‘Hotter Than Expected’ Inflation Report Due to Opening ‘Pandora’s Box,’ Economist Says

Samantha Aschieris /

An economist is blaming both Republicans and Democrats for their “overspending” after the federal government revised inflation numbers upward for the January 2023 report on price increases.

“Not only was January’s inflation number hotter than expected, but the last three months of 2022 were also revised upwards,” EJ Antoni, a research fellow for regional economics in the Center for Data Analysis at The Heritage Foundation, told The Daily Signal in a statement Tuesday after the report’s release. “That means inflation has not cooled as much as originally estimated.” (The Daily Signal is Heritage’s multimedia news organization.)

“The Federal Reserve was premature in its decision to slow its interest rate hikes,” Antoni added. “Further evidence of this is the fact that national financial conditions continue loosening, not tightening. We have a long way to go before the Fed closes this Pandora’s Box, which they opened.”

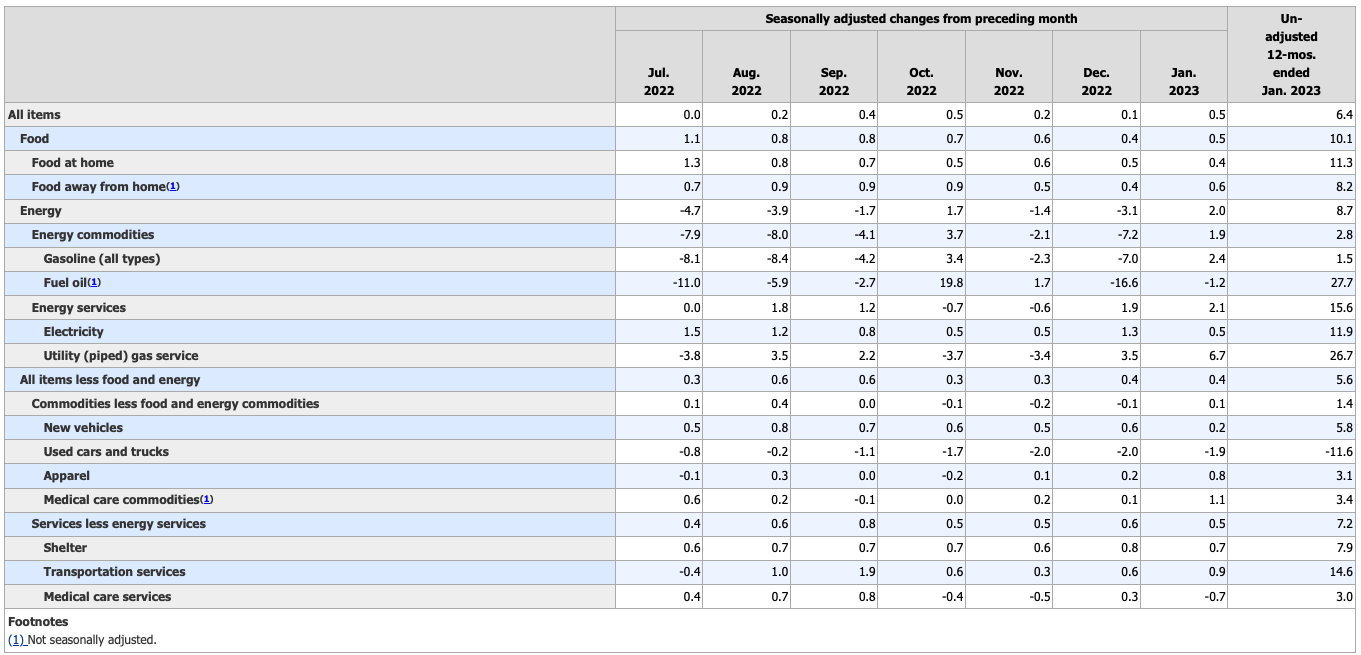

The consumer price index, a key measure of inflation, rose 0.5% in January, up 6.4% from January 2022, the U.S. Bureau of Labor Statistics reported Tuesday.

Antoni blamed federal spending for the rising prices.

“For the last three years, Congress has spent trillions of dollars that we simply don’t have,” he said in a press release. “The Federal Reserve created the money to finance those unprecedented levels of spending, which caused inflation.”

Butter has increased 31.3%, gasoline has increased 48.4%, natural gas service has increased 57.2%, and eggs have increased 229% since Jan. 2021, The Heritage Foundation press release said.

The food index rose 0.5%, the utility (piped) gas service index rose 6.7%, the shelter index rose 0.7%, and the gasoline index rose 2.4%, while the fuel oil index fell 1.2%, the used cars and truck index fell 1.9%, and the medical care services index fell 0.7%, the Bureau of Labor Statistics reported.

The new report was worse than some economists’ expectations that inflation rose 0.4% in January and a year-over-year rate of 6.2%, CNBC reported.

“As the Federal Reserve belatedly acts to rein in inflation, it continues to work at cross- purposes to Congress, which continues to overspend,” Antoni explained. He added:

The more Congress overspends, the tighter the Federal Reserve will have to squeeze the private economy to bring down inflation, increasing the risk of slowing the economy even further. It is imperative that Congress begin cutting spending immediately.

The explosion of deficits and debt over the last three years have put the federal budget in a precarious position where rising interest rates will automatically add an additional $300 billion to the next budget.

Antoni blamed both Democrats and Republicans for “overspending.”

“This is not an issue of politics but policy. Both Republicans and Democrats have been complicit in overspending and both parties must rein in the monster they’ve created,” Antoni said.

“Washington’s out-of-control spending and debt are hurting families and working Americans. Congress has a moral and fiscal obligation to stop the reckless spending that imperils American’s’ financial futures,” he added.

December’s consumer price index was initially reported as having decreased 0.1%, which was up 6.5% from December 2021, according to the Bureau of Labor Statistics.

However, the bureau revised the consumer price index for December upward to an increase of 0.1%, rather than a decrease of 0.1% as initially reported, Reuters reported on Friday. The consumer price index for November was also revised from an increase of 0.1% to 0.2% as was the consumer price index for October, which was updated from an increase of 0.4% to 0.5%.

“We are seeing the effects of our policy actions on demand in the most interest-sensitive sectors of the economy, particularly housing. It will take time, however, for the full effects of monetary restraint to be realized, especially on inflation,” Jerome Powell, chairman of the Federal Reserve Board, said at a press conference on Feb. 1.

“In light of the cumulative tightening of monetary policy and the lags with which monetary policy affects economic activity and inflation, the Committee decided to raise interest rates by 25 basis points today, continuing the step down from last year’s rapid pace of increases,” Powell said.

The consumer price index for February will be released March 14.

Have an opinion about this article? To sound off, please email [email protected] and we’ll consider publishing your edited remarks in our regular “We Hear You” feature. Remember to include the url or headline of the article plus your name and town and/or state.