Congress Plays Around on China

Derek Scissors /

The Senate is today considering a bill to punish China for its currency policy. The bill requires the U.S. to place duties on Chinese goods if the exchange rate of the yuan against the dollar isn’t brought to a level Congress finds suitable. It is vague on that level, on timing, and on basic logic.

There are serious issues in our economic relationship with the Chinese, but the Senate bill won’t address any of them.

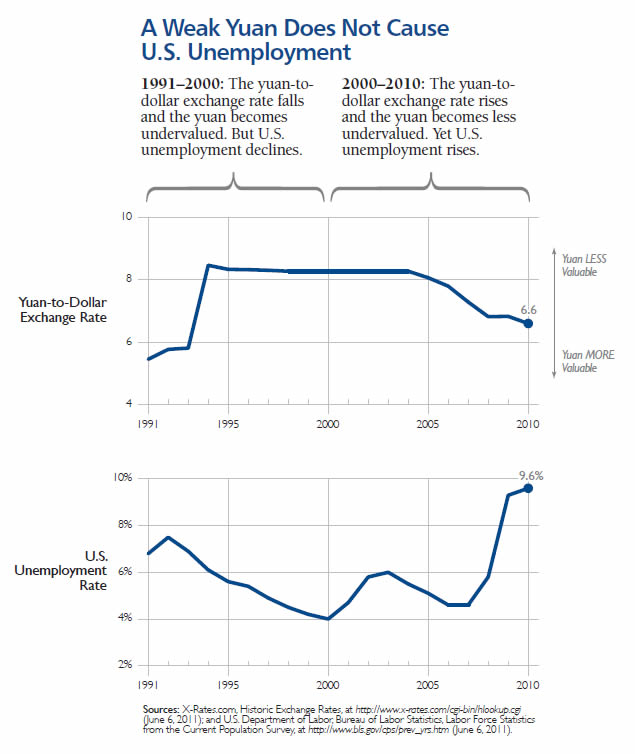

China’s currency policy doesn’t cost American jobs. In fact, 20 years of figures appear to show a yuan that is falling against the dollar—–the weak yuan Congress doesn’t like is associated with lower U.S. unemployment. A stronger yuan, as we’ve seen recently, seems to be associated with higher U.S. unemployment.

Critics calling for a 20 or 30 percent revaluation might want to note that there has been a 25 percent revaluation since 2005, and American unemployment has soared. (Read more below chart.)

The yuan just doesn’t matter, and this isn’t surprising. The American economy is more than twice the size of the Chinese economy. Our policies matter to the entire world far more than theirs do. So Congress has to take responsibility. Since that’s an unpleasant thought for many Members, a scapegoat must be found. And there’s a big one right across the Pacific.

China makes a good scapegoat because it isn’t an open trading partner. China blocks American imports, distorts its own exports, and unbalances the entire world economy. It does this through policies that are much more powerful than the controlled exchange rate. The most important of these are a set of subsidies to state-controlled enterprises.

These subsidies feature regulatory protection against competition. There are also colossal amounts of no-cost loans. And free land. And access to below-cost power and energy. And yet more.

Regulatory protection against competition is the most fundamental—and the least appreciated—policy. It is the least appreciated because it’s hard to measure. It’s the most fundamental because the biggest subsidies any firm can receive is to have a guarantee against bankruptcy and have competitors barred from competing. Chinese state-controlled enterprises have both.

In a wide range of industries, Chinese state firms are required by government decree to be dominant. Chinese private firms, foreign firms operating in China, and imports from the U.S. and other countries are all fighting for what’s left over, if anything. And Chinese state firms are not permitted to fail—they just get merged with other state firms. American exports or American companies are never permitted to out-compete Chinese state rivals.

The U.S. has complained about this issue for years but has never taken comprehensive steps to address it. The first of these is to identify and measure the full range of Chinese subsidies, not just bits and pieces. This should start with measuring the effect of regulatory protection. It will be difficult, but it is necessary to start to solve the true problems in the Sino–American economic relationship. It is long past time for American attention to change focus from currency to subsidies.