Heritage Responds to Obama’s Debt Reduction and Tax Proposal

Mike Brownfield /

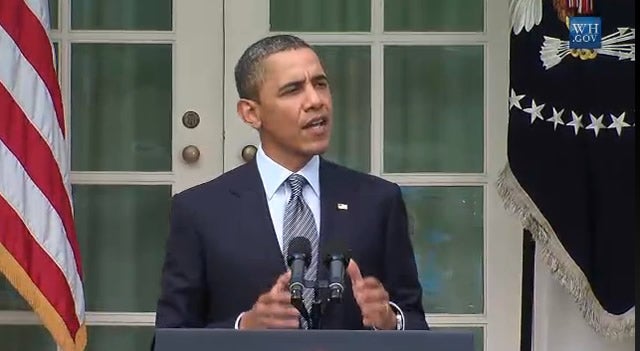

Heritage’s experts watched President Barack Obama’s debt reduction and tax increase proposal. Here are their immediate reactions:

Obama’s Plan Is More Bad News for Defense

President Obama’s approach to deficit reduction, which he outlined in a Rose Garden statement today, means additional bad news for the defense budget and the nation’s security. According to the fact sheet provided by the White House, accompanying his statement from the Rose Garden, the deficit reduction plan sees the continued application of $1.2 trillion in discretionary spending cuts already included in debt ceiling law that was enacted recently. Office of Management and Budget Director, Jack Lew, released a blog on August 4th that estimated that this provision will cut roughly $350 billion from the defense budget over ten years. The new deficit reduction plan would add $1.1 trillion in cuts from defense to come from funding for the military operations in Afghanistan and Iraq. Finally, it would impose an unspecified level of spending reductions in benefits for military personnel.

Today’s statement, however, ignores the fact that President Obama had already proposed an inadequate five-year (FY 2012 through FY 2016) defense budget in February. The news in this latest statement is the recommended cut in funding for the overseas operations. While it is unclear what baseline the White House is using in advancing this proposal, the President’s own budget estimates spending only a bit more than half the amount of proposed cuts to the budget for such operations over a similar timeframe. This not only repudiates a provision in the debt ceiling law to protect these operations through a special instrument for adjustments in the applicable spending ceiling, it implies that the President will apply additional cuts to the budget for the core defense program.

The greatest disappointment, however, is that the President’s deficit reduction proposal sidesteps the kind of structural reforms in the major entitlement programs that are necessary to avoid draconian cuts to the budget for the federal government’s most important constitutional obligation, which is to defend the nation and its vital interests.

Baker Spring

The President’s Disappointing Retreat on Medicare

During the Debt Ceiling negotiations, President Obama tentatively joined the large and growing consensus that the age of eligibility for Medicare enrollment should be raised from 65 to 67. Among serious advocates of entitlement reform, raising the age of normal eligibility has emerged as one of the few precious areas where there has been a broad consensus. It was a position endorsed by analysts at both the American Enterprise Institute and the New America Foundation, and by former Democratic CBO Director Alice Rivlin and Republican Budget Chairman Paul Ryan. It would also result in significant savings. The Congressional Budget Office (CBO) projected that budget savings from the proposal would amount to $124 billion over the period 2012 to 2021.

The Medicare age of eligibility change is long overdue. When Congress and the Johnson Administration enacted the Medicare program in 1965, the average life span had increased to 70.2 years. They made the decision to retain the normal retirement age at 65, which was enacted for enrollment in Social Security back in 1935. By 2009, the average life span had reached 78.2 years, and by 2030, when the Medicare population is projected to jump to approximately 80 million enrollees, the average life span is projected to top 80 years of age. At that time, there will be roughly 2 younger workers supporting each retiree. We’re doing it to the kids.

The President’s retreat is a disappointment. He must know that long-range structural reform of the Medicare program is necessary, since, in the estimate of the Medicare Actuary, it faces a long term unfunded liability of almost $37 trillion. In his deficit reduction program, he is proposing savings of $248 billion over ten years, and 90 percent of these savings will come from reducing “overpayments” in Medicare. These include a number of “cats and dogs” in Medicare’s complex payment system, relating to such items as changes in payments to rural providers, payments for post acute care, payments for advanced imaging, earmarking penalties ($500 million) for non-compliance to deficit reduction, applying the Medicaid rebate (kick-back, price control system) for drug payments to Medicare Part D (a terrible idea); and the old crackdown on Medicare waste, fraud and abuse, which is expected to save $5 billion over ten years. (According to a July 28, 2011 GAO report, there are estimated $48 billion in annual Medicare “improper” payments, representing about 38 percent of the total $125.4 billion estimate for the entire federal government.) The President wants to toughen Medicare payment caps to be enforced by the Independent Payment Advisory Board (IPAB), reducing the target from GDP plus 1 percent to GDP plus 0.5 percent.

