European-Level Taxes Coming to America If US Keeps Up Unsustainable Spending

Preston Brashers /

Compared to Western Europe, the American middle class has it pretty good when it comes to taxes. Of course, that’s more of an indictment on Western European governance than it is an endorsement of the U.S. tax system. And, unless Washington changes its big-spending ways, the U.S. middle class soon will face similar astronomical taxes.

That’s the price we’ll pay if we allow our unsustainable deficits to continue.

And that’s why the ongoing debt ceiling standoff between Speaker of the House Kevin McCarthy, R-Calif., and President Joe Biden is so important.

If we continue spending like the Europeans, then America’s middle class must prepare to be taxed like the Europeans.

For a typical American family of four, a European-style tax system could carry a price tag of $20,000 per year or more in additional taxes.

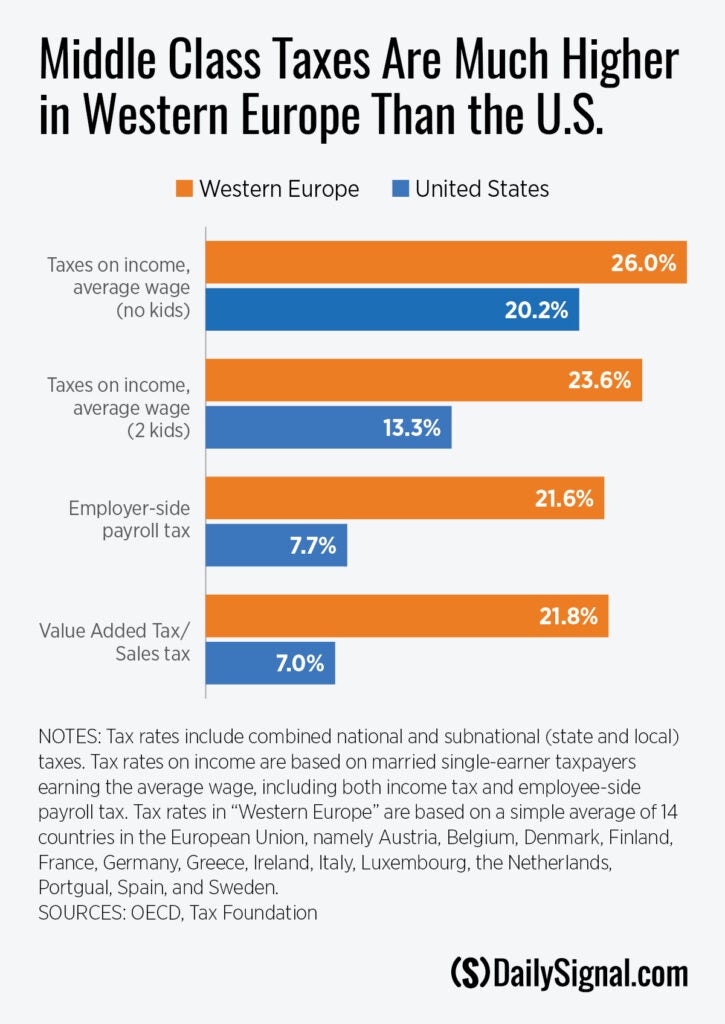

Breaking it down, let’s look first at taxes on income, including the portion of payroll taxes taken out of employees’ paychecks for Social Security and Medicare. Married, childless Americans with one spouse working full time at an average wage (equivalent to about $65,000 of annual income) pay about a combined 20% tax rate on income, including state and local income taxes. A typical Western European married couple with no kids pays about 26%.

Because of America’s child tax credit, the gap between U.S. and European tax rates is even larger for parents. A married parent with two kids earning an average wage pays a 13.3% tax on income in the U.S. compared to 23.6% in Western Europe.

But for the Western European middle class, taxes on wages are only the beginning.

Western European countries impose hefty taxes on businesses’ payroll. These taxes have the same effect as other taxes taken out of wages—namely that workers take home less pay. The only difference is that these taxes are better hidden from the workers.

The U.S imposes a 7.65% employer-side payroll tax, but the average Western Europe country hits employers with a 21.6% payroll tax on employee wages. That’s money employees never get to see.

But the biggest difference between middle-class taxes in America and Europe is that Europeans are subject to the value-added tax.

The VAT is a form of consumption tax, a cousin of the sales taxes that many U.S. states impose. U.S. states’ sales taxes usually exempt a broad range of products ranging from food to medicine to many services; VATs typically allow fewer exemptions.

And while the typical American pays a 7% sales tax at the state and local level, a consumer in a typical Western European country faces a 21.8% VAT.

And if all that wasn’t enough, since many Western European countries are as deep in debt as the U.S., middle-class Europeans can only expect their taxes to rise.

What about the rich? Politicians like Sen. Bernie Sanders, I-Vt., and Sen. Elizabeth Warren, D-Mass., claim that we can go on spending like Europeans by making the rich and corporations “pay their fair share.”

