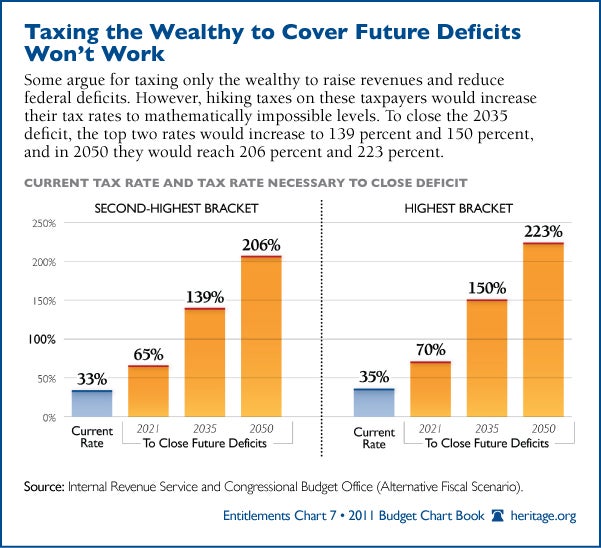

Chart of the Week: Taxing the Wealthy to Cover Future Deficits Won’t Work

Rob Bluey /

Democrats on the Joint Select Committee on Deficit Reduction last week floated a proposal that includes massive tax increases on wealthy Americans. While their plan would also include some cuts to entitlement programs, the tax-code changes make up a significant portion, according to press reports.

The Los Angeles Times reported: “Revenue would be raised mostly by bumping up the high-end tax bracket and limiting deductions for upper-income earners, those familiar with the talks said.”

This isn’t exactly a surprise. President Obama and his liberal allies in Congress are waging a war against successful Americans. House Budget Chairman Paul Ryan (R-WI) spoke at Heritage last week about the divisive nature of Obama’s scheme.

The so-called Super Committee, of course, could be an opportunity for Congress to reform the tax code. Writing in the Washington Times last week, Heritage’s J.D. Foster observed:

But if tax reform is part of a deficit-reduction exercise because the language of tax reform has been co-opted to disguise a tax hike, then both the hike and the reform should and likely will fail. Be very clear — tax reform is revenue neutral as traditionally scored. If a tax proposal is shown to raise revenue, then it’s not tax reform, it’s just another big-government tax hike.

As for that proposal floated by Democrats this week, it’s simply not a viable solution. This chart from Heritage’s 2001 Budget Chart Book reveals that Congress would need to increase tax rates on wealthy Americans to mathematically impossible levels to close future deficits.