The President is also proposing to increase Part B and D premiums for upper income retirees; increase the Part B deductible by $25 for new retirees; introduce a Part B “surcharge” for enrollees who buy Medigap coverage that provides “near first dollar” coverage. While these ideas have merit, they are substantially modest and don’t even kick in until 2017. In other words, the reform falls far short of what is needed, as embodied in Heritage’s Saving The American Dream, which delivers a balanced budget within ten years and guarantees the solvency of the Medicare program.

Robert Moffit

The President’s Debt Reduction Proposals: The Wrong Diagnosis

The President’s “debt reduction” proposals released today are a fine statement of liberal ideology, but a poor attempt at fiscal policy. His so-called “balanced approach” – using a mix of spending reductions and tax increases – is the wrong formulation to start with. It merely perpetuates a misunderstanding of the fundamental problem: deficits and debt are symptoms; the underlying illness is excessive and uncontrolled spending.

The federal government today is claiming roughly one-fourth of total economic output – about 25 percent of gross domestic product (GDP) – a post-World War II record. This is dead weight on the economy, because every dollar of spending gets paid for – through taxes, borrowing, fees, offsetting receipts, etc. – and hence is no longer available to growth producing activities in the economy. That is why spending is considered one of the best measures of the size and scope of government. As Professor Allen Schick has written, fundamentally government is what it spends.

But even more problematic than the level of spending is its trajectory – especially in federal entitlements. According to the latest figures by the Congressional Budget Office, entitlement spending is projected to rise at a rate of about 5.3 percent per year. That is faster than projected inflation, and faster than nominal GDP. So even if the gap between spending and revenue were closed, entitlements would immediately begin outrunning taxes again, resurrecting deficits.

As is well known, the problem is most acute in the Big Three entitlements: Social Security is growing at a rate of 5.8 percent per year, Medicare at 6.3 percent, and Medicaid at 9 percent. Clearly, these growth rates cannot be lowered by trimming around the edges of the programs, cutting wasteful spending and overpayments, and squeezing medical providers. It requires fundamental reforms that alter the incentives toward overutilization and inefficient delivery of medical services. But these are exactly the kinds of things the President has ruled out. He expressly rejects adjusting benefits or eligibility. He claims his proposal will save $248 billion in Medicare, of which 90 percent would come from reducing overpayments, not from restructuring the program. This is not a serious proposal for addressing the government’s spending and debt problems.

Similarly, he claims savings “that build on the Affordable Care Act” almost entirely from vague improvements in efficiency: “by reducing wasteful spending and erroneous payments, and supporting reforms that boost the quality of care.” Nevertheless, it is curious that his vaunted health care program – which was advertised as reducing deficits – is so inefficient that it is already projected to generate $320 billion in overspending over the next 10 years.

In addition to all these failings, the President takes credit for a whopping $2.3 trillion in spending reductions that either are already assumed, or are based on manufactured spending projections.

First he claims $1.2 trillion in savings (including debt service reduction) from the spending caps in the Budget Control Act. Those are not new savings.

Even more exotic is his $1.1 trillion in savings from drawing down military activities in Iraq and Afghanistan. The President’s budget proposed a total of just $576.5 billion over 10 years for Overseas Contingency Operations (OCO). This amount consists of a $126.5-billion request for fiscal year 2012, and then placeholders of $50 billion a year through 2021. In other words, the 10-year total is largely illusory. Even if it were real, however, it would be impossible to save $1.1 trillion in war spending when the President proposed to spend only about half that amount. It appears the savings are measured against a Congressional Budget Office (CBO) baseline hat assumed the peak, 2010 “surge” level for war spending, and then inflated it for subsequent years. This was an unreal figure to begin with – and one CBO removed in estimating discretionary savings in the Budget Control Act – and yet the President assumes the savings. This is emblematic of just how disingenuous his debt reduction plan truly is.

