We Hear You: ‘High-Tax Paradises Such as New Jersey and California Better Wake Up’

Ken McIntyre /

Editor’s note: With tax reform now in the Senate’s hands following passage of a House bill to overhaul the tax code, it’s a good time to review some more related thoughts of The Daily Signal’s audience. Remember to write us at [email protected].—Ken McIntyre

Dear Daily Signal: Regarding Rachel del Guidice’s story on repealing the state and local tax deduction, homeownership is less appealing and less affordable for the middle class when they are forking over nearly as much in property taxes as for their mortgage (“How Keeping the Property Tax Deduction Could Backfire on the Middle Class”).

These high-tax paradises such as New Jersey and California better wake up to the fact that the millennials aren’t interested in using the greater part of their earnings to saddle themselves with long-term debt offering very few advantages.

Being used as marks whose sole function is serving as cash cows for bloated, spend-happy state and local governments doesn’t have near the same appeal it did to their parents.—Bill James

A way of bringing other lawmakers on board might well be a phased reduction in the property tax deduction. Say 10 percent per year. That would give those getting the deduction time to correct for its loss while making those who don’t pay such property taxes would subsidize less and less of it.

As long, that is, as the timeframe for the overall “permanent” tax changes extends far beyond that. Enacting a “sunset” provision on the current tax proposals, say 50 years, would prevent future legislatures from changing it within the prescribed time. Nothing in government is “permanent,” especially where taxes are concerned.—Edward Vanover

***

I support doing away with any type of income taxes with brackets and shifting instead to a flat tax of around 11 percent. This would reduce the cost of homeownership since mortgages no longer would be subsidized. It would force high-tax states to be more frugal. And it would extract more tax revenue from higher-income wage earners who can afford expensive middlemen to do their returns so that they can reduce their taxes.—Eileen Machida

How Keeping the Property Tax Deduction Could Backfire on the Middle Class https://t.co/s00WI0hnK0 @DailySignal

— Bette Anderson (@wufandmew) November 4, 2017

I had a big house and a big mortgage and big property tax. Divorced. Now I have half the house, half the mortgage, and half the property tax. But now I pay more in federal income tax because I don’t have as much to deduct on the house.

Bottom line: Unfortunately, that hard-earned money is not mine to keep. It either will go to the feds or the locals; I’d rather keep it local. My new wife wants a larger house and I am inclined to get it just to keep my dollars local.

Local property taxes are not high because they are deductible–you give local politicians too much credit—local taxes are high because the community either provides a lot of services, is mismanaged or corrupt, or some combination of the three. A flat tax would be best.—Barry Rava

Why This State Lawmaker Wants the State and Local Tax Deduction Repealed https://t.co/Yp4PsBctu5 via @LRacheldG @DailySignal

— Jennifer Rush (@JennRush) November 7, 2017

How to Turn the Tables on the Democrats

Dear Daily Signal: Those living in the fly-over states and the South are paying for improvements in other, high-tax states by default, basically, as Rachel del Guidice reports (“Why This State Lawmakers Wants to Repeal the State and Local Tax Deduction”).

Another potential solution would be a cap similar to that which is on Social Security, but in reverse: If your income falls below that same threshold, then you deduct your state property and wages tax from your income; above such, you begin losing that deduction.

It would be easy to turn the tables on the Democrats if they were to not go along: Simply ask just who is in reality making exemptions for the rich; who is making the rich richer instead of making them pay their fair share. The Democrats would have to simply stay out of that fight.— Robert Joseph Shannon

***

If you itemize rather than take the standard deduction, which is very charitable, you make enough money to pay your own state, local, and property taxes without the poorer taxpayers subsidizing your decision to live in a high-tax state or area. Eliminate the state, local, and property tax deductions completely. If you don’t like it, move to a state with lower tax rates.—Don Weimelheimer

***

Rachel del Guidice quotes economist Jonathan Williams of the American Legislative Exchange Council as saying: “Fifty-three percent of the benefits of the state and local tax deduction go to just seven states, so it is really a benefit to high-tax, high-spend states.”

