CBO Debunks Myth That Tax Code Favors Oil Over Renewables

Lachlan Markay /

Environmental activists and liberal politicians are fond of bemoaning the supposedly disproportionate tax benefits that go to the fossil fuel industry compared to its renewable energy competitors. The president specifically has made “ending tax breaks for oil companies” a pillar of his paltry efforts to reduce the federal deficit.

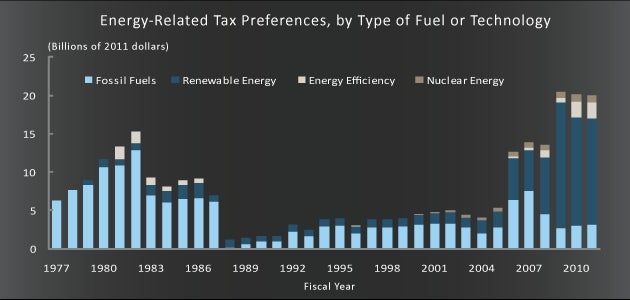

But a new report from the Congressional Budget Office (CBO) handily debunks the myth that oil companies uniquely or excessively benefit from the tax code. One devastating chart sums up CBO’s key findings:

As the chart shows, renewable energy is far more heavily subsidized by tax carveouts than any other energy sector, including fossil fuels.

The chart does not, however, take into account the level of those subsidies in proportion to the amount of energy that each sector creates. By that measure, renewables’ federal subsidies are even more lopsided.

As Heritage’s David Kreutzer has pointed out, wind energy companies, for instance, get about 1000 times the subsidies that oil companies do, per kilowatt-hour of energy produced.

As CBO notes, the sudden spike in tax benefits for renewable energy companies stems from the president’s stimulus package, which included billions in tax breaks for wind, solar, biofuel, and geothermal energy.

But while many of those tax breaks are set to expire soon, the fact remains that renewable energy is heavily favored by current tax policy. The notion that the oil industry disproportionately benefits from “tax breaks” is simply wrong.

That said, a strong energy policy would not seek to equalize subsidies for all energy sectors, but would rather eliminate all such subsidies, and allow each energy sector to compete in the marketplace on its own merits.