The Millionaire Surtax: Back from the Dead?

Curtis Dubay /

The “millionaire surtax” is the Michael Meyers of bad tax policy. Like the villain in the Halloween movie franchise, it keeps rising from the dead.

Just as the writers of the infamous horror movies keep coming up with more preposterous ways to revive Mr. Meyers, the surtax keeps coming back for a host of reasons. Usually it is a “pay for” for some new big-government spending program, or to unnecessarily “offset” the cost of keeping a tax cut in place.

The current revival comes at the hands of freshman Representative Rick Crawford (R–AR). His plan would slap a 5 percent surtax on incomes over $1 million to get Democrat support for a balanced budget amendment to the Constitution.

By indicating that tax hikes are necessary to lower the deficit, Crawford displays a misunderstanding of the cause of the problem—it is that the government spends too much, not that it taxes too little.

Yes, the Congressman is proposing a balanced budget amendment as a way to cut spending. But why not leave it there and let Congress get down to the business of cutting spending?

Giving Congress any more of our money— through higher taxes—to spend won’t rectify the problem. Congress spends every dime it takes in plus whatever it can get away with borrowing. That’s why tax hikes never lower the deficit.

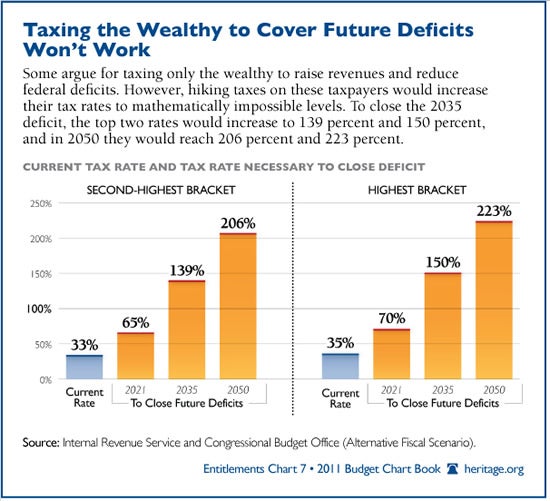

And its not as if taxing the rich could even come close to solving the deficit problem, even if it weren’t the exactly wrong approach. Just raising the top two rates to “cover the deficit” would require a top tax rate of 223 percent! Taxing 100 percent—much less 200 percent—of a taxpayer’s income is impossible. (Article continued below)

To lower the deficit, Congress must cut spending. It is that simple.

Crawford also doesn’t seem to understand that a surtax on millionaires would hurt middle-income and low-income Americans the hardest. That’s because the surtax would hit half of all the income earned by businesses that employ workers yet pay their business taxes through the individual income tax code, according to the Treasury Department.

The surtax would strip these important employers of resources they could have used to hire new workers or pay their existing workers more. So much for soaking the rich.

The pain inflicted on middle-income and low-income workers is probably why Congress has failed to pass the surtax time and time again—even when liberals were the majority in the House of Representatives and Nancy Pelosi (D–CA) was Speaker. If the misguided surtax couldn’t make it into law then, there is little chance of it passing now.

All Americans can be thankful for that.