And those states tend to be the most liberal and have the most debt. We need a level playing field and a fair tax rate across the board. By getting rid of loopholes and special interest favors, we should see a much improved economy and fewer government favors directed at a few.—Wes Potts

***

This shows everybody what states have been stealing from their citizens and which haven’t.

Residents of states like California, Illinois, New York, here you get all upset that a tax deduction might be taken away for your state income tax. Why don’t you complain to your state about the high state income tax?

People who live in states like Alaska, Wyoming, Texas, and Nevada don’t pay any income tax. Why is that? Maybe the politicians are a little less corrupt and greedy?—Jeff Pearson

https://twitter.com/Denise9532/status/930483779600375808

Why Corporate Health Matters

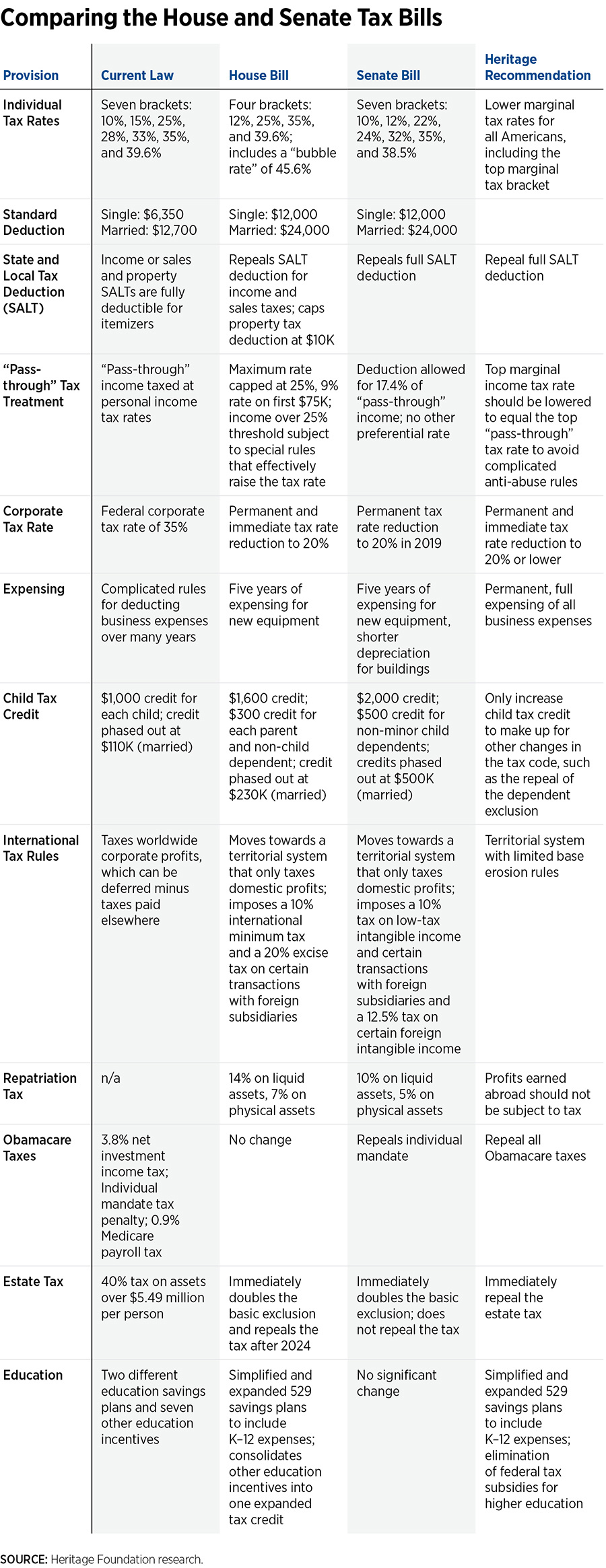

Dear Daily Signal: Our economic recovery depends on corporate health, as Adam Michel’s commentary states (“A Tale of 2 Tax Bills: Comparing the House and Senate Reform Plans”). The business that I started would be able to grow and employ many more people if we could get the government off our neck.

Corporate health leads to economic health for the workers and for the nation. We ignore that truth too often.

By the way, I was homeschooled in the 1950s. More than 70 percent of homeschoolers end up being self-employed. I wonder why?—Bill Tanksley

***

Regarding Adam Michel’s commentary on the House and Senate approaches, one major problem that I have with the tax code is the earned income tax credit, where people not only don’t pay taxes but get a refund.