But the truth is, the taxes on the rich and corporations in the “social democracies” of Western Europe that the Left idolizes so much aren’t that different than here in the United States.

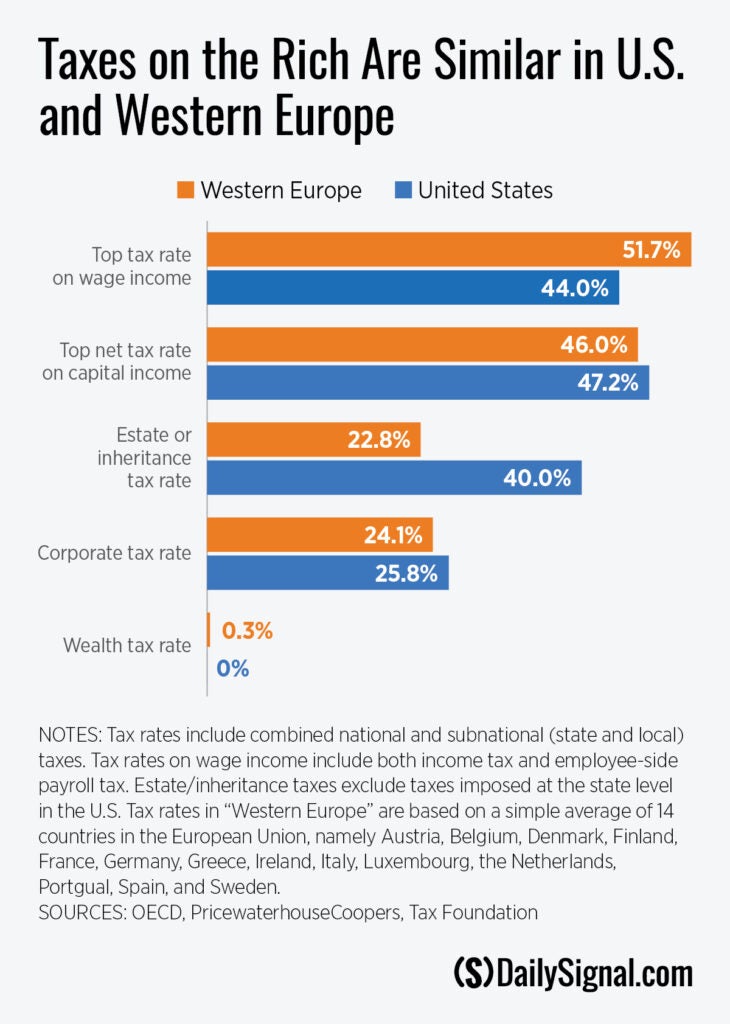

Including average state and local taxes, the top combined statutory tax rate on wage income for the wealthy in the U.S. is 44%, compared to 51.7% in Western Europe.

Even that overstates the difference between European and American taxes on the rich, though. The highest-income taxpayers don’t earn most of their income from wages, but rather from capital investments. And the top combined tax rate on dividend income—including taxes paid by corporations before issuing dividends—is 47.2% in the U.S., slightly higher than the 46% tax rate in Western European countries.

And when wealthy Americans die, their estates are subject to an additional 40% federal tax, almost twice as high as the 22.8% average tax that the Western European countries apply when estates are inherited.

It’s not that Western Europeans haven’t had the idea to soak the rich to pay for their large social welfare states. They’ve tried. But the cold, hard reality for redistributionists is that there’s only so much juice you can squeeze out of even the largest of oranges.

Europe’s disastrous experiments with wealth taxes are a perfect illustration of this. Wealth taxes were commonplace in Western Europe in the early 1990s. Today, they’re almost nonexistent because they were such spectacular failures.

The wealth taxes failed to bring in the promised revenues and drove the wealthy to run for the exits, taking their money with them.

Politicians’ favorite game is to promise benefits that someone else will pay for, but, as the example of Western Europe shows, the burden of unchecked government spending will ultimately fall on the vast middle class.

Americans have gotten just a taste of what that feels like over the last two years as excess spending bled into the 40-year high inflation that has robbed the average American family of more than $7,000 of purchasing power a year. But that’s nothing compared to what could be coming down the pike.

As Biden and McCarthy continue to square off over the debt ceiling, it’s not an exaggeration to say that the future prosperity of the American middle class is at stake.

If Biden’s proposed “clean” debt ceiling increase with no spending cuts or growth caps were to get through Congress, that would show that our elected officials are unwilling to take even modest steps to slow the explosive growth in federal spending. If that’s true, then we can see our future when we look across the Atlantic: an over-taxed middle class, economic stagnation, and a declining standard of living.

To avoid that bleak fate, Biden and congressional leadership must step up and unite behind a plan that—like the House’s Limit, Save, Grow Act—pares back unnecessary spending, limits spending growth, and stops the proliferation of economy-strangling regulations.

The middle class can afford nothing less.

Have an opinion about this article? To sound off, please email [email protected], and we’ll consider publishing your edited remarks in our regular “We Hear You” feature. Remember to include the URL or headline of the article plus your name and town and/or state.