, firing many of its top executives, after posting heavy losses and being delisted by NASDAQ.

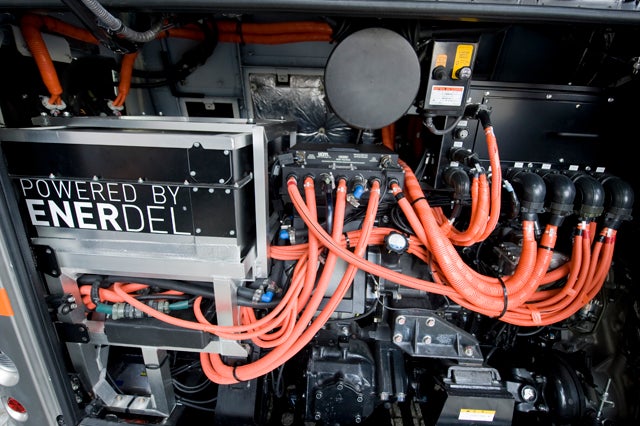

Ener1, which, with subsidiary EnerDel, has received more than $120 million in federal grants, announced early last week that it had replaced its president, its chief executive, and its top financial officer. The company manufactures lithium-ion batteries for smart-grid energy storage.

That move came about a week after NASDAQ delisted Ener1 for a failure to comply with SEC filing requirements.

The Solyndra scandal will likely continue to be a black eye for the administration’s “green jobs” push. But the solar company has company in other green-energy sectors, and the list may continue to grow.