This is not a serious effort to address the government’s very real spending and deficit crisis – which has worsened significantly in the past two-and-a-half years. It is, to repeat, ideology, not policy.

Patrick Louis Knudsen

Grover M. Hermann Senior Fellow in Federal Budgetary Affairs

Tax Hikes Not the Answer, but Obama Wants Them to Be

President Obama seems intent on not solving our budget and debt crisis. Indeed, he seems almost fixated on making it worse. His latest plan would immediately ramp up spending to “jolt” job creation in ways that have proven to fail. Once again, Obama is sticking to his strategy of ramping up spending thus “locking in” higher levels that make the job of budget cutters more difficult. Somehow, he maintains, this is necessary and right for America, making it seem that this spending is inevitable and inexorable. Thus, the only thing we can do is to hike taxes.

Riiiiiiight.

Tax hike are not the answer. Plain and simple. Unless we fundamentally tackle entitlement programs taxes will have to be perpetually raised to keep pace with dramatic growth in spending as Medicare, Medicaid and – yes Mr. President — Social Security grow like a giant tsunami blowing toxic red ink all over the budget and the economy.

Yes, the President did propose spending cuts. Teeeeensie tiny ones. $250 billion to Medicare and $72 billion to Medicaid likely over ten years. But bear in mind these are two of the biggest and fastest growing programs in the budget. Medicare this year alone is over $500 billion and over the next ten years will likely reach $7.5 trillion. But here, the devil is in the details. The small changes he may propose that would affect retirees will be backloaded – until after any possible second term. And he abandons future retirees by taking any changes to Social Security off the table. He’s right that spending cuts alone aren’t the solution – the policies must be right too.

Obama is demanding a “balanced” approach as though somehow hiking taxes is both fair and necessary. But this notion that he is pushing – half tax hikes and half spending cuts – is beyond the class warfare message it sends. It is a tactic. A tactic to stall the real reforms that our leaders in Washington must undertake now in order to avert a fiscal, economic and moral crisis.

The simple fact is that our budget and debt crisis can be solved without hiking taxes. Saving the American Dream, the Heritage Plan to Fix the Debt, Cut Spending and Restore Prosperity is a bold, innovative plan that does just that. It transforms our entitlement programs, rolls back wasteful and inefficient spending, protects the nation and overhauls our punitive, inefficient and uncompetitive tax code.

Federal Spending needs a complete do-over. We must return to our roots our founding fathers’ laid out – of a limited government. A low tax, low spending and fast growing nation. One where our kids can enjoy the same kind of opportunity as their parents and grandparents. One where our seniors know they can go into retirement with the economic security that they will be able to access quality health care that works for them, and a Social Security benefit that will protect them from poverty.

President Obama’s newest plan is simply his April speech cast under the lighting of the Super Committee with the election as a backdrop. The nation needs more.

Alison Fraser

Raising Investment Uncertainty Will Prolong Economic Stagnation

One of the pillars of the President’s deficit reduction plan unveiled this morning is a new minimum tax rate for millionaires. Targeting American earners whose income often comes from investment profits, the President is proposing a special tax, the “Buffett Rule,” to increase the tax burden on investors.

Investment drives productivity and economic growth. Already, many investors are shying away from markets at this uncertain time, choosing instead to preserve their principal wealth in bonds and commodities such as gold. Proposing higher taxes on investment only increases uncertainty for investors and means that even less investment will occur. Even a little less investment leads to lower productivity, slower economic growth, weaker wages and salaries, and lower household wealth. This is the exact opposite of a jobs plan. It’s a plan to prolong the economic stagnation.

Holding necessary entitlement reforms hostage to higher taxation undermines debt reduction and economic recovery. According to the Heritage Foundation,

While it is currently popular to target high-income individuals for higher taxation, it is economic folly to target investment income. Raising the tax burden on investment income further damages the economy and ultimately affects all members of society. Investment income is highly elusive, as individuals and businesses can alter the timing of investment income and forego investment altogether if their returns fall below required levels. The current economic uncertainty, which increases risk premiums, is already causing many investments to be delayed or foregone. Policymakers are scrambling to encourage businesses and entrepreneurs to start investing again. Why they would then threaten to tax the income from these investments to pay for new entitlements is not clear. […] Taxing investment income would […] reduce investment in the economy, which is dangerous during a period of recovery.