Why should anyone get tax money paid to them? This is a form of welfare. If a person is to get money from the government, it should be under the welfare program, where they at least have to show some proof they are destitute.—Michael Navarre

Recharging the Economy, Giving Relief to Taxpayers

Dear Daily Signal: I’m sick and tired of “bait and switch” by Republicans (“What You Need to Know About the GOP Tax Plan”). They promised reform so most could fill out their tax returns on a postcard; now they propose a plan that is different but just as complex. They promised a full repeal of Obamacare, then as soon as the election is over they started talking repeal and replace, then partial repeal and replace, and so far have done nothing. Don’t promises mean anything to these people? (He asks rhetorically.) —Mark Simmons

***

Eliminating fraud in the earned income child tax credit needs to be addressed. It is a huge tool in redistributing wealth to those brazen enough to fraudulently game this program. Simply forcing verification will pay for itself 100 times over right away. It doesn’t take a new bill, but enforcement; it’s a great opportunity to clarify proper use of this necessary credit for low-income families.—Roy Cossairt

GOP Tax Plan Would Revitalize US Economy, Give Significant Tax Relief https://t.co/d2qJPVuvHu @DailySignal

— DEPLORABLE BETSY (@eeynouf) November 3, 2017

It would be far better to simplify the income tax to a flat tax, say 20 percent, just like the proposed business tax. The proposed changes described by Heritage Foundation experts may be a step in the right direction, but are still too complicated for average Americans to understand. Politically, as long as these complications remain, people will not support the changes, even when the ball is moving in the right direction.

Here’s a crazy idea: Instead of playing the tax shell game, cut government by 5 percent and give everyone a tax cut. Is President Trump’s hiring freeze still in place? Government employment could be cut by 6 percent annually by attrition.—Steve Skinner

***

No discussion regarding elimination of medical deductions? Eliminating this deduction would be a huge burden on taxpayers who have large, annual medical bills, for special needs people, and those who are experiencing enormous bills for cancer and other medical problems.—Norm Wood

https://twitter.com/RobertBluey/status/920473508559425536

The President Pitches Tax Reform to Heritage Donors

Dear Daily Signal: Well, that speech to a Heritage Foundation audience lost President Trump the inner-city “freebies” population that doesn’t want to work (“Trump: Tax Reform ‘Will Lift Our People From Welfare to Work’”). They are “entitled” to free everything, and every election gets them even more free stuff.

Then there is the welfare industry that services these freeloaders. They want more “clients.” It’s called job security.—Anthony Cangemi

***

I believe that tax reform directed at the portion of the middle class that makes higher pay ($100,000 to $400,000) will end up stimulating the economy. These are the people who own small businesses but are not incorporated, and therefore pay individual taxes. Many have other sources of income too.

Small business fuel the employment machine. There are other taxpayers in this class that make enough to buy property, hire service people, and so on.

I don’t see larger family deductions doing much for the economy. These help families raise their kids, but we are entering an era where robotics, artificial intelligence, and foreign workers are reducing the demand for a large domestic labor force. We need to stop subsidizing large families.—Van Hamlin

***

Let’s put a ceiling on the size of tax refunds. The maximum refund you could get is the amount of taxes you paid for that year. You could keep all the tax credits you are allowed, but if you paid only $1,000 in taxes for the year, the most you could receive as a refund would be $1,000. Period.—Rosa Russell

***

Americans work for a living. Thank you, Mr. President.—Juan Bassett

***

I don’t know if I agree with you on this one, Mr. President. The Obama administration has made hundreds of thousands of citizens very, very comfortable in their so-called poverty and welfare status. I have no doubt that the Democrats like it this way.—Jerry Roth

***

This is good common sense, and those who disagree are unlikely to understand the real issues due to their own political agenda outside of helping America in a real, substantive way.—Rick Stanley

New Report: GOP Tax Reform Could Boost Household Income by $4,000 https://t.co/iLE0mDT6le

— The Daily Signal (@DailySignal) October 17, 2017

Boosting Household Income

Dear Daily Signal: I am retired, itemize my deductions, and am solid middle class. I will wait to see what comes out of Congress, but if past tax cuts are any indication, my tax bill likely will increase (“Report: GOP Tax Reform Could Boost Household Income by $4,000”).

