Side Effects: Employees Lose Insurance and Taxpayers get the Bill Under Obamacare

Alyene Senger /

The House Ways and Means Committee just released a report that shows that the most successful companies would save billions of dollars if they stopped offering coverage to their employees and dumped them into the taxpayer-funded Obamacare exchanges.

On a confidential basis, 71 Fortune 100 companies supplied information to the committee regarding the cost and coverage of their health insurance plans. The committee used the data to calculate the potential savings of dumping employees into the exchanges and paying the employer mandate penalty.

The report’s findings will likely scare the many Americans who like their current employer-sponsored insurance. The report concludes that companies could save $28.6 billion in 2014 alone by dumping their employees into the exchanges. Moreover, the savings grow over time: Between 2014 and 2023, dropping health coverage would collectively save these companies $422.4 billion—and that’s after paying the penalty.

According to the report, in 2011, the average per-employee cost of providing health insurance to these companies was $5,197 after taxes and is expected to increase to $6,487 in 2014. The employer mandate costs only $2,000 per full-time employee. The financial incentive to forgo offering health insurance coverage to employees is obvious and enormous.

Before Obamacare, individuals without employer-sponsored coverage had few other alternatives, which discouraged mass employer dumping to save money. But under the President’s health law, the conditions have changed. A study by McKinsey and Company explains:

[Obamacare] reduces the social-equity advantage of employer-sponsored insurance, by enabling these workers to obtain coverage they could not afford on today’s individual market. It also significantly increases the availability of substitutes for employer coverage. As a result, whether to offer [coverage] after 2014 becomes mostly a business decision. Employers will have to balance the need to remain attractive to talented workers with the net economics of providing benefits—taking into consideration all the penalties and tax advantages of offering or not offering any given level of coverage.

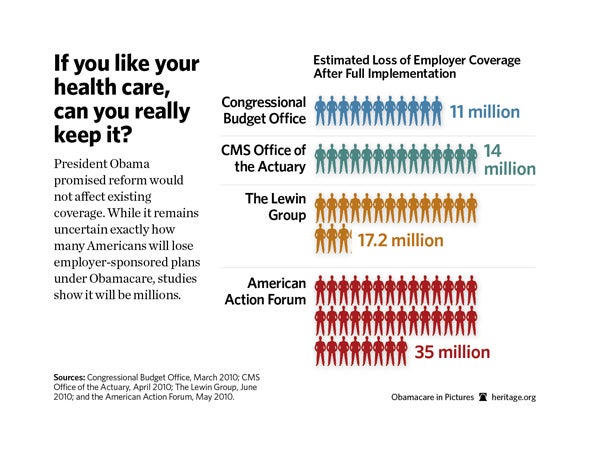

It will simply be a better business move for many employers to pay the fine and dump millions of American workers into the government-run exchanges. McKinsey found that 30 percent will either definitely or probably drop insurance coverage for their workers under Obamacare.

But subsidized coverage in the Obamacare exchanges isn’t free, as Heritage’s Kathryn Nix has warned before: “As employers drop health plans for their employees, taxpayers will be left to pick up the tremendous cost of offering more and more subsidized coverage in the exchanges. This will drive up the cost of Obamacare and its already-huge impact on deficit spending.” More Americans will be dependent on government, which gives the government more control over health care decisions that should be made by the patient.

President Obama’s promise that “if you like your health care plan, you’ll be able to keep your health care plan” has been indisputably broken. The American people deserve health care reform that benefits them, not the broken promises of Obamacare.