The President is correct in that our tax system is too complex. However, the President’s proposal to increase taxes on investors is the wrong way to reform our tax system.

Romina Boccia

Want to Tackle Spending? Obamacare Has Got to Go.

President Obama pointed to changes already enacted into law under Obamacare to reduce federal health spending, but the fact is, Obamacare will increase deficit spending significantly. To fix the health care system and restore fiscal responsibility in Washington, Obamacare has got to go.

The new health law relies on tax hikes and dubious savings from broken programs to cover the cost of a major Medicaid expansion and new health entitlement spending, despite the fact that serious reform is needed to rein in the cost of the health entitlements we already struggle to pay for (which the President rejected in his speech). New Obamacare entitlement spending includes a generous taxpayer-funded subsidy to offset the cost of coverage for several million Americans, and a new, government-run long-term care insurance program already acknowledged by independent experts to be unworkable and likely to require a taxpayer bailout (in other words, more deficit spending). Obamacare originally received a favorable CBO score only because of the budget gimmicks included in the legislation. Looking beyond the smoke and mirrors shows that not only will Obamacare fail to fix our health care system, but we simply cannot afford it. Repeal is the only solution.

The President also pointed to his signature health care legislation to control the cost of health, but the new law does not tackle the main drivers of runaway health care spending and will not control costs or make health care more affordable. It leaves in place a flawed system which insulates patients from the cost of their health care decisions and encourages unnecessary spending. It keeps health care consumers from choosing the health plan that best suits their needs and from seeking the best available value for the medical goods and services they require. Obamacare increases the role of government in every corner of the health care system and grows dependency on flawed government health care programs.

Kathryn Nix

Who Really Is Paying Obama’s Latest Tax Hikes

Over half of President Obama’s deficit reduction plan announced today would come from tax increases – to the tune of $1.5 trillion – on families and businesses earning over $250,000 a year.

His plan singles out both industries and individuals, such as oil companies and corporate-jet owners. This is a worn out, faulty proposal for a tax system that needs major restructuring rather than a few fine-sounding flourishes. Taxing those who Obama calls the wealthiest of Americans won’t solve our deficit problem – and it certainly won’t solve our spending problem. The top 10 percent of earners in America already pay about 70 percent of federal income taxes. And adopting the flawed deficit reduction proposal of taxing the wealthiest Americans would require mathematically unfeasible tax rates.

How ironic for this speech – specifically its tax hikes component – to come on the heels of Obama’s speech on job creation? Never mind the President’s flawed assumption that the federal government can and should be in the business of creating jobs. But to propose taxing further the very Americans who should be the ones creating jobs in our economy flies in the face of logic. Rep. Paul Ryan (R-WI) summed up the situation well over the weekend:

If you tax job creators more, you get less job creation. If you tax investment more, you get less investment.”

Mr. President, America needs more investment and it needs more job creation. It needs Washington to get out of the way.

Emily Goff

This is not Tax Reform Mr. President

President Obama’s says he wants to debt committee to reform the tax code but raise taxes by $1.5 trillion at the same time. That isn’t tax reform. It is dressing up tax hikes in tax reform’s robes.

Tax Reform entails fixing the tax base so it does not favor certain economic behaviors or deter others. This is done by closing so-called “loopholes.” The revenue raised from eliminating those credits, deductions, and exemptions is then used to lower income tax rates and eliminate taxation on saving and investing to encourage more productive activity. The new and improved tax code should raise the same amount of revenue as the old code.

The new revenue would come from allowing the Bush tax cuts to expire for families and small businesses earning more than $250,000 a year, limiting deductions their deductions, and the President’s new “Buffett Rule” that would further raise these job creator’s taxes in some way which the President has not defined. He also wants to eliminate deductions, credits, and exemptions. This is a war the President is waging on success – as if so-called fat cats were the root of our spending problems.

The $1.5 trillion in higher taxes would grow the already bloated federal government by that amount. Congress never uses tax hikes for deficit reduction. It always uses the extra revenue to pay for new programs.

The brunt of these tax hikes would fall on job creators – businesses that employ workers and investors – that the economy desperately needs to start adding new jobs. Raising their taxes will only cause them to cut further back on their hiring plans or scrap them altogether. And without seriously tackling spending, taxes will have to rise perpetually.