Typically, Congress reduces tax rates, increases the standard deduction, and eliminates many deductible expenses, calling them by the pejorative term “loopholes.” I understand that this time some lawmakers plan to eliminate the individual exemption, lumping it in with the standard deduction. That means the standard deduction did not get doubled—false advertising.

In spite of its being likely to cost me more, I am in favor of simplifying the tax code and eliminating things such as the death tax, where the government gets 55 percent of inherited wealth, and the alternative minimum tax (AMT).

Business is being punished by the current tax code, which inhibits business owners in being competitive on a world scale and limits their growth. The tax code is strangling our economy and must be changed.

Everybody should pay a fair share. Yes, even the poor should contribute. We cannot continue to have half of the people paying nothing. The middle class is heavily taxed, but the wealthy pay about half of the taxes paid. They are getting soaked already and should participate in a tax cut.

The wealthy are also the ones who invest and grow the economy. What we now have is a tax code that simply redistributes the wealth, a Marxist concept.—Randy Leyendecker

Sounds like an improvement for the taxpayers. The only fault I have with it? They are not addressing the massive increase in the national debt this will cause.

Sounds like an improvement for the taxpayers. The only fault I have with it? They are not addressing the massive increase in the national debt this will cause.

Think about this:

- You have massive tax cuts at the individual and corporate levels.

- You have massive spending increases for things not really needed, like growth in the military during peacetime.

- So the plan is massive tax cuts coupled with massive increases in spending.

That equals fiscal irresponsibility. If you cut taxes, you must cut spending to match. Better yet, let’s dust off that constitutional amendment for a balanced budget.—Chris Vaughn

***

Lowering taxes won’t work unless we also lower spending. So how about this:

- 10 percent personal income tax, no deductions, no exemptions.

- No other taxes allowed.

- States get a percent, set by Congress, of their residents’ 10 percent.

- States give part of their percent to cities and counties.

- Government must adhere to a strict balanced budget.

All of that (especially the 10 percent, no other taxes, and the balanced budget) should be written into an amendment to the Constitution so it’s more difficult to change. That would eliminate most of the IRS and tax preparation costs, give a 0 percent corporate tax rate to bring corporations and jobs back to the U.S., and decrease the national debt because of the balanced budget requirement.

The downside? For politicians: They probably wouldn’t be able to get so rich in office due to the unavailability of funds for pet projects. For the 40 percent and more of Americans who have income but don’t pay income tax: They’d have to pay 10 percent just like everyone else.—Jeffrey Moore

https://twitter.com/eavesdropann/status/919935413120372737

Living by the Same Laws

Dear Daily Signal: I have read most of the letters and ideas on tax reform published in The Daily Signal (“We Hear You: The IRS, the Rich, the Nanny State, Republicans, Trump, and Tax Reform”). I have thought about many of the ideas for many years, and studied the Constitution through Hillsdale College as well as other sources.

I think the three things we must do, after having a convention of the states, are to pass: 1) a balanced budget amendment, 2) term limits for the House and Senate, 3) a flat tax or consumption tax, but not on food or medical costs.

All of our representatives should live by any and all laws they pass for the people they represent. I also do not feel it is the people’s job to pay their retirement.—Jerral Wayne Pearson

***

The IRS is so corrupt, they are beyond redemption. Their existence is predicated on an overly complex and unfair system, and too much power is put in the hands of middle-management bureaucrats with no real oversight.

Additionally, the IRS seems to be above the law and the Constitution. In their eyes, you are guilty until proven innocent and due process goes out the window. They can seize any of your assets, seemingly without cause.

A completely new tax code must include spending cuts by Congress, especially when it comes to their salaries, staffs, budgets, and benefits. They seem to write their own rules, and these they treat as “suggestions,” not laws.

Term limits are an absolute necessity for any progress to be made. Sen. Dianne Feinstein, D-Calif., recently announced she will run for reelection next year at the age of 85. This is ridiculous. She has taken advantage of her position for decades, and seems to be intent on being carried out of chambers toes up.

