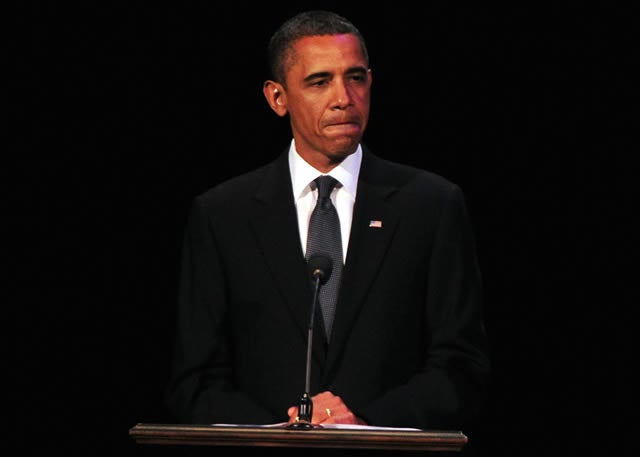

When President Barack Obama began his Midwest “jobs tour” in August, he set out to campaign for the passage of a yet-to-be-released plan to turn around the country’s stagnant economy. But after the details of that plan emerged–more stimulus spending and higher taxes–and when the Democrat-controlled Senate put the measure up for a vote this week, the President’s plan was defeated. Even members of the President’s own party opposed more taxing and spending as a way of pulling America out of its unemployment ditch.

Take Senator Jim Webb (D-VA), for example. The Hill reports that he opposes raising taxes on ordinary income during a time of recession and that the federal government should encourage people to invest in the economy instead of raising their income taxes. In Webb’s own words:

I strongly believe that the way to bring good jobs back is to improve our economy in the private sector, and that means more capital investment. Winston Churchill once said something to the effect that you can’t tax your way out of an economic downturn any more than you can pick up a bucket if you’re standing in it.

Others from the left, too, staked out opposition to the bill. As The Hill also reported, Senator Joe Lieberman (I-CT) took issue with the new spending the President proposed. “The bottom line here is that I don’t believe the potential in this act for creating jobs justifies adding another $500 billion to our almost $15 trillion national debt.”

There’s good reason to stand against the President’s plan. For one thing, it is hundreds of billions of dollars in new spending on more of the same “stimulus” that has left America with virtually zero job growth and continued economic stagnation. And it’s paid for with a massive tax increase on job creators–the very people who would be investing their money to expand businesses and put more Americans back to work.

The President proposed permanently raising taxes by $1.5 trillion over 10 years, with most of the burden falling on families and businesses earning more than $250,000 per year, all in the name of “fairness.” In a new paper, Heritage’s Curtis Dubay explains that the supposed “fairness” of the new rule is anything but fair:

To President Obama, it is ‘fair’ to raise taxes on families and businesses earning more than $250,000 a year by raising their income tax rates and limiting their deductions. That must also mean he believes that they currently pay too little in taxes.

Yet the data show the highest-earning families and businesses already pay the lion’s share of the federal income tax burden. According to the IRS, the top 1 percent of income earners–those earning more than $380,000 in 2008–paid more than 38 percent of all federal income taxes while earning 20 percent of all income. The top 10 percent ($114,000 and above) earned 45 percent of income and paid 70 percent of all taxes. At the same time, the bottom 50 percent of income earners–those earning less than $33,000–earned 13 percent of all income and paid less than 3 percent of federal income taxes.

Then there was Majority Leader Harry Reid’s (D-NV) plan to impose a millionaire tax–a 5.6 percent surtax on incomes of married filers earning over $1 million starting on January 1, 2013, pushing the average top U.S. income rate to 55 percent, higher than all but two of the 30 most economically developed countries in the world. Dubay explains how the tax would negatively impact job creation:

Taxpayers earning more than $1 million a year are investors and businesses that are directly responsible for creating jobs. Investors provide the capital to existing businesses and startups so they can expand and add new workers. Raising their taxes would deprive them of resources they could invest in promising businesses that are looking to add employees. Raising their tax rate would deter them from taking the risk to invest.

It’s this philosophy of soaking the rich to pay for more wasteful government spending that has ginned up opposition to the President’s jobs plan. The White House, though, isn’t getting the message, and it’s totally glazing over the bipartisan opposition. White House communications director Dan Pfeiffer laid the blame squarely on Republicans and wrote, “We can’t take ‘no’ for an answer.” The President, too, lashed out at the GOP, painting them as a minority that “got together as a group and blocked this jobs bill from passing the Senate.” The New York Times got in on the act, too, lambasting the right for its opposition, without acknowledging opposition on the left.

Instead of playing the blame game, the President should take a step back and understand why Members of Congress from both sides of the aisle oppose his plan. Raising taxes to pay for stimulus spending that has proven to be a failure simply will not get the economy back on track.

Quick Hits:

- Congress approved last night free-trade agreements with Colombia, South Korea, and Panama. The South Korea agreement is the largest approved by Congress since the North American Free Trade Agreement.

- A U.S. drone strike in northwestern Pakistan killed an insider of the Afghan militant group known as the Haqqani network. The group is said to be aided by Pakistan’s spy agency.

- More details have emerged regarding the Iranian-backed terrorism plot to assassinate Saudi Arabia’s U.S. ambassador. A $100,000 payment to the alleged plotters was traced to an elite Iranian military branch, the Qods Force.

- Home foreclosure proceedings are again on the rise, surging 19 percent in states like California where courts don’t oversee the process. In states with court involvement, foreclosure proceedings increased 9 percent.

- Representative Darrell Issa (R-CA), the House’s lead investigator, yesterday served Attorney General Eric Holder with a subpoena relating to the Operation Fast and Furious gun-running scandal.