The economy and the American people cannot afford the President’s government-growing, job-killing conception of tax reform.

Curtis Dubay

Here’s How to Pay Your “Fair Share,” Mr. Buffett

President Obama proposes the “Buffett Rule” to make sure the rich pay their “fair share.” However, there is already a system in place for Mr. Buffett and all the other millionaires and billionaires to pay more without a new job-killing tax hike.

Here’s how. Warren and his rich pals can go to this website: http://www.treasurydirect.gov/govt/reports/pd/gift/gift.htm

There they can follow these simple instructions for sending more of their money to the Treasury to reduce the national debt:

How do I make a contribution to the U.S. government?

Citizens who wish to make a general donation to the U.S. government may send contributions to a specific account called “Gifts to the United States.” This account was established in 1843 to accept gifts, such as bequests, from individuals wishing to express their patriotism to the United States. Money deposited into this account is for general use by the federal government and can be available for budget needs. These contributions are considered an unconditional gift to the government. Financial gifts can be made by check or money order payable to the United States Treasury and mailed to the address below.

Gifts to the United States

U.S. Department of the Treasury

Credit Accounting Branch

3700 East-West Highway, Room 622D

Hyattsville, MD 20782Any tax-related questions regarding these contributions should be directed to the Internal Revenue Service at (800) 829-1040.

It is as simple as that. Now how can we stop seeing poor Warren every time we turn on the television incorrectly whining about his taxes are lower than his secretary?

Curtis Dubay

Where Will the Tax Hike REALLY Go???

Obama’s economics are at times stunning. Proposing tax hikes in the midst of the highest and most persistent unemployment in decades is stunning. Doing it to pay for a massive jobs package is also stunning. But for a moment, set all that aside.

Set aside the terrible effect these tax hikes would have on jobs in America. On investors. On job creators. On American competitiveness. Set aside the cigarette tax that went to pay for expansion of SCHIP at the very beginning of the President’s term. Set aside the 18 new or increased taxes in Obamacare. Set all that aside and consider this.

Do you believe for one simple moment that these new taxes will be used for paying down the deficit? Or do you believe that past is prologue? The President’s own jobs package is proof: New taxes go to pay for new spending.

Alison Fraser

Obama Vague on “Buffett Rule”

President Obama wants tax reform to adhere to his newly formulated “Buffett Rule” which states: Families and small businesses making more than $1 million should not pay a smaller share of their income in taxes than a middle income family.

But the Congressional Budget Office shows that Buffett Rule is already in effect. The highest earners pay more than double the amount of taxes as a share of their income than middle income earners. The top 1 percent of earners currently pays 29.5 percent of their income in all federal taxes while middle income families pay 14.3 percent.

The President and his staff surely know this so the Buffett Rule likely refers to something else. It is impossible to say for sure since, as usual, the President’s plan is light on details. One likely direction the President may propose when details come out is to equalize the taxation of capital gains with the taxation of income for millionaires. The President wants the top income tax rate to be 39.6 percent like it was before the Bush tax cuts. And that’s just for starters. Perhaps the Buffet Rule would then raise the capital gains rate to that level. This comes after three years of the President claiming he only wanted to raise the capital gains rate to 20 percent.

So kind of surtax on high earners is not a new idea. Then Speaker of the House Nancy Pelosi wanted one to pay for Obamacare. It went nowhere then when Democrats controlled both houses of Congress so it has no chance of passing now. The President proposes to further tax the rich not because he wants his class warfare policies to become law, but so he has a talking point for his re-election campaign.

Should the President’s misguided Buffett Rule become law who would lose more? Millionaires or the economy? The so-called coddled rich, or America’s workers? The cost of capital would rise considerably. This would make it harder to businesses to expand and add new workers. It would also hamper entrepreneurs looking to get their ideas off the ground. And even if President Obama and Warren Buffet can “afford to pay a little more” it’s not like this money is just lying around idly in mattresses – it’s already at work invested in some way in the economy, whether it’s cash in the banking system which keeps the nation’s finances moving, or invested in businesses which create jobs. Pulling money out and putting it into government spending will not help the economy. Ultimately the Buffett Rule would result in fewer jobs for American workers and lower wages for those employed. The punitive effect the rule would have on American workers is hard to reconcile with the President’s supposed new focus on job creation.

Curtis Dubay