CBO Shows Obama’s Budget Produces More Staggering Spending and Debt

Patrick Louis Knudsen /

The Congressional Budget Office (CBO) estimate of the President’s budget reveals a reckless fiscal plan that shirks the spending cuts in the Budget Control Act and increases spending by more than $1 trillion over the next 10 years. It confirms that Obama is the first President to preside over four years of deficits in excess of a trillion dollars. Moreover, it deepens the debt by $3.5 trillion. A few details:

Higher Total Spending. In the CBO’s analysis, the President’s spending is $1.15 trillion higher between 2013–2022. Roughly half of the increase comes from policy changes and the other half from increased interest payments. The President’s record total spending would hold above 22 percent of gross domestic product (GDP) throughout the decade, “well above the 21.0 percent average seen over the past 40 years,” CBO says.

Higher Mandatory and Entitlement Spending. Though entitlement spending is the single worst problem in the budget, the President increases mandatory spending by $1.16 trillion through 2022. Most of the increase, $486 billion, comes from reclassifying transportation spending from discretionary to mandatory. Another $366 billion consists of refundable tax credits—payments to individuals and families who have little or no tax liability.

Hidden Discretionary Spending Hikes. The President’s budget takes the audacious step of ignoring the automatic sequestration spending reductions under the Budget Control Act (BCA) that are scheduled to take effect in January—the same legislation he signed to get a $2.1 trillion increase in the debt limit to nearly $16.4 trillion. He does this by increasing spending by $1 trillion over the next 10 years rather than staying within the BCA caps and by discarding the overall level of sequestration cuts. Then the President claims to offset this spending increase with two large budget gimmicks.

- First, the budget claims $810 billion in new savings from reductions in spending that were already scheduled to occur for activities in Iraq and Afghanistan. It is curious that CBO credits the President’s budget with these phantom savings, as CBO’s director previously disavowed them.

- Second, the Administration counts $486 billion in reductions just from the reclassification of transportation cited above.

- Without these two gimmicks, the President’s discretionary spending would actually be $697 billion higher—on top of the $1 trillion increase—over the next 10 years, based on CBO’s figures.

Deeper Deficits. The combination of policies in the President’s budget produces cumulative deficits of $6.4 trillion through 2022, $3.5 trillion more than CBO’s baseline—sharply different from the more than $5 trillion in deficit reduction the President’s budget claimed.

Mounting Debt. Debt held by the public in the President’s budget remains at more than three-fourths the size of the entire economy throughout the decade. By 2022, the President’s proposals would send debt to 76.3 percent of GDP, rather than rein it in below the 61.3 percent in CBO’s baseline.

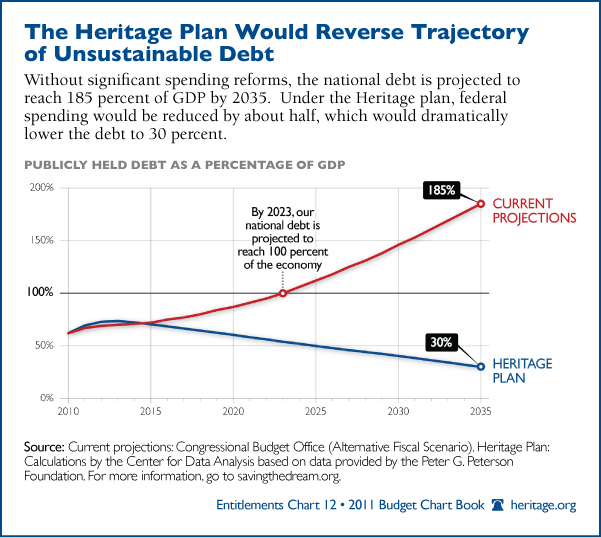

In the final analysis, CBO’s new report confirms earlier assessments that the President’s budget is an empty political document that pays short shrift to solving the nation’s twin crises of spending and debt. His budget stands in stark contrast to The Heritage Foundation’s Saving the American Dream: the Heritage Plan to Cut Spending, Fix the Debt and Restore Prosperity.

Because the Senate refuses to pass a budget of its own, the burden is now shouldered solely by House Budget Committee Chairman Paul D. Ryan (R–WI) to build on his successes last year and produce a House budget that will fix the nation’s daunting fiscal outlook.