Fed Reports on Bailouts and Moral Hazard

Anthony B. Kim /

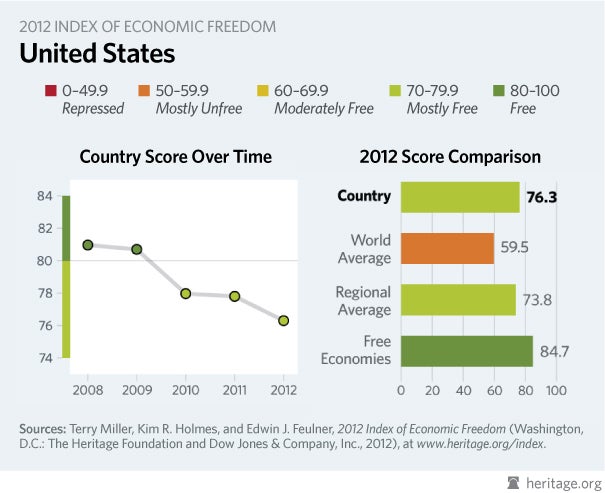

Back in 2010, The Heritage Foundation’s Index of Economic Freedom first reported the shocking erosion of America’s long-cherished economic freedom. The interventionist policies put in place by the “Yes, We Can” Administration caused our nation’s economic freedom status to plunge from “free” to “mostly free.”

The downward trend has continued since 2010, undermining long-term prospects for dynamic economic growth.

More specifically, warning on the peril of moral hazard, the 2010 Index detailed that “the absence of transparency and accountability in the operations of the Troubled Asset Relief Program (TARP) and in other ‘bailout’ programs managed by the Treasury and the Federal Reserve has increased concerns about the potential for government corruption.”

According to a March 2012 report by the Federal Reserve—surprise, surprise—moral hazard was in practice amplified in financial institutions that took TARP funds, particularly the large banks:

The program was developed by congressional mandate; however, the purpose of the program was not entirely clear from the beginning. The program was originally portrayed as an effort to reduce the risk profile of banks by increasing bank capitalization.… In our regression results, we find consistent evidence that the TARP capital injection significantly increased the risk of loan originations by the large banks receiving the funds.… In addition, the use of government funds to support banks may have created incentives for excessive risk-taking through moral hazard.

Just as predicted, excessive regulation and bloated government spending have bred cronyism and corrupted our free-market system.

The time to reverse this trend and restore our economic freedom is now.