The same goes for anyone who is serving themselves, not their constituents.—Teresa Barrett

***

“Divide and conquer” tribalism is the means for the power seekers to destroy the people’s ability to rein in out-of-control government. When nearly half the country pays zero taxes and then the Congress critters come around promising free stuff if those Americans vote for them, it becomes a “them and us” problem of one group ripping off another.—Ferd Berfel

Tax Reform Is ‘Opportunity of a Lifetime’ That ‘Has to Be Seized,’ @SpeakerRyan Says https://t.co/Axv5dXpktL

— The Daily Signal (@DailySignal) October 12, 2017

Seeing the Monetary Benefits

Dear Daily Signal: The biggest deductions most people have are mortgage interest, state taxes, local taxes, and maybe medical expenses (“Tax Reform Is ‘Opportunity of a Lifetime’ That Has to Be Seized, Ryan Says”). With that said, most would benefit by filing the proposed $24,000 standard deduction.

Deductions for mortgage interest and medical expenses should be kept to assist when there is a major medical event. One thing taxpayers with home mortgages will realize is that as their mortgage is paid off, their taxes will not increase.

Under the present system, as you pay off your mortgage your interest payments go down and thus the amount you can claim as a deduction. Besides making it simpler, I believe taxpayers will see the monetary benefits.

The biggest problem I have had in making a decision about the proposal is the lack of specifics on the tax brackets. Until that is settled, I will not be able to evaluate the package.—Philip Daspit

***

The mentioned reforms are definitely righting wrongs. I fear that we are swapping crutches for a wheelchair as we move downhill toward a fiscal cliff.

Unless we put an end to deficit-spending and nationalize the Federal Reserve Bank, Congress will simply be taking us all on their bandwagon to hell—hell being the financial collapse of the nation.—Michael Watson

Why Washington’s Spending Addiction Is a Threat to Tax Reform https://t.co/bXk9IRXcVa via @WmBillWalton @DailySignal

— Fred Lucas (@FredLucasWH) October 12, 2017

Balancing the Budget Too

Dear Daily Signal: About Bill Walton’s commentary: All that Congress cares about is bribing people to vote for them by increasing entitlements, basically paying people for not working (“Why Washington’s Spending Addiction Is a Threat to Tax Reform”). They have created a permanent underclass more pernicious than slavery. They have also created an enormous lobbying industry to advise them on how to hide the real reason for their profligate spending.

We should adopt the idea that if Congress does not balance the budget, they should be fired en masse so they can be replaced by more responsible “civil servants.” Politicians have become our masters rather than the public’s servants. This must change.—John E. Olsen

***

I am all for tax reform, but I am also for a balanced budget. It is not responsible to run up $650 billion per year of debt. One day this will come back to haunt us when foreign governments call in their markers and demand payment.

There is a good bit of debt that is owned by other countries. In other words, they “bought” debt to be repaid later. What if they wanted it now? Can you imagine the great depression?—Chris Vaughn

***

Funny how welfare is never brought up. Social Security would be solvent if billions of dollars weren’t sucked out of it by politicians.

Every working American and legal immigrant pays their own money into Social Security, plus their employer matches funds, plus what interest is accumulated over the years. And they say it is broke. Oh, and let’s not forget: Everybody who comes to the U.S. and never saved a penny gets our money.

Maybe it is time to force a few things on politicians: 1) You are a servant to the people. 2) Your job is not meant to be for life. 3) You don’t need any pension or medical past your service, and you get the same medical as you shoved down America’s throat. 4) You don’t need all of the staff you have. 5) And quit spending my Social Security money on your feel-good projects.

Then we would have plenty of money in Social Security and Medicare, which I don’t consider an entitlement.—Jeff Pearson

***

Cut spending before tax cuts. I’ll be willing to grudgingly accept any tax reform bill that pays for tax cuts with commensurate across-the-board spending cuts, including defense.

If the cuts result in growth, we can use that additional revenue to revisit raising funding for some of the programs cut, or for new programs, or to justify another round of tax cuts. It’s madness to cut taxes without also cutting spending when we already have something like a $500 billion annual deficit.—Edward Buatois

Casey Ryan helped